November 2-8: US Restaurant Sales Steady Despite Momentum of Covid-19’s Third Wave

Correction: Last week we experienced an error in our Index data extraction process and reported faulty data. We apologize for this mistake and have now updated the data and analysis below.

Index at a Glance

- All Avero Index: Sales down 2%, no change in open units

- Midwest: No change in sales, open units down 4%

- Northeast: Sales up 1%, no change in open units

- South: Sales down 1%, open units up 1%

- West: Sales up 5%, open units up 1%

Nationwide Restaurant Performance

The US restaurant industry is largely holding ground despite the latest upswing in Covid-19 infection rates sweeping the country. National restaurant sales were down 2% last week and there was no change in the percentage of open units.

According to the New York Times’ interactive state-by-state reopening tracker, Illinois is alone in mandating the state-wide closure of bars and restaurants currently. Some states have taken action to close restaurants and bars in particular counties. But most are relying on evening curfews for alcohol sales and local governments to monitor and curb restaurant regulations as needed. Let’s take a look at additional regional data below.

Regional Restaurant Performance

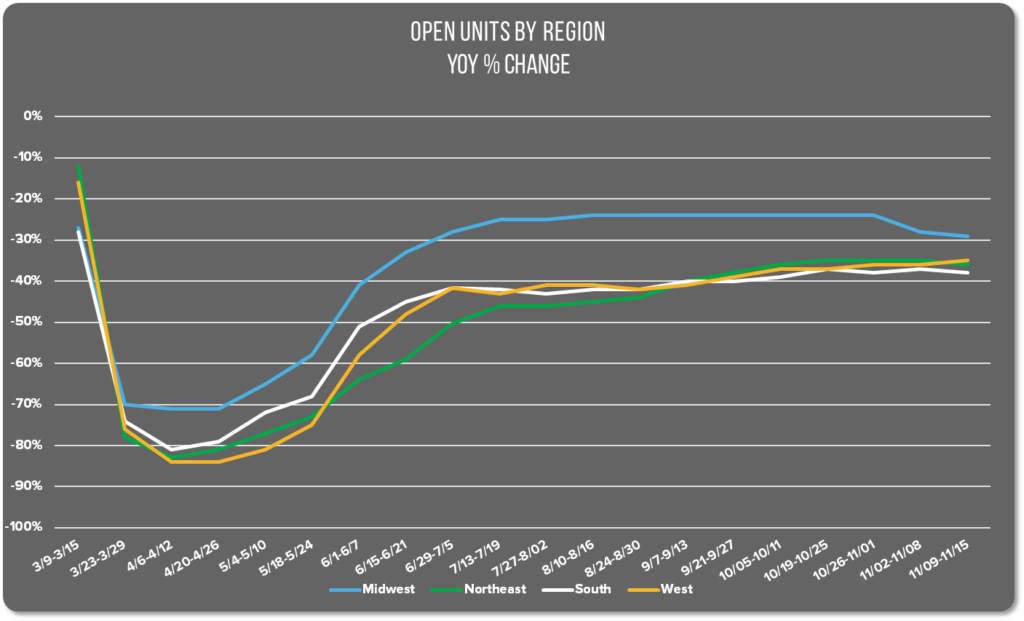

The Midwest continues to struggle to contain new coronavirus infections. Restaurant sales remained steady but experienced a 4% dip in the number of open F&B units. The drop in open units isn’t surprising considering Illinois Governor JB Pritzker’s executive order banning all indoor dining in the state beginning November 4th.

In Michigan, officials are reporting 6,940 new cases of the virus and 45 additional deaths today, for a total of 236,225 cases and 7,811 deaths. Unlike March, when the outbreak was concentrated in certain areas of the state, this time the outbreak is widespread in every region of the state. Schools in Detroit are suspending face-to-face instruction until at least January 11th. Restaurants in the state remain open for indoor dining at 50% of capacity. A new rule took effect on November 2, requiring restaurants to collect the name and phone number of each customer for contract tracing purposes.

Restaurants in the Northeast fared somewhat better than the Midwest. Sales gained 1% in the Northeast last week and there was no change in the number of open units. New York is currently grappling with measures to curb the virus’ spread without instituting widespread lockdowns. With test positivity pushing 2.9% in New York City, Governor Andrew Cuomo has instituted a 10 pm curfew for on premise dining and prohibited alcohol for take-out orders past 10 pm as well. Considering the 3% test positivity threshold set by Mayor Bill de Blasio for school closures, it’s likely that the entire NYC school system will close by Thanksgiving.

Similarly, Massachusetts has issued a 9:30 pm curfew for on-premise dining, casinos, movie theaters, indoor recreational facilities, and other entertainment venues in the state. The latest action prompted the Massachusetts Restaurants United coalition of independent restaurateurs to issue a statement both recognizing the need for the restrictions, as well as calling for the state to pass the Economic Development Bill and create a Distressed Restaurant Fund to help restaurants survive the winter.

In the Western region, sales grew 5% and the number of open units increased 1% despite looming curfews and shutdowns in the region.

Restaurants in San Francisco will be closed for indoor dining again as of Friday, just six weeks after reopening for indoor dining. The latest shutdown follows a 250% increase in infections in the city. On October 30, the city declined to open dining room capacity from 25% to 50% as planned due to the virus positivity rate which has increased to 3.7%. The city is also restricting capacity in gyms and movie theaters and has restricted high schools from reopening.

In Nevada, Governor Steve Sisolak warned that renewed restrictions may be necessary if the state can’t reduce the number of positive cases over the next two weeks. Currently, the state allows indoor dining at 50% capacity.

In the South, sales fell slightly landing 1% below the prior week. The number of open units grew by 1%.

Texas became the first US state with more than 1 million confirmed Covid-19 cases, surpassing their previous single day record of 74 cases set on July 15. El Paso has temporarily shutdown nonessential businesses until December 1, despite the state’s attorney general’s ongoing efforts to fight the order in court. A decision is expected later this week.

Kentucky has 8 counties in the “red-zone,” with a 7.68% state-wide positivity rate. Governor Andy Beshear said last Thursday that he will not increase precautions but will work to enforce those that do exist. The Kentucky Supreme Court is currently weighing legal challenges to Beshear’s previous mandates.

That’s it for this week’s index analysis. Check back for more updates next week.

