NOV 30-DEC 6: US RESTAURANTS SEE LARGEST ONE-WEEK SALES LOSS SINCE MARCH

Published 12.10.20

Index at a Glance

- All Avero Index: Sales down 8%, open units up 1%

- Midwest: Sales down 6%, no change in open units

- Northeast: Sales down 9%, no change in open units

- South: Sales down 9%, open units up 1%

- West: Sales down 10%, open units down 1%

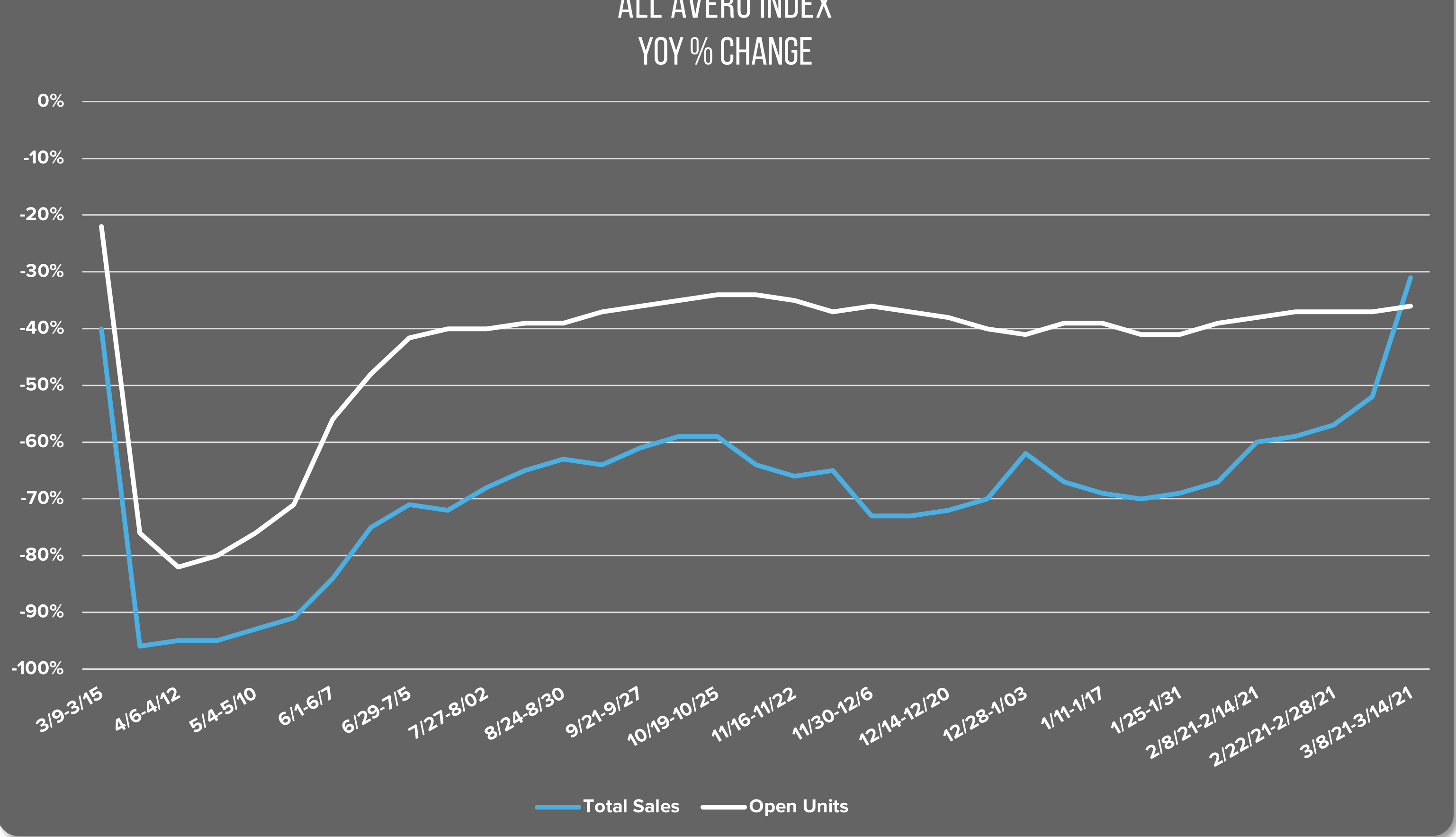

Nationwide Restaurant Performance

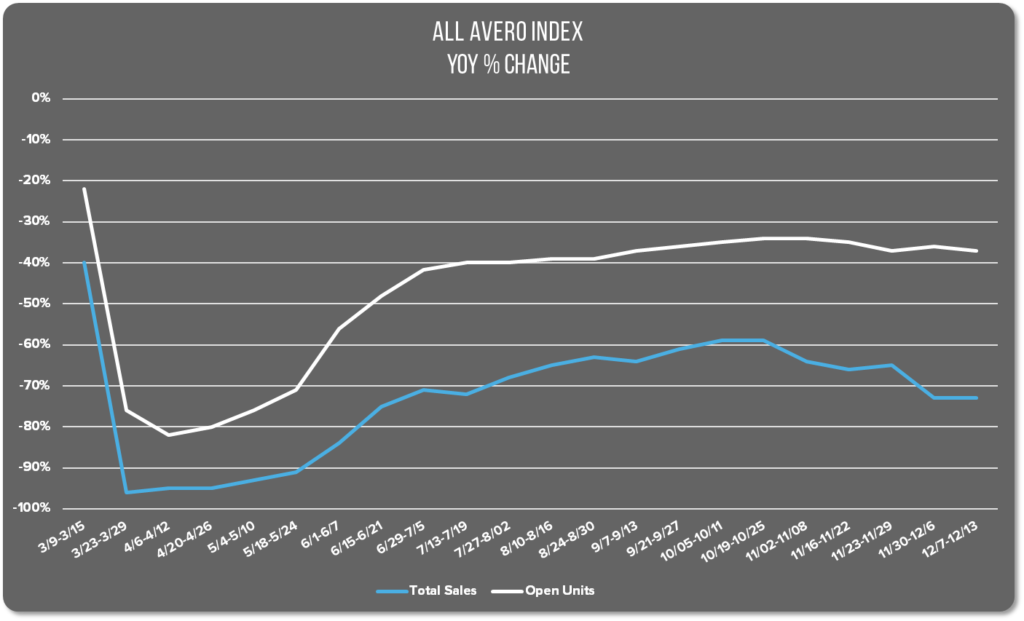

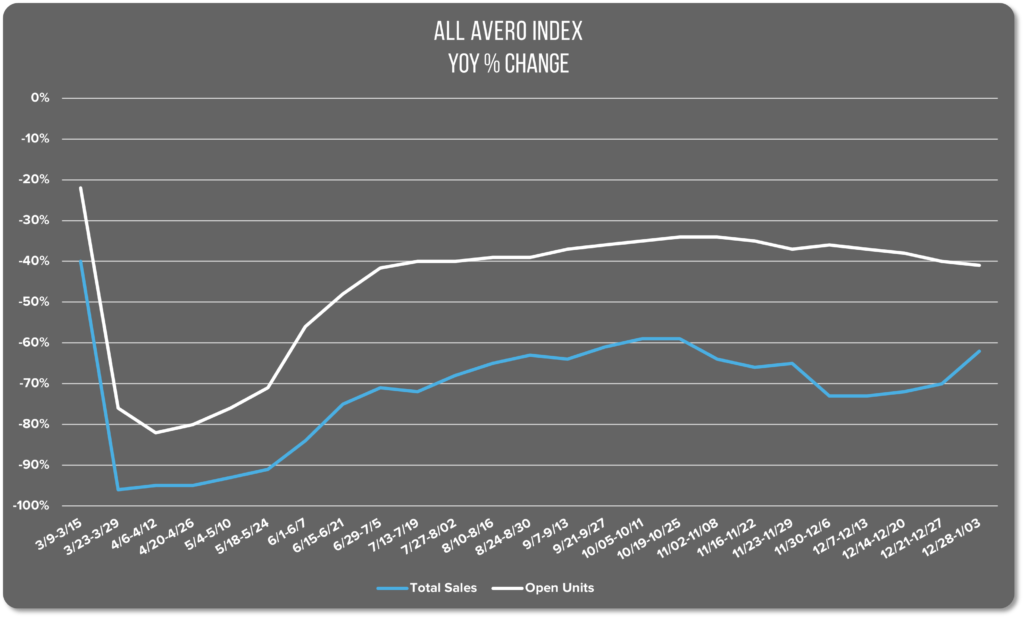

National restaurant sales fell 8% in the All Avero Index (AAI). That is the greatest one-week loss we’ve seen in the AAI since the second week in March when sales fell 51%. Thankfully, last week’s loss is nowhere near the level we saw in March. But it is notable that since then, restaurant sales have been slowly but steadily trending up. Losses have generally stayed below 3% and have been quickly regained in the following weeks.

One exception to this pattern is the sales spike we saw over Labor Day. The week following the holiday looked like a 7% loss but was simply a return to pre-holiday levels. That is not the case now, considering that sales were down over the Thanksgiving holiday. This week’s 8% loss follows two weeks of 3% losses, bringing November’s losses to 14%.

The percentage of open units increased by 1%. The increase is perhaps not statistically significant. But it does provide further evidence that so far, government officials are taking a drastically different approach to virus mitigation than they did in the spring with widespread shutdowns.

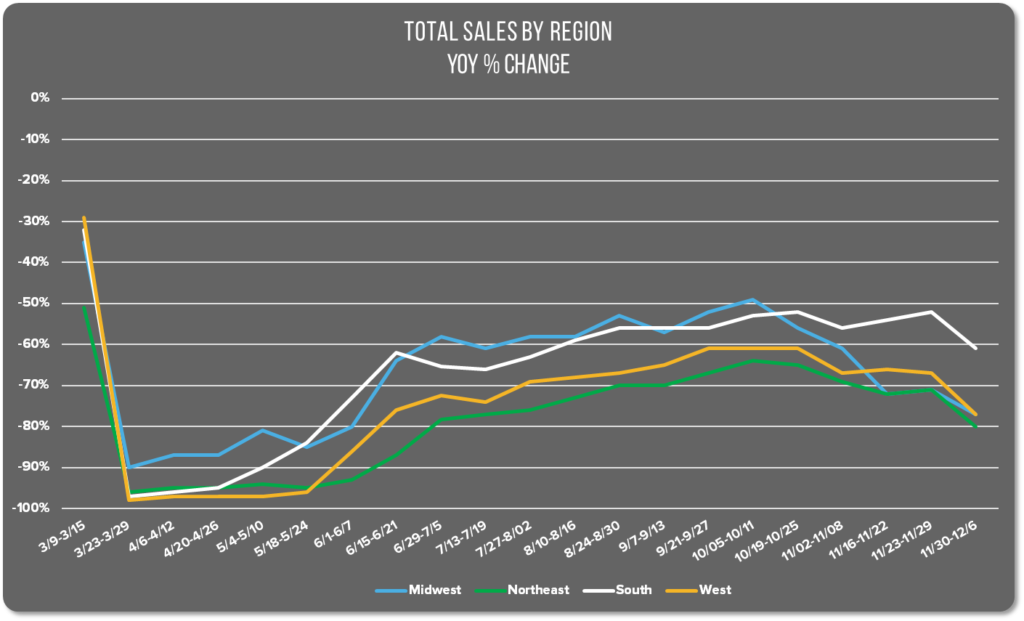

Regional Restaurant Performance

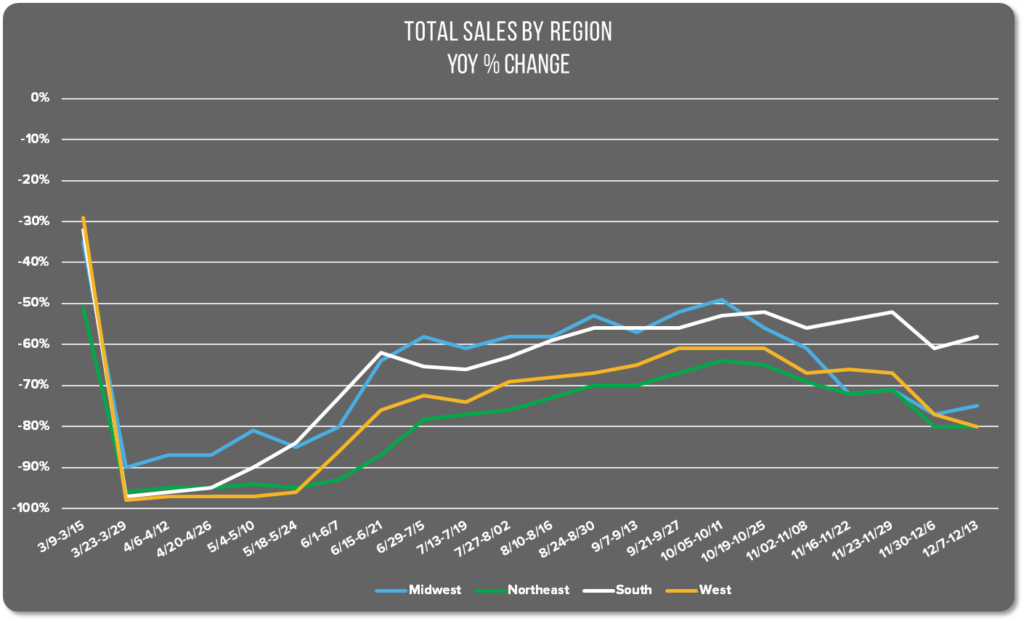

The Midwest gets a break from being the loss leader in the regional view last week. Restaurant sales in the region only fell 6% and there was no notable change in the percentage of open units. At the end of September and into early October, sales were hovering around the 50% of normal range. Their best week coincided with Labor Day when sales were 54% of normal. Things turned mid-October, and since then, the region has seen incremental loss nearly every week.

The Southern region shows a 9% sales loss last week. Aside from Labor Day, sales have fluctuated a few points week-to-week but have been consistently in the same range—about 46% of normal. This 9% change is the biggest one-week change in the region since March, excepting the temporary boost over Labor Day. The South saw a 1% increase in the number of open units last week.

Sales in the Northeastern region fell 9% as well with no change in the percentage of open units. Last week’s sales were only 20% of normal in a YoY comparison—a level not seen since the second week of July when New York Governor Andrew Cuomo abandoned plans to reopen indoor dining in the city. The Northeast has struggled the most out of all the regions in terms of returning to normal sales levels. Since March, the highest restaurant sales have been in the Northeast was in early October and only reached 36% of normal YoY.

The Western region has fared better than the Northeast, but not as well as the Midwest or South. Sales dropped 10% last week, with an accompanying 1% loss in the percentage of open units in the region. That puts them currently at 23% of normal YoY. The high point for sales in the West occurred on Labor Day at 42% of normal. Other than that holiday outlier, the best performance was 39%, which they maintained for nearly 5 weeks this fall. Sales started to slow again in November.

Health experts estimate that we will begin to truly see the effects of Thanksgiving travel on the virus’ spread beginning next week. The logic is that it will take about a week for people to develop symptoms and seek a test. It could take another week to get test results or for the infection to progress to the point of hospitalization. It could be another two weeks before the seriously ill die, and then additional time before those deaths are officially recorded.

As high as Covid-19 levels are in every region of the US right now, we can be certain they will continue to grow over the coming weeks, repeating and compounding the same scenario for the upcoming winter holidays. Friends, please stay safe out there! Make good choices. Support your local restaurants with takeout and delivery orders and be a generous tipper. We’re all in this together.

DECEMBER 7-13: NATIONAL RESTAURANT SALES EXCEED EXPECTATIONS FOR THE BETTER

Published 12.16.20

Index at a Glance

- All Avero Index: No change in sales, open units up 1%

- Midwest: Sales up 2%, no change in open units

- Northeast: No change in sales, open units down 1%

- South: No change in sales, no change in open units

- West: Sales down 2%, open units down 2%

Nationwide Restaurant Performance

This week’s Avero Index was a pleasant surprise. The All Avero Index shows no change in sales. The percentage of open units rose by 1%. Coming off the heels of a big loss last week, we’re pleased to see sales holding ground for the most part.

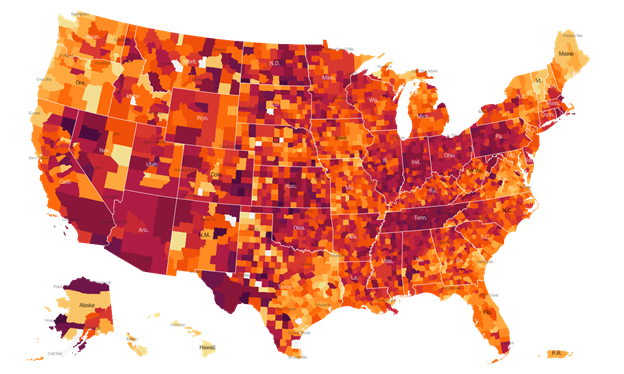

The New York Times reports that last week the US saw an average of 206,557 new coronavirus cases per day, a 28% increase in the average two weeks ago. The heat map shows a country desperately in need of a relief. Forty-one states have sustained high rates of infection. Nine states have a high rate that is slightly decreasing. On December 9, the country hit a tragic milestone of 300,000 deaths.

Luckily, relief is on the horizon. The Covid-19 vaccine program is officially underway. Around 500,000 doses of the newly approved Pfizer vaccine were delivered to over 140 sites across the country on Monday. A second vaccine made by Moderna is set to receive approval on Friday which will trigger shipment of six million doses to over 3,200 US locations over the weekend.

Regional Restaurant Performance

Restaurant sales held ground regionally as well. The Midwest did the best out of all the regions. Sales grew there 2% with no change in the percentage of open units.