NOVEMBER 9-15: RESTAURANT SALES HANG ON WHILE COVID-19 RUNS RAMPANT

Published 11.18.20

Index at a Glance

- All Avero Index: Sales up 1%, open units down 1%

- Midwest: Sales down 5%, open units down 1%

- Northeast: Sales down 1%, open units down 1%

- South: Sales up 3%, open units down 1%

- West: Sales up 5%, open units up 1%

Nationwide Restaurant Performance

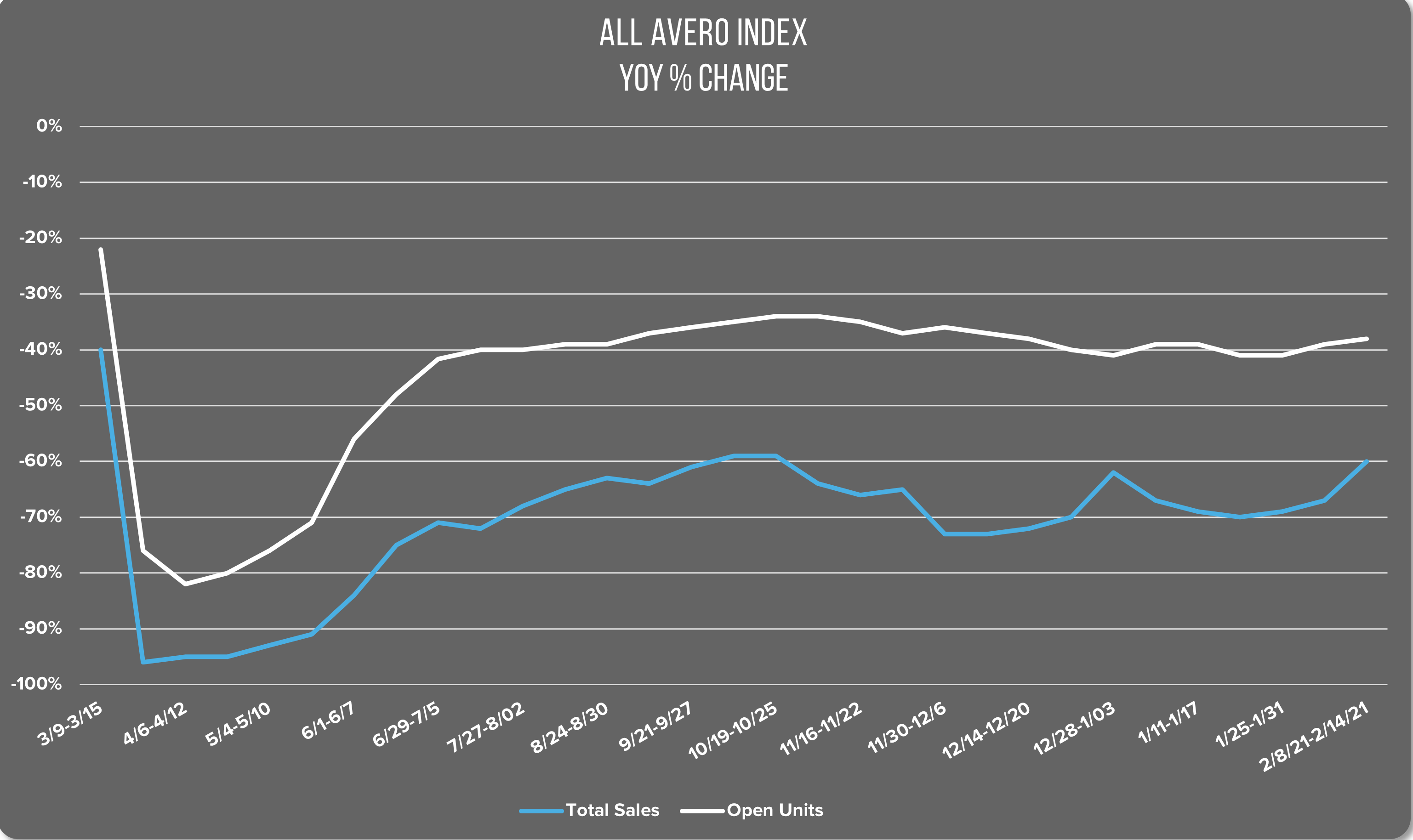

Despite a nation-wide surge of Covid-19 infections, US restaurants in the All Avero Index only collectively lost 1% in sales last week. Likewise, the percentage of open units only fell 1% across the Index.

Wednesday, the US reported more than 79,000 new Covid-19 hospitalizations and the seven-day average of new cases surpassed more than 162,000. The current seven-day average represents a 77% increase in the average seen two weeks earlier. Unlike the second wave in the summer, which was largely regional in nature, this current, third wave is widespread across the country. So far, restaurants have mostly been spared from widespread lockdowns. Some areas are reinstating earlier capacity restrictions, curfews, and other regulations, while others continue business as usual. Let’s take a look at the regional impact below.

Regional Restaurant Performance

Last week, the West led the regions with a 5% sales increase and a 1% increase in open units. The South comes next, with a 3% increase in sales and a 1% drop in the number of open units. The Midwest fared the worst, showing a 5% sales loss and 1% dip in open units. And the Northeast came in with a 1% drop in both sales and open units.

Though Covid-19 is surging across the country in nearly every state, the hospitality industry has so far avoided a total shutdown similar to the one that occurred in March. Those who have been following the industry’s progress via the Avero Index know that its not always possible to connect virus rates with restaurant performance broadly with so many variables at play. In some markets, infections and restaurant sales rise in tandem. In others, restaurant sales suffer when infection rates grow, and then rebound when they taper off again. With each state taking its own approach to virus mitigation, and local governments within those states making additional, localized decisions, its difficult to make broad assumptions in patterns. To make things even more challenging, customers’ attitudes about social distancing and mask wearing tend to vary by region as well.

Data is becoming clear about the relationship between restrictions and infections. A New York Times analysis of University of Oxford data tracks the effect of policy responses to the pandemic on new virus cases and hospitalizations. The findings show that outbreaks are smaller in states where leaders made an effort to contain the spread over the summer and fall. Iowa and North Dakota for example, just instated mask mandates for the first time since the start of the outbreak and now have some of the worst infection rates and the most hospitalizations.

The study shows that seven out of the 10 states with “tightest control measures” are Northeastern states. Conversely, 16 out of the 18 states with “fewest control measures” are located in the Midwest or South. The two exceptions are Utah and Arizona.

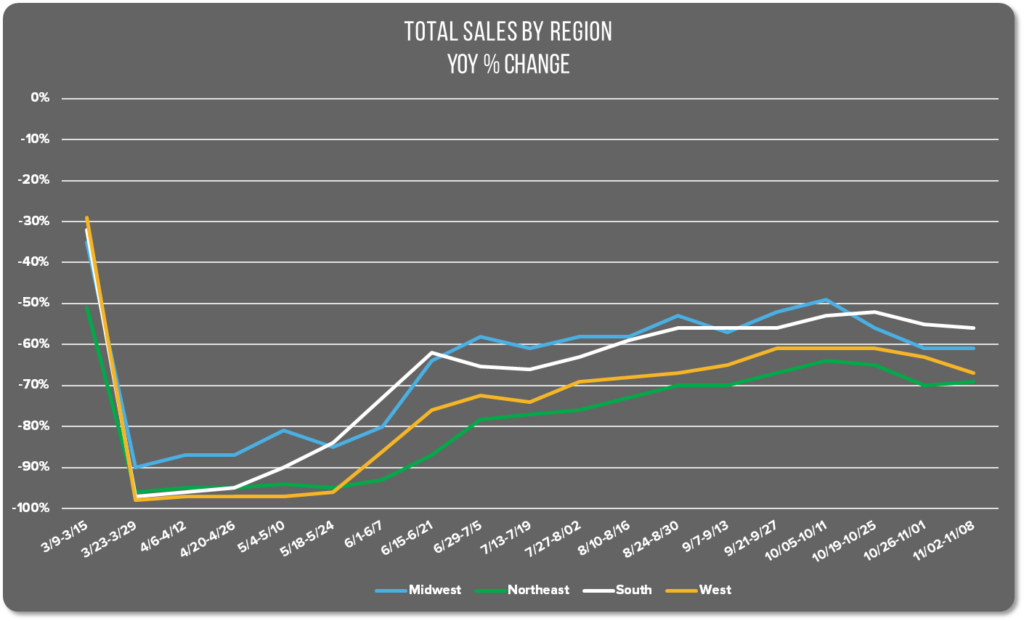

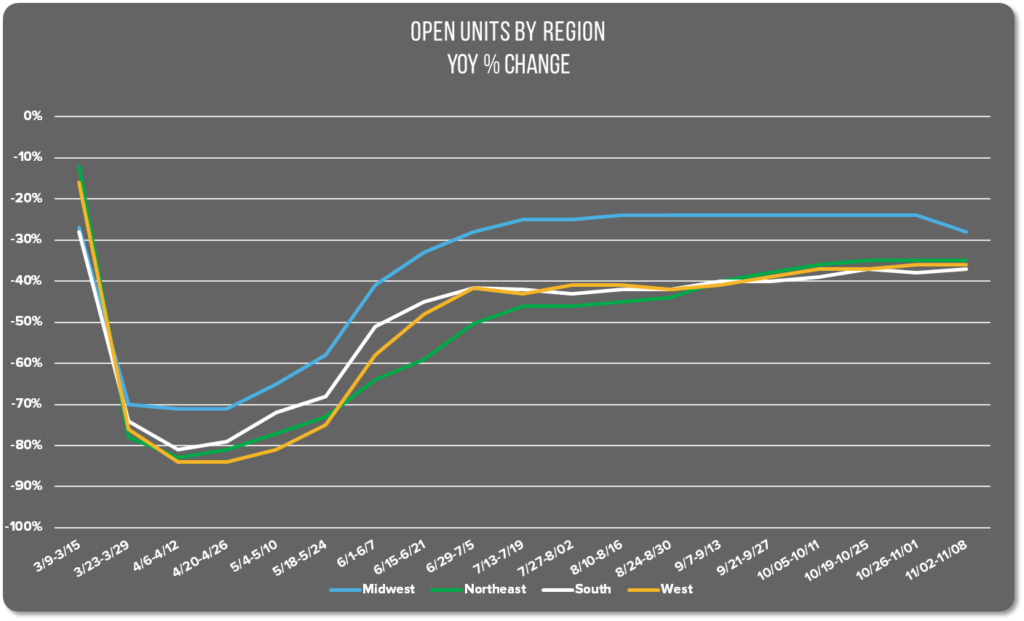

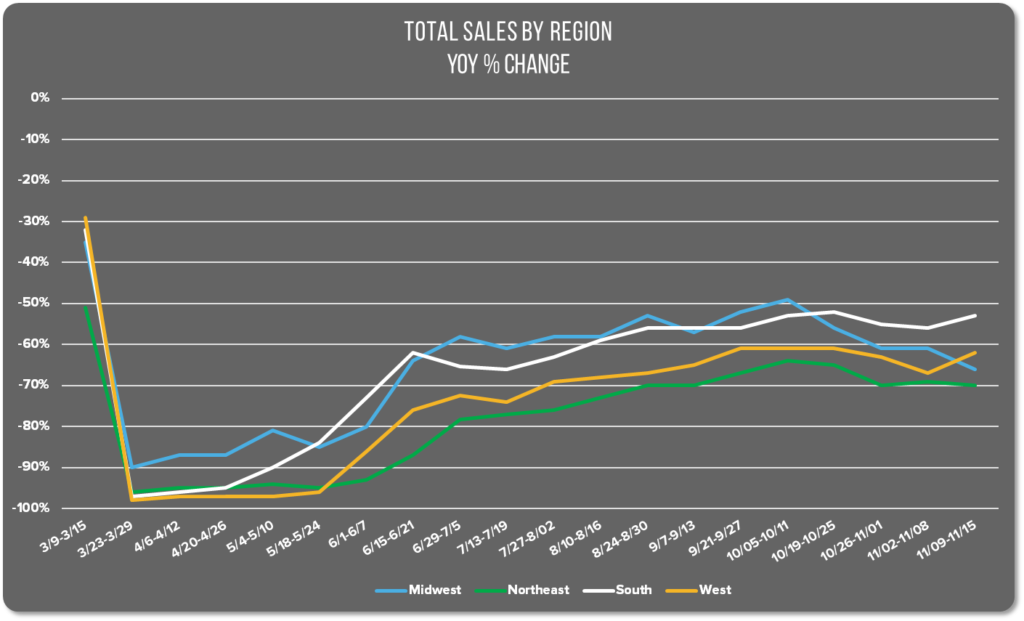

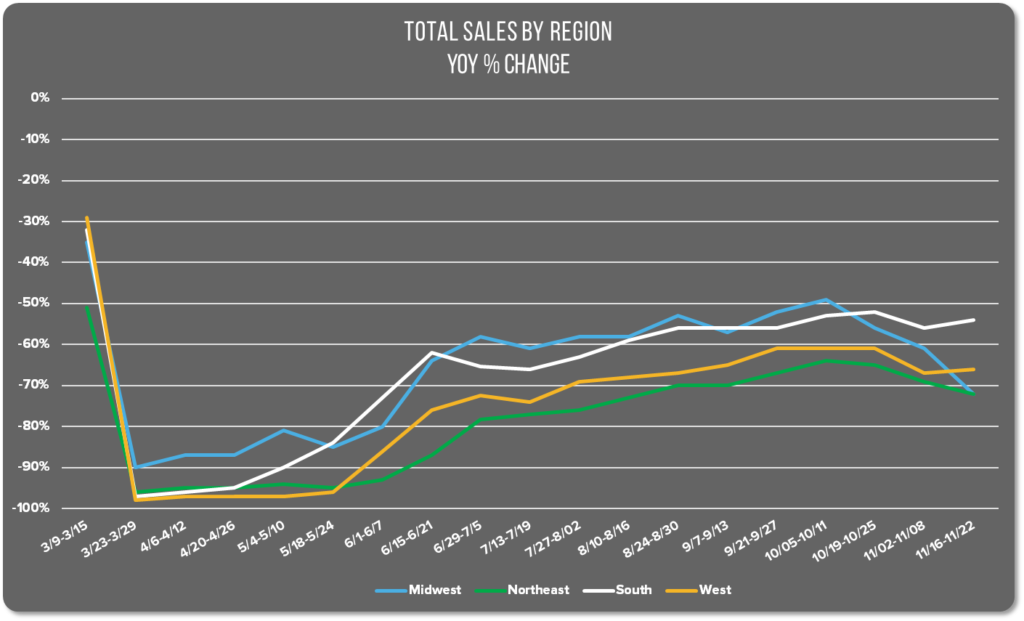

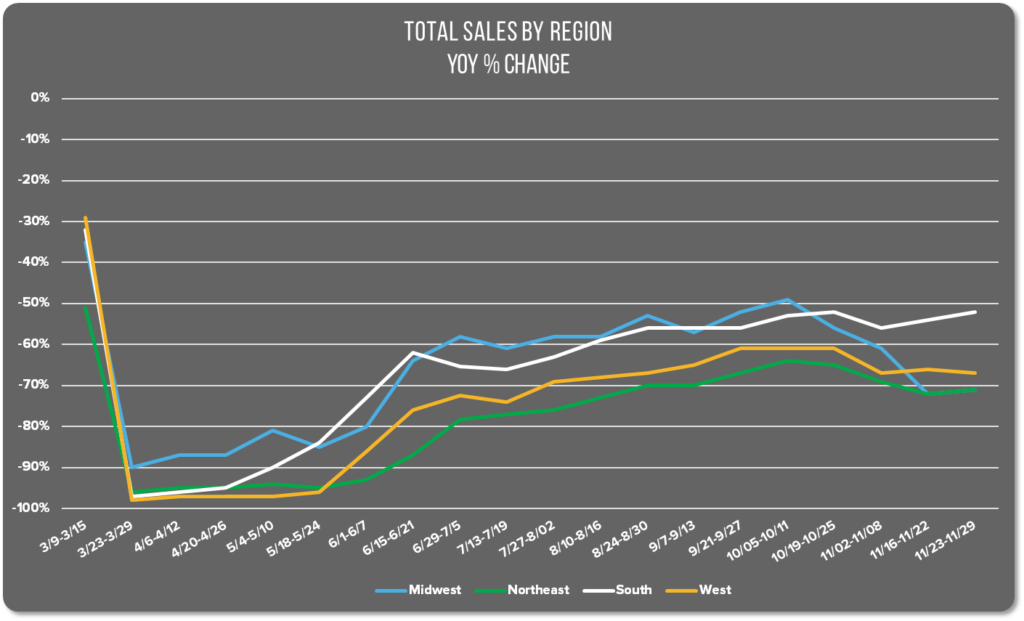

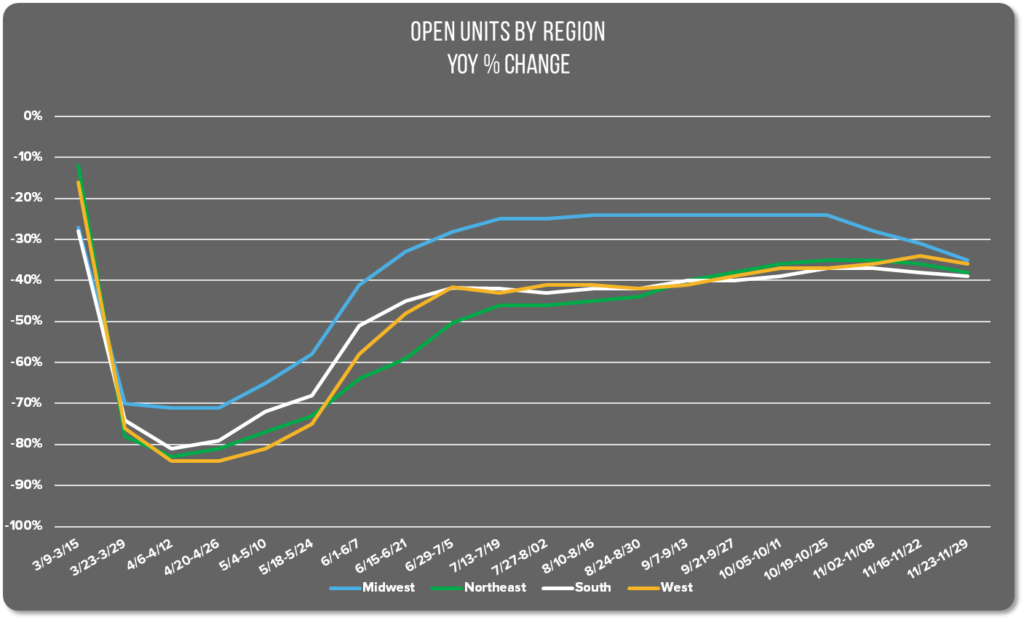

When we look at the Total Sales by Region graph of our Index, the Northeast has consistently suffered the most in terms of restaurant sales since June. The Midwest and the South have taken the top spot in turns, clearly dominating restaurant sales recovery.