The Western region struggled the most with a 2% sales loss, and 2% decrease in the percentage of open units. California is currently under a second stay-at-home order that began December 6th and will last until at least December 28th. Restaurants are restricted to takeout and delivery orders only. The outdoor dining pavilions created earlier this year to extend the outdoor dining season into the winter months have largely been dismantled to discourage people from congregating. Many restaurants are opting to close rather than shift to takeout/delivery.

The West’s other major restaurant market, Las Vegas, is also operating under heavy restrictions, though not quite as severe as those in California. In Las Vegas, restaurants, bars, and casinos are currently restricted to operating at 25% capacity.

Restaurant sales in the Northeast and South remained steady last week. The only change in either region was a 1% dip in the percentage of open units in the Northeast.

New York City has closed indoor dining once again for a minimum of two weeks while cases and hospitalizations continue to rise. With sales a mere 20% of what they were this time last year and having never exceeded 35% of YoY sales since March, the latest pause is yet another blow in a seemingly endless rollercoaster ride. Though the city has extended a moratorium on commercial evictions, industry insiders warn that we will continue to see hundreds of permanent closures before the pandemic ends.

Due to the upcoming holidays, we won’t update the Index again until the new year. In January we will provide an in-depth analysis of restaurant performance over the holidays and a retrospective look for the year. Plus, we’re releasing our deep dive on the state of the industry in Las Vegas tomorrow so stay tuned. Have a wonderful holiday and let’s all raise a glass in hopes of a better 2021!

DECENT NEW YEAR’S EVE RESTAURANT SALES FOLLOW BLEAK CHRISTMAS PERFORMANCE

Published 1.13.21

Index at a Glance 12.13.20-1.3.21

- All Avero Index: Sales up 11%, open units down 4%

- Midwest: Sales up 11%, open units down 3%

- Northeast: Sales up 7%, open units down 10%

- South: Sales up 14%, no change in open units

- West: Sales up 12%, open units down 1%

After a brief hiatus over the holidays, we’re back with this week’s Avero Index analysis. Today’s report includes a week-by-week glance at restaurant performance over the past three weeks. Plus, we’ll also take a look at how restaurants fared over the Christmas and New Year holidays.

Week of 12.14.20-12.20.20

- All Avero Index: Sales up 1%, open units down 1%

- Midwest: Sales up 3%, no change in open units

- Northeast: Sales down 5%, open units down 6%

- South: Sales up 5%, open units up 1%

- West: Sales up 5%, open units down 1%

Week of 12.21.20-12.27.20

- All Avero Index: Sales up 2%, open units down 2%

- Midwest: Sales up 5%, open units down 1%

- Northeast: Sales up 9%, open units down 1%

- South: Sales down 4%, open units down 1%

- West: Sales down 1%, no change in open units

Index at a Glance 12.28.20-1.3.21

- All Avero Index: Sales up 8%, open units down 1%

- Midwest: Sales up 3%, open units down 2%

- Northeast: Sales up 3%, open units down 3%

- South: Sales up 13%, no change in open units

- West: Sales up 8%, no change in open units

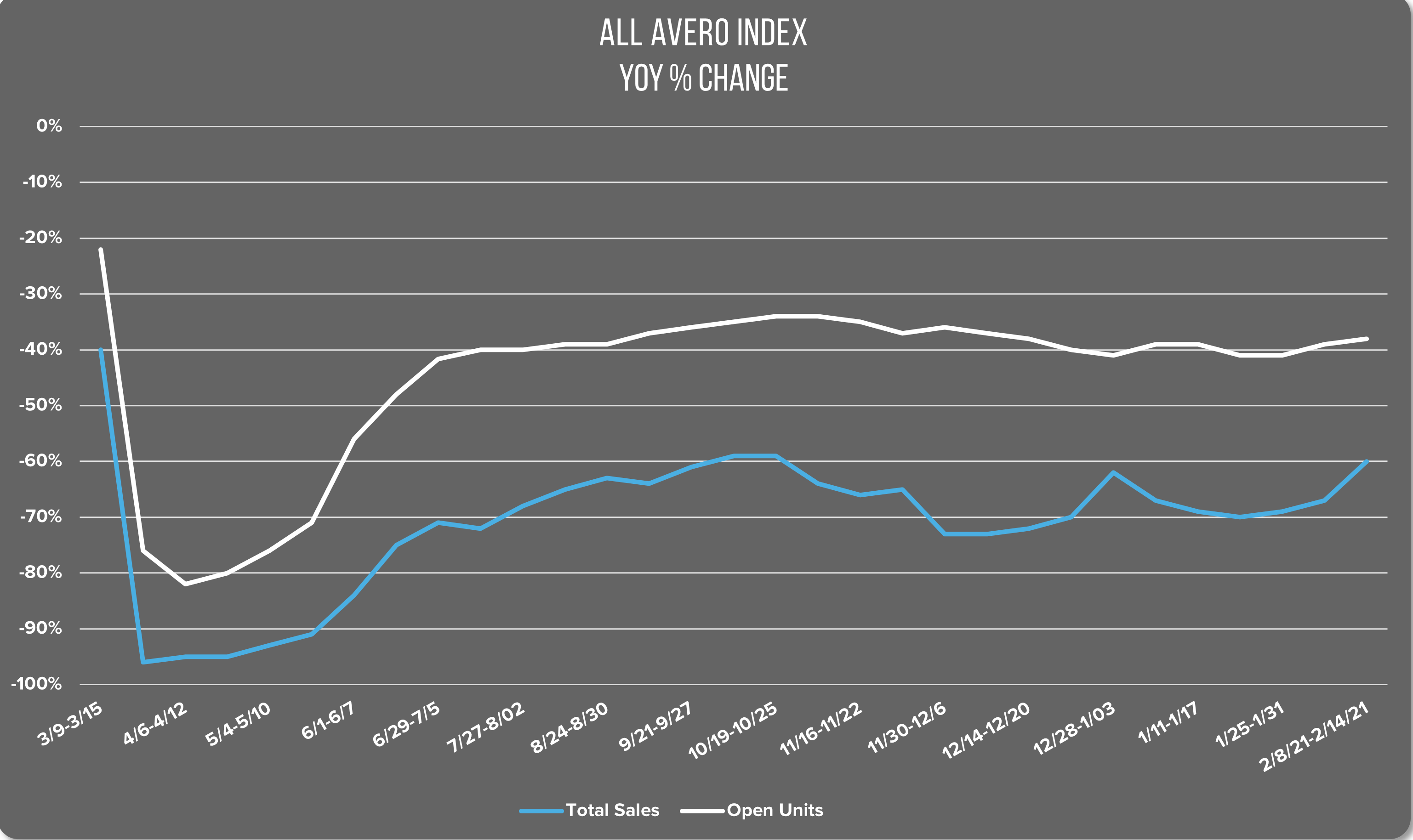

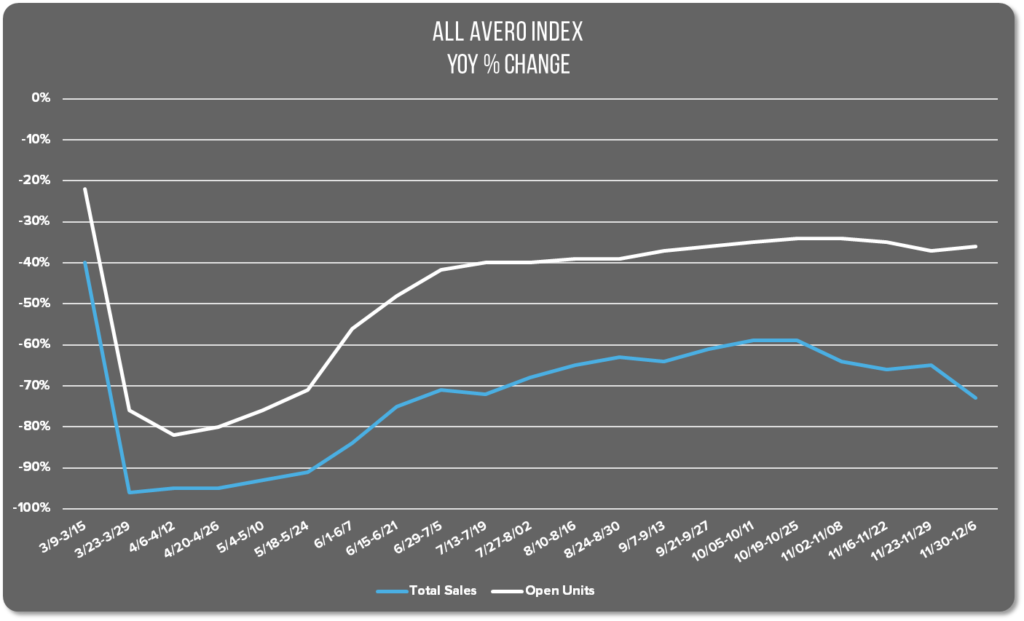

Nationwide Restaurant Performance

National restaurant sales are on the rebound in early 2021. Since our last report on December 16, the All Avero Index is up 11% and percentage of open units fell 4%. Following a dismal fall and disappointing Thanksgiving, the current upward sales trend is a very welcome development.