The West has two states in the “tightest control measures” group (California, and New Mexico) and two in the “fewest control measures” group (Arizona, and Utah). The rest of the Western states fall in the “intermediate” category, which tracks with our Index. The Western region consistently performed better than the Northeast in terms of restaurant sales, but not as well as the Midwest and South.

Professor Thomas Hale, who leads the Oxford tracking effort said the data makes it clear that quick, forceful action gives governments the best shot at combatting the virus, and the more swiftly they act, the shorter lockdown policies need to be.

With the Thanksgiving holiday coming up, it’s likely that Covid-19 numbers will climb even higher over the coming weeks. Health experts and government leaders have urged Americans to stay home next week rather than travel to celebrate Thanksgiving. To that end, AAA anticipates a 10% drop in travel over the holiday weekend. Still, a much greater percentage than 10% would need to skip mixed-household gatherings to reduce the impact the holiday is likely to have on new infections in December.

We’ll be sure to let you know how it goes here on the Avero Index. Read on for an important correction in last week’s update.

NOVEMBER 16-22: NATIONAL RESTAURANT SALES FALL SLIGHTLY HEADING INTO THANKSGIVING HOLIDAY

Published 11.25.20

Index at a Glance

- All Avero Index: Sales down 3%, no change in open units

- Midwest: Sales down 6%, open units down 2%

- Northeast: Sales down 2%, no change in open units

- South: Sales down 1%, no change in open units

- West: Sales down 4%, open units up 1%

Nationwide Restaurant Performance

National restaurant sales fell 3% last week though there was no change in the percentage of open units in the All Avero Index. The data reflects the difference between how state and local governments are handling this current third wave of Covid-19 compared to the first wave in March. Unlike this spring, when most of the country shut restaurants down to try to mitigate the virus spread, the current national trend is to allow up to 50% capacity for indoor dining.

November’s Covid-19 positive case load is setting records. By the end of November, it’s likely the tally will top four million, which is more than double the number of infections in October. In fact, the November total is more than half a million cases larger than the combined totals of the first six months of 2020. You can see the monthly case totals here.