National Restaurant Performance Over the Holidays

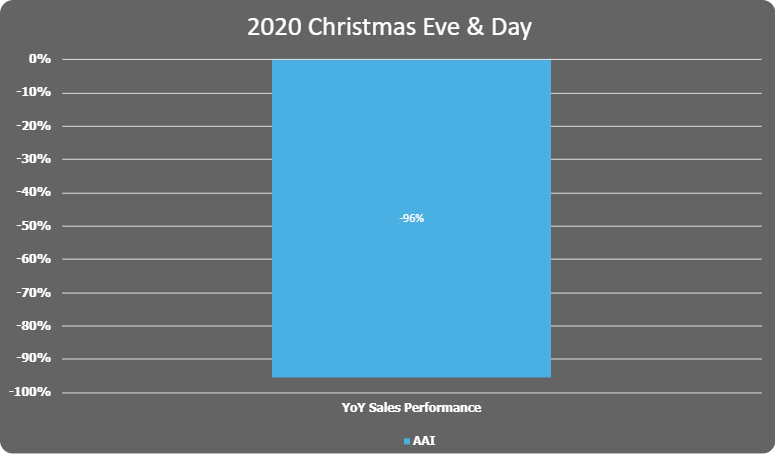

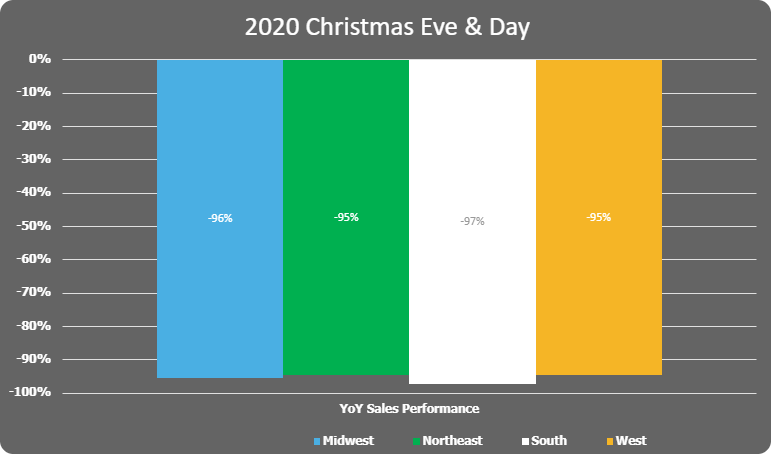

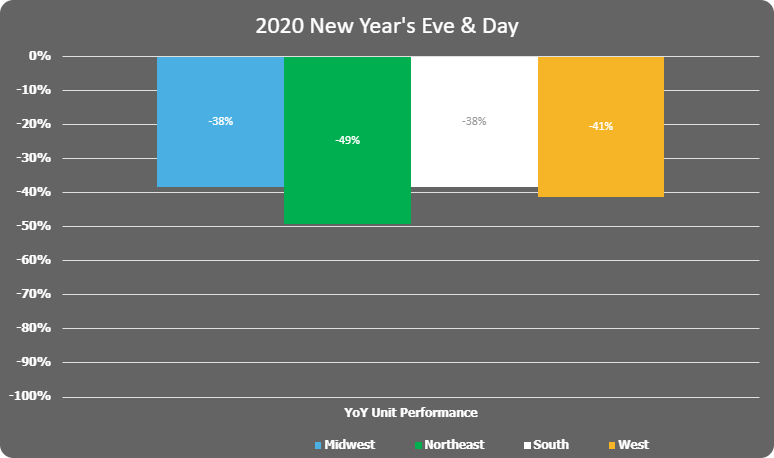

Christmas restaurant sales were bad. Really bad. Sales on Christmas Eve and Christmas Day were 96% below same day sales last year. We checked our records to see if Christmas sales were uncharacteristically high last year, contributing to the extreme deficit. But they weren’t. Christmas in 2019 fell on a weekday and was fairly quiet.

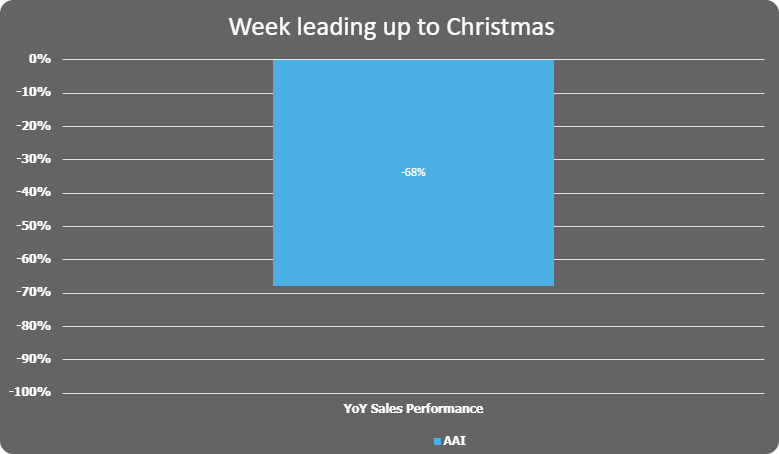

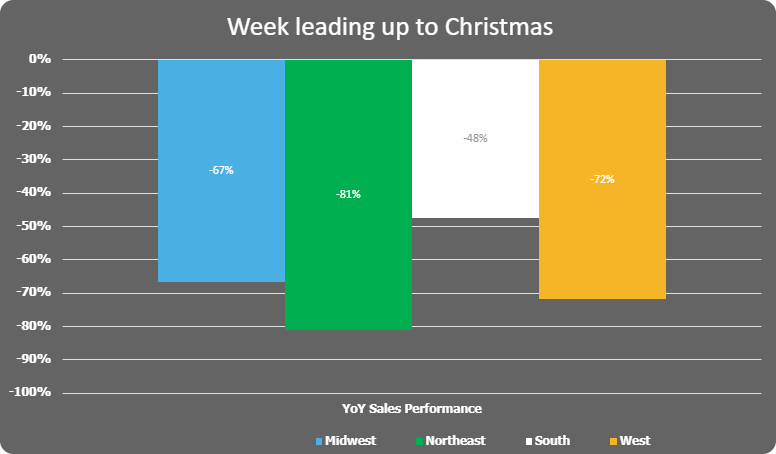

National restaurant sales on the days leading up to Christmas were decent and contributed to the 2% growth we see on the All Avero Index that week. With the pandemic in full swing in most regions of the country, we rightly anticipated that in-person