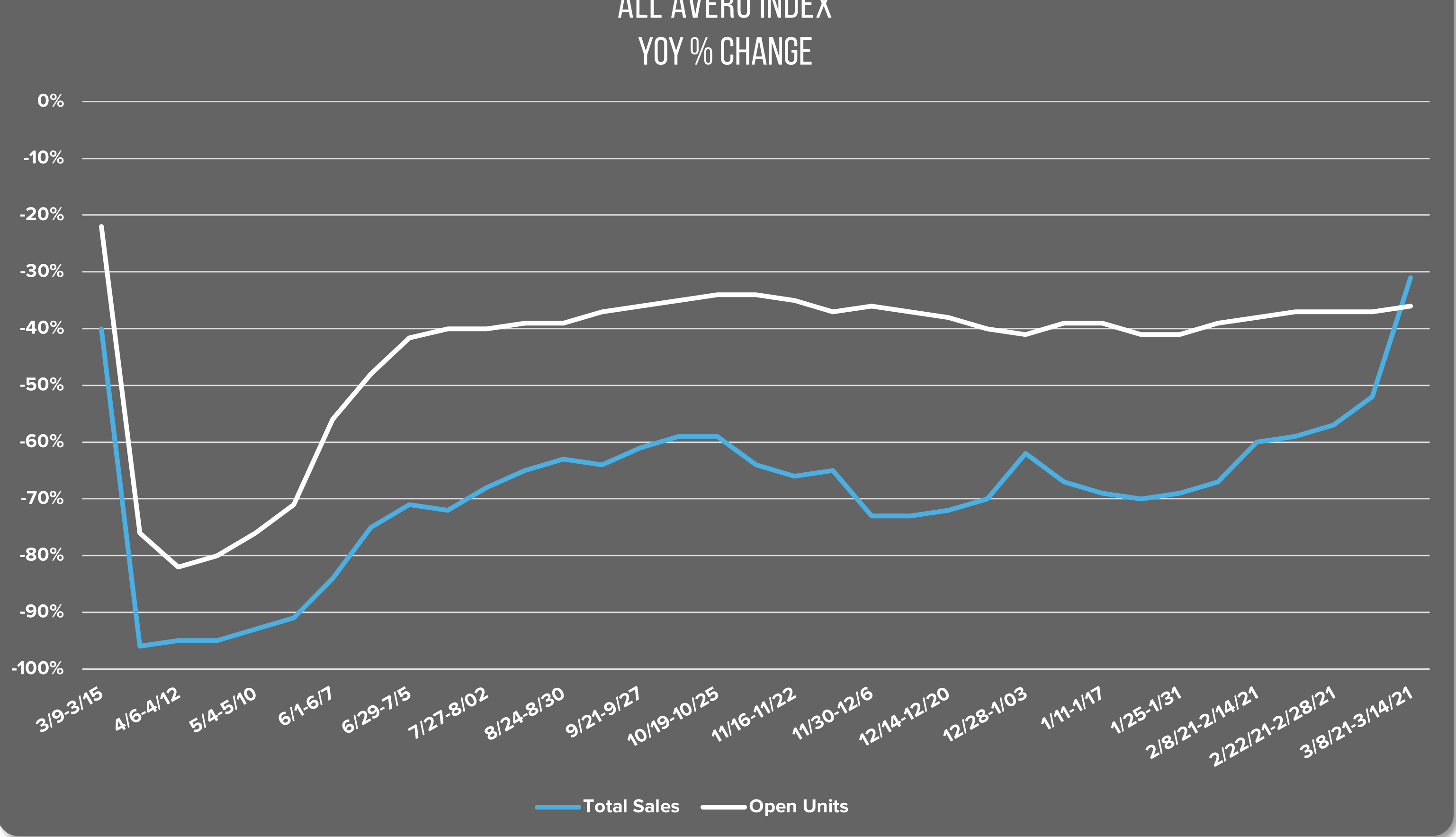

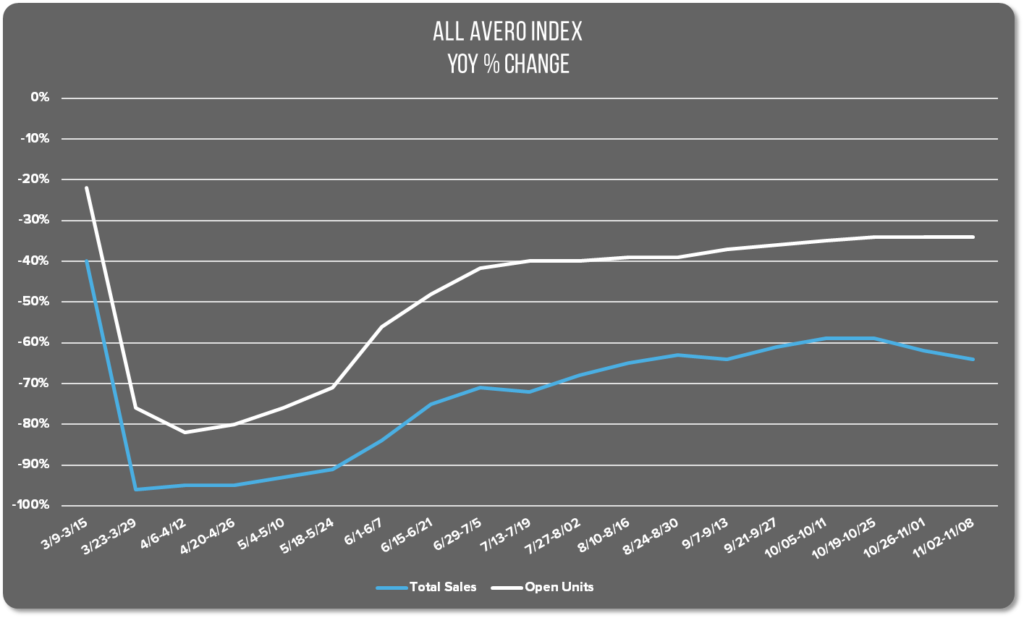

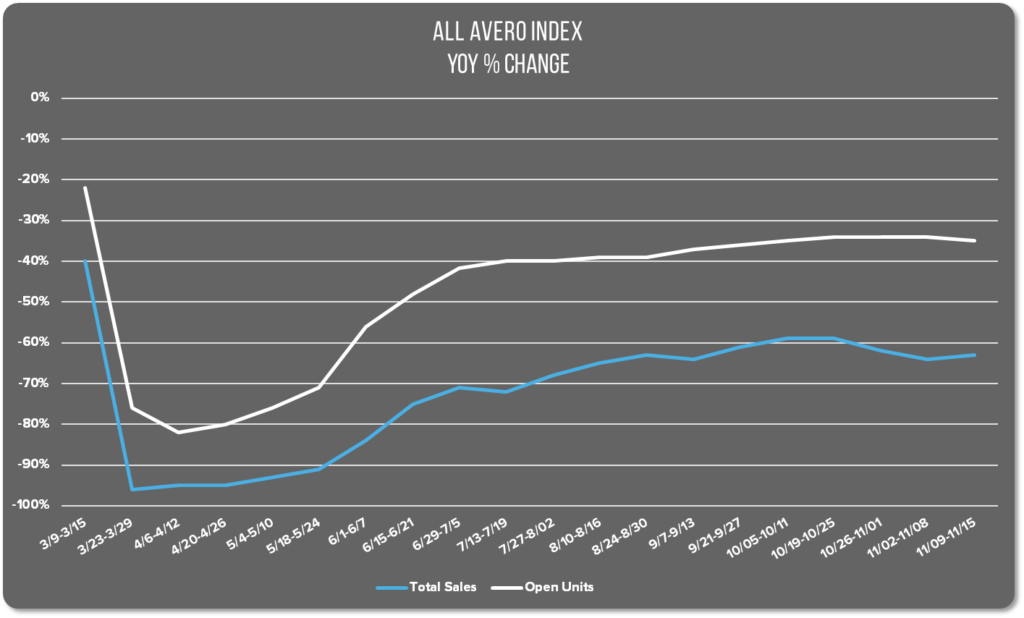

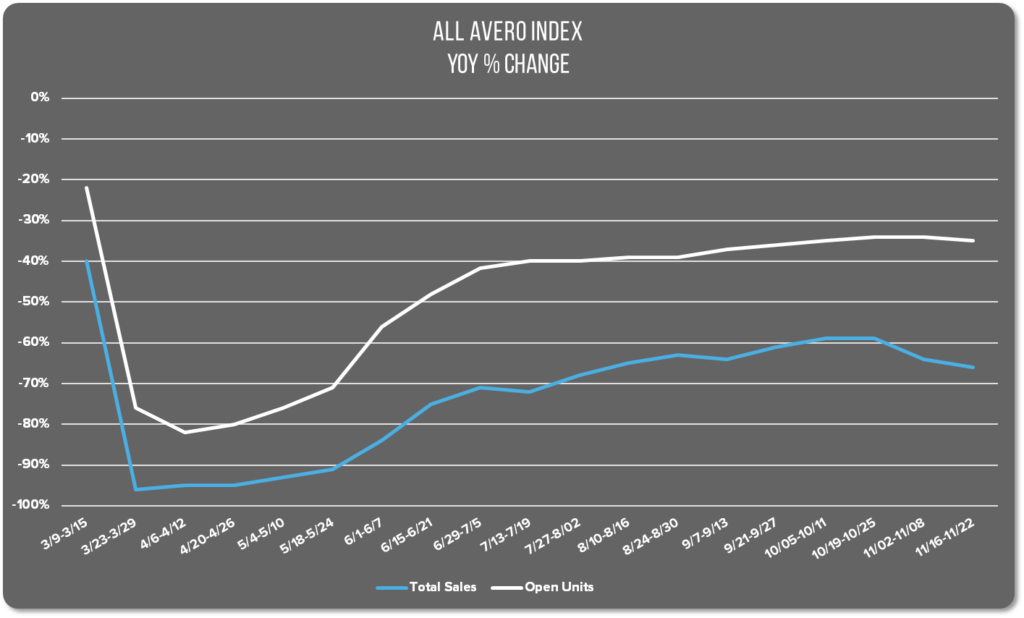

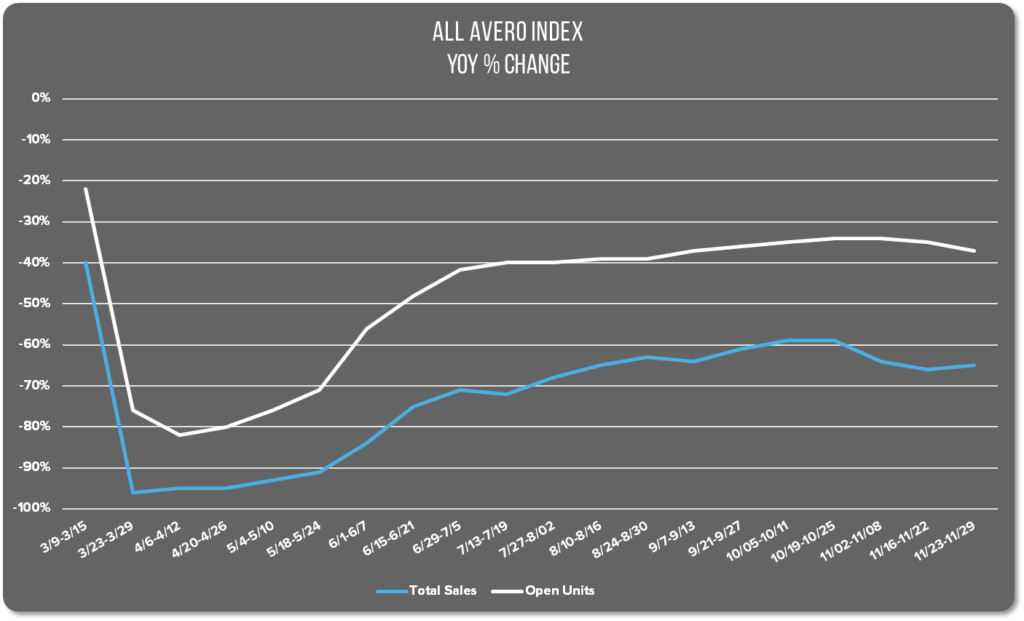

The week of March 23-29, the Avero Index shows that restaurant sales fell to just 4% of normal in a YoY comparison. Since then, sales have recovered somewhat, hovering just below 40% of normal this fall. Considering that the spread of the virus in the US is at an all time high, and projected to grow, it’s a relief that we’re not seeing a return to the dismal restaurant sales seen in March. However, the fact that restaurants never even reached even half of their normal volume over the past 8 months should make it clear just how dire the situation is for the hospitality industry with the coldest months still ahead.

Regional Restaurant Performance

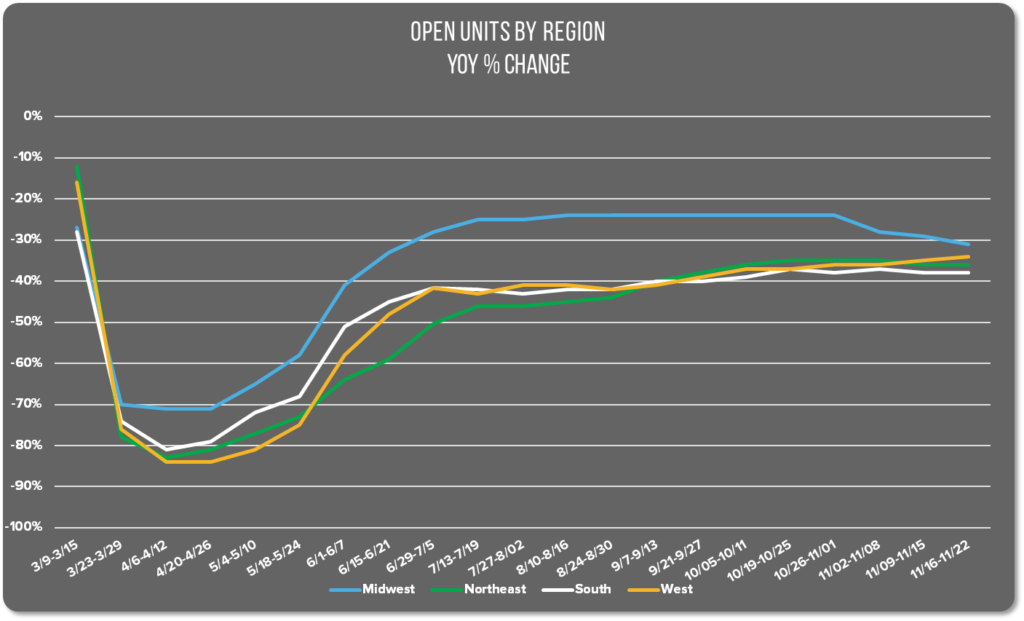

The Midwest continues to be the unfortunate loss-leader in the regional index. Restaurant sales fell 6% in the region accompanied by a 2% dip in the percentage of open units. No other regions recorded a loss in open units last week. Illinois is one of only a handful of states that has restricted restaurants to takeout and outdoor dining. Similar restrictions are in place in Minnesota and Michigan and three additional states have followed suit in the Western region.

The Western region suffered the next largest loss last week showing a 4% dip in sales. Surprisingly, that dip was accompanied by a gain in the percentage of open units. California reported 15,000 new coronavirus cases on Saturday and a looming hospital bed shortage. The governor has not instituted state-wide bans on indoor dining, though it has been restricted more heavily in some areas.

The Los Angeles area implemented a ban on indoor dining earlier this month but has been allowing outdoor dining with restricted capacity. As of today however, LA officials have prohibited all in-person dining, leaving takeout and delivery as the only options for the next three weeks. The Bay area currently allows limited capacity outdoor dining but that may change soon. New Mexico, Oregon, and Washington have all restricted restaurants to takeout and delivery only.