dining on Christmas Eve and Christmas Day would be low. But we wanted to capture holiday-related sales in the form of pre-orders in the preceding days. Many Americans rely on restaurants to fully cater, or help supplement their homecooked holiday meals, and this year was no exception. Sales leading up to the holiday were 68% below normal YoY. That sounds bad. But don’t forget to take that number with a grain of Covid-flavored salt. In our “new normal,” 68% is 5 points higher than sales were at the beginning of December.

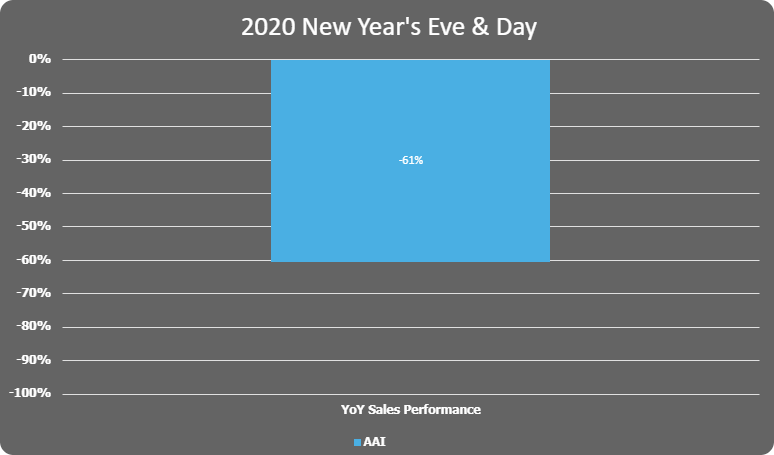

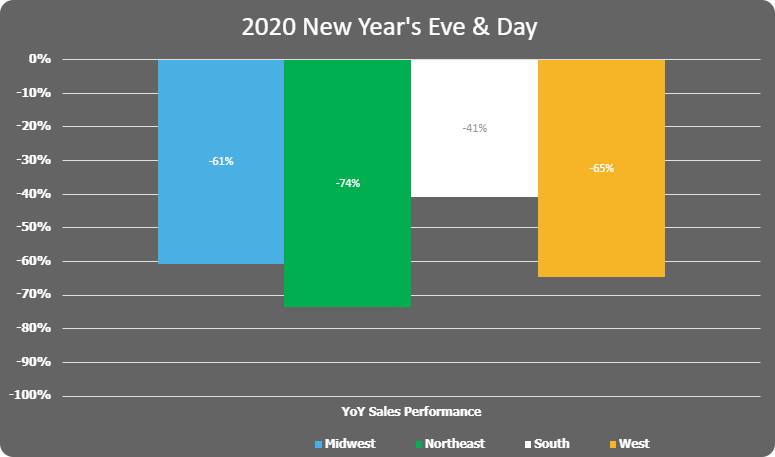

New Year’s Eve and New Year’s Day fared much better than Christmas in terms of restaurant sales. The All Avero Index shows sales at 61% below normal for those days. Compared to Christmas’ 96% deficit, New Year’s sales look downright amazing.

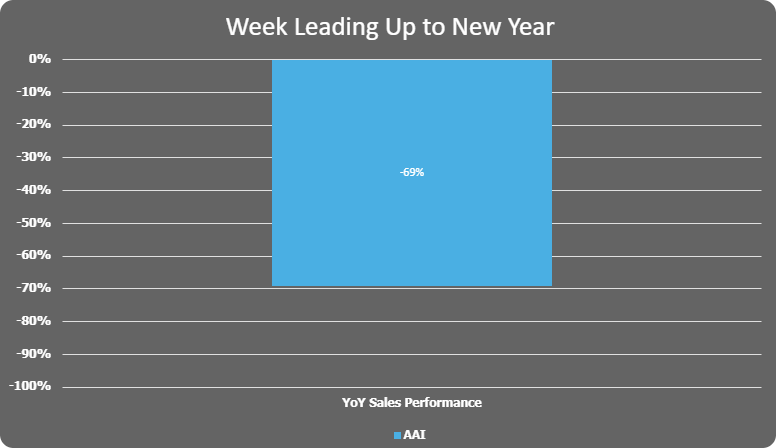

Sales grew over 8% in the week that included New Year’s Eve/Day. Most of that growth occurred on the actual holiday. Whereas there was a 28-point difference between sales on Christmas Eve/Day and the week prior, there was only an 8-point difference between sales on New Year’s Eve/Day and the week prior.

Regional Restaurant Performance Over the Holidays

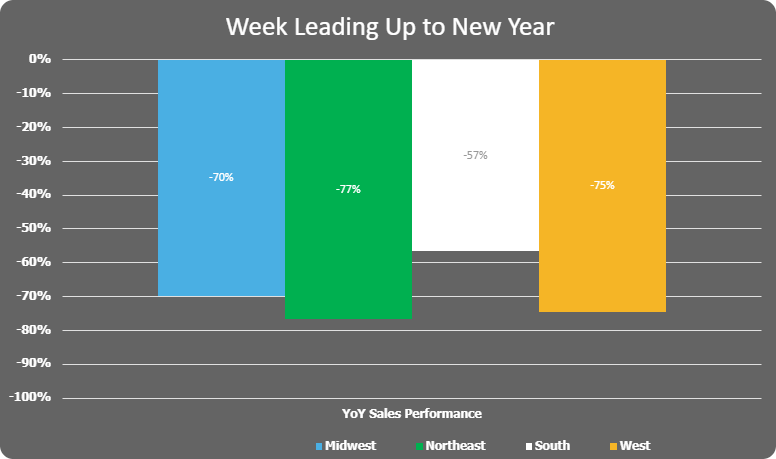

No region did especially well on Christmas Eve or Christmas Day. The point spread between the highest and lowest performance on those days is only 2%. But the South clearly outperformed all regions in the week leading up to the holiday with sales only 48% below 2019 YoY sales totals. The Northeast had the worst performance that week coming in 81% below their YoY totals in 2019.

The Northeast also had the worst sales totals over New Year’s Eve and New Year’s Day with sales 74% below 2019 YoY. Restaurant sales in the South were only 41% below normal on those days. The Midwest and West saw similar performance, coming in at 61% and 65% respectively.

Unlike the week before Christmas, which produced higher sales than the actual holiday, every region did better on New Year’s Eve and Day than they did on the non-holiday days that week. In the South, New Year’s celebrations brought in 16% higher sales than the other days that week. The Northeast only saw 3% higher sales on the actual holiday.

That difference isn’t surprising considering that major markets in the South, like Orlando and Miami don’t have mask mandates or restrictions on indoor dining, whereas New York City and Philadelphia have both. The Northeast has the lowest percentage of open units among the regions as well. The percentage of open units in the West, Midwest, and South are all within the same range.