Restaurant sales in the Northeastern region fell 2% last week though there was no change in the percentage of open units. New York still allows some indoor dining in most regions. The major exception is upstate where New York City is split into zones according to the level of infection. Each zone has its own level of restrictions. In a red zone, restaurants are limited to takeout and delivery only. Orange zones prohibit indoor dining and outdoor dining is limited to a four-person maximum per table. In yellow zones, both indoor and outdoor dining are relegated to four-person maximums. Last week, mayor Bill DeBlasio said he expects the entire city to be designated as orange at a minimum within a week or two.

Pennsylvania announced a one-day prohibition against alcohol sales in bars and restaurants after 5 pm on Wednesday. Governor Tom Wolf announced the decision Monday after claiming that the biggest day for drinking is the day before Thanksgiving.

In the South, sales only fell 1% and there was no change in the percentage of open units. Kentucky is the only state in the region with a restriction on all in-person dining. Florida by contrast has been granted protection against shutdowns and capacity restrictions greater than 50% by Governor Ron DeSantis

Florida is quickly approaching the one million cases milestone previously reached by California and Texas. According to a White House report, the number of counties in the red zone doubled last week and there is concern about the rising number of long-term care facilities with positive staff.

Whether or not to travel over the Thanksgiving holiday has been a hot topic in the news. Despite pleas from Dr. Anthony Fauci and other top health experts, up to 50 million people could be traveling for the holiday this week. With widespread vaccine availability still months away, the impact Thanksgiving plans will have on infection rates heading into Christmas and New Year’s is certain to be significant.

Many will choose to keep their plans and go forward with travel and gather indoors in groups. But certainly, many others are changing their plans and paring down the guest list. Will we see a rise in restaurant sales as more people stay home and supplement their holiday menu with takeout options? Or will less travel result in fewer restaurant sales? We’ll let you know the answer in next week’s Avero Index analysis.

NOVEMBER 23-29: NATIONAL RESTAURANT SALES REMAIN 68% BELOW NORMAL ON THANKSGIVING DAY

Published 12.3.20

Index at a Glance

- All Avero Index: Sales down 3%, no change in open units

- Midwest: Sales up 1%, open units down 4%

- Northeast: Sales up 1%, open units down 2%

- South: Sales up 2%, open units down 1%

- West: Sales down 1%, open units down 2%

Nationwide Restaurant Performance

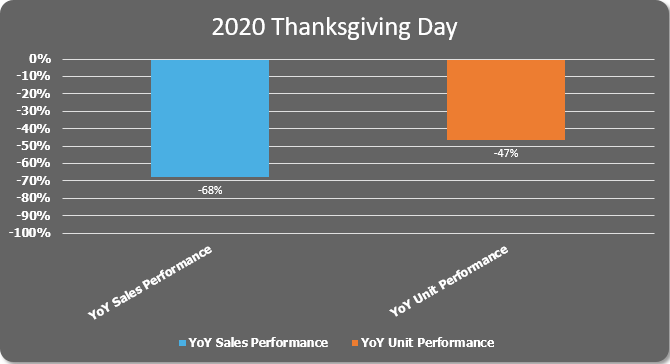

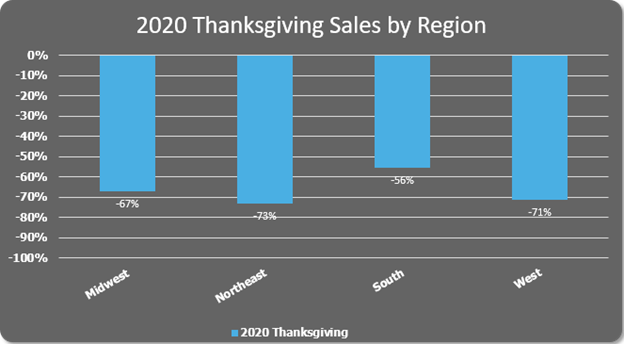

National restaurant sales fell 3% last week compared to the previous week. That puts sales 65% below normal in a YoY comparison. Sales on Thanksgiving Day fell slightly more, coming in at 68% below the sales average for the holiday in 2019.

The day before Thanksgiving, the number of Americans hospitalized with Covid-19 was 100,000, which is more than double the high point of the first wave in the spring. The death toll also broke April’s record at 2,885. In the spring, the virus spread and deaths were concentrated in New York and the Northeast whereas today, the outbreak is effectively spread across the entire country. Health experts expect the death toll to worsen significantly in a couple of weeks once the effects of Thanksgiving travel are felt.

On the Friday following Thanksgiving, the number of travelers screened at a US airport topped 1 million for the second time since March according to TSA. TSA screened 1.17 million on Sunday. Though the number of travelers is only 41% of what it was in 2019, it’s important to note that 2019 was a record high year. All told, 9.4 million people were screened in airports over the Thanksgiving travel week. Since March, security checkpoints have only screened over one million passengers on five individual days. Four of them occurred over the holiday period. The fifth was Columbus Day (Oct 12).

The upside in terms of the virus’ spread is that millions of people opted not to travel for the holiday. Less travel precipitated smaller gatherings. We had hoped to see a slight uptick in restaurant sales due to more people foregoing large guestlists and elaborate home cooking. These restaurants, for example, reported an increase in preorders for Thanksgiving. Unfortunately, that didn’t pan out. Thanksgiving Day sales were slightly lower than the weekly average as seen below.

Regional Restaurant Performance

Regionally, restaurant sales rose slightly last week, except in the West where sales fell 1%. Conversely, the percentage of open units fell slightly in every region. Perhaps the same number of diners patronized restaurants at the same rate but had fewer outlets to choose from.

In the West, the number of open units fell 2% last week, and is likely to fall further next week as California has announced a stay-at-home order for every region where ICU beds have reached 15% capacity. CBS reports fewer than 2,000 available ICU beds currently, with over 1,800 patients currently in ICU units across the state. At the current level of positivity, those remaining beds will be full before January. Governor Gavin Newsom says he expects 4 out of 5 regions to meet the standard for stay-at-home orders by the end of the week. A non-essential travel ban will impact the state’s hotels, limiting them to “essential travelers” only. Travelers to the state must also undergo a 14-day self-quarantine.

The Southern region had the best performance last week showing 2% sales growth despite a 1% decrease in open units. Florida reported 10,870 new cases today and became the third state to surpass one million Covid-19 cases, following California and Texas.

After a month of silence from Florida Governor Ron DeSantis, he appeared in a press conference to reiterate his steadfast opposition to lockdowns, mask mandates, and school closures in the state. Following an investigation that interviewed over 50 doctors, scientists, state health department employees, and other state officials, the Sun Sentinel revealed unfavorable facts about DeSantis’ “timeline of secrecy.” The report includes evidence that De Santis prevented state employee spokespeople for the Florida Department of Health from mentioning Covid-19 in the weeks leading up to the election, and throughout the month of November. The governor’s anti-mask spokesman regularly posts misinformation about the virus on Twitter and state officials withheld information about infections in prisons, schools, hospitals, and nursing homes, relenting only under pressure of legal action from advocacy groups and journalists.

The lack of regulations in Florida may be good for the short-term revenue of packed bars in college towns. The longer the virus spreads unchecked, the longer the pandemic stands to drag on, which is bad for business in the long term.

Sales rose 1% in the Northeastern and Midwestern regions. The percentage of open units fell in the Northeast by 2% and 4% in the Midwest. On Thanksgiving Day, the South had the biggest sales, a full 12% higher than the national average for the holiday. The Midwest takes second place with a 1% lead on the national average. The Northeast fared the worst, coming in 5% below the national average. The West performed 3 points below the national average.

With the holiday travel numbers and restaurant sales accounted for, we now await news of how much of an impact the holiday will have on the virus’ spread in the days to come. Check back next week for more insight into national and regional restaurant sales in the wake of Covid-19.