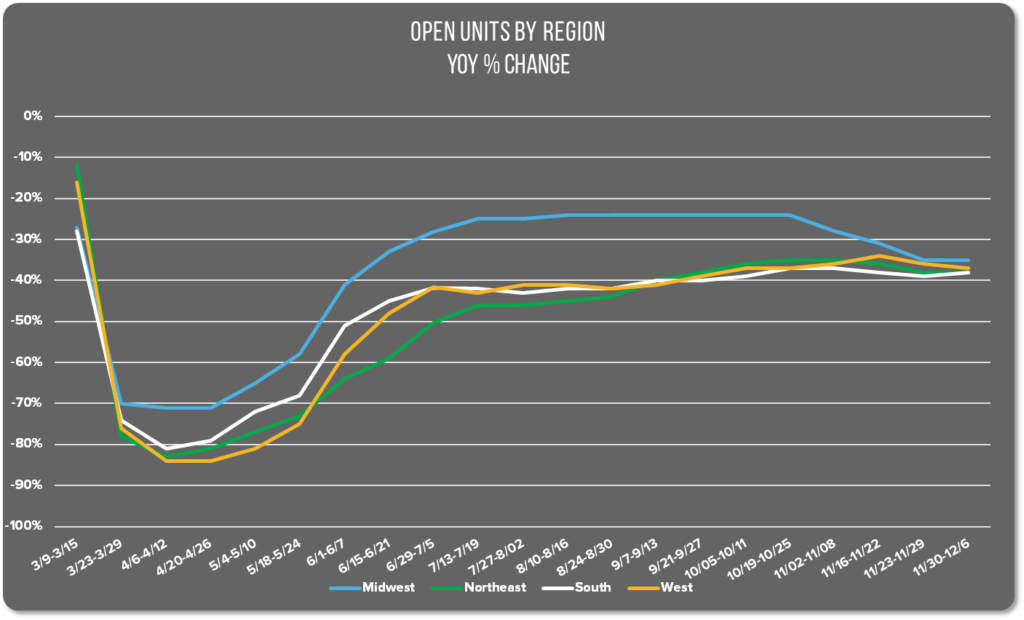

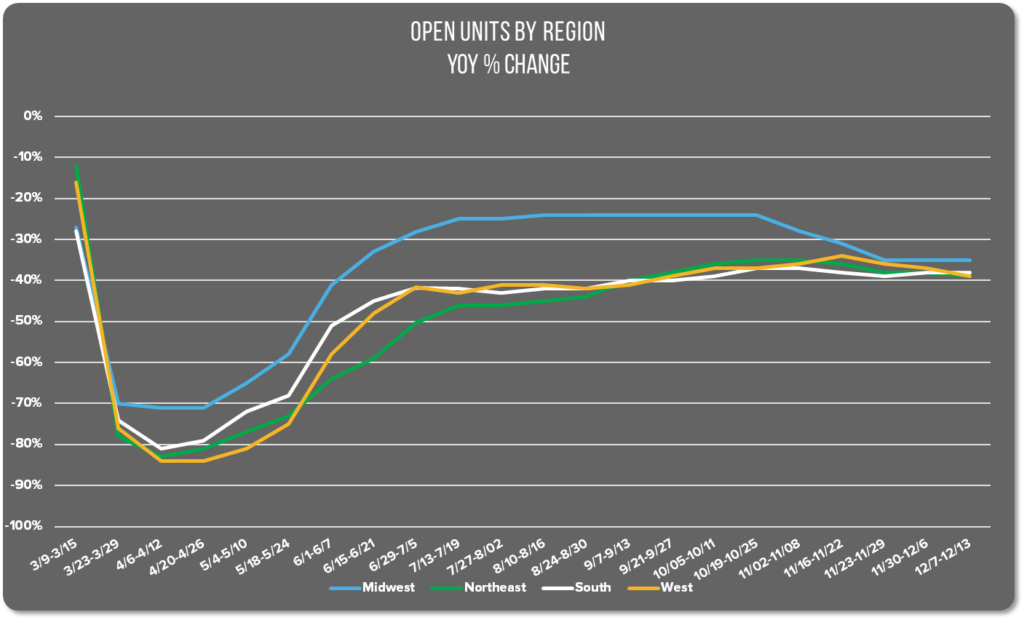

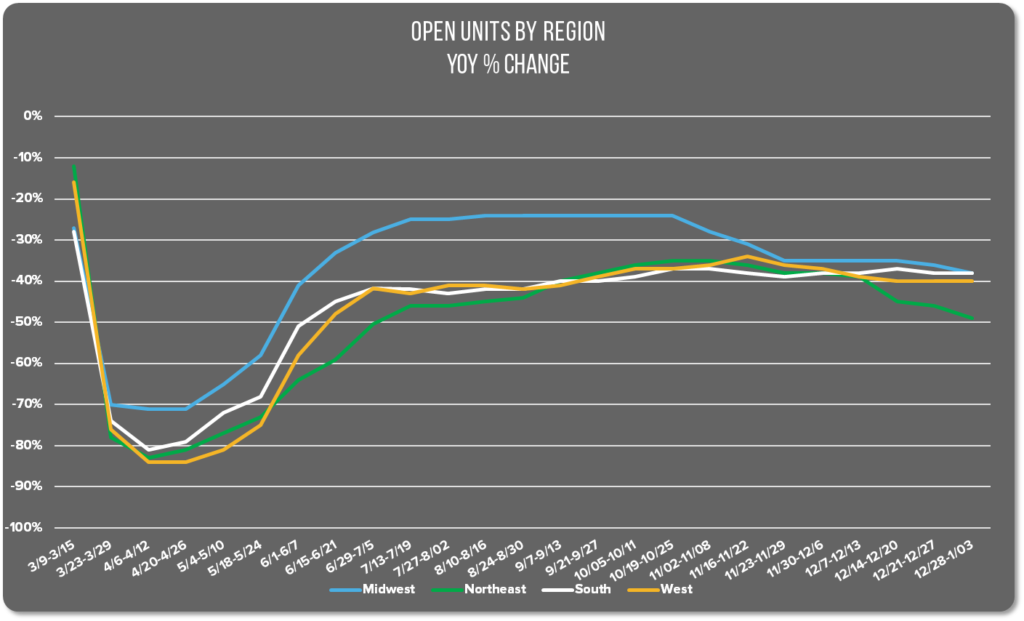

The percentage of open units has fluctuated slightly from region to region over the past 8 months depending on which areas were hotspots for the virus. The Midwest and the Northeast have at times been outliers in terms of open units. The Midwest reopened faster in the spring and saw a greater recovery of units than any other region. The reverse is true of the Northeast. It has often been an outlier on the negative side of open units, as it is now. But for the most part the percentage of open units has remained around 40% below normal. At this stage of the pandemic, it’s likely that a solid portion of that 40% is and will remain permanently closed.

Moving Forward in 2021

That 2020 was a bad year for hospitality goes without saying. Almost every aspect of this industry has suffered, exceptions being third-party delivery services and perhaps food trucks. If you’ve made it to January with an open restaurant, please join us in giving yourself a huge round of applause. You are amazing. If you didn’t, please take our condolences and know that it’s not your fault.

The good news that we’ll carry with us into the new year, is that sales are almost guaranteed to get progressively better. We’ve already experienced rock bottom in terms of restaurant sales in April when the viral spread was relatively low. It is very likely that we are experiencing rock bottom in terms of Covid right now. We set another new record high for deaths in a single day last week—over 4,000 Americans lost. But restaurant sales are 22-54 points higher than they were in April, depending on region. With the holidays behind us, three Covid vaccines in play, and warmer weather coming at the end of this quarter, it’s clear that things will continue to improve for restaurants in 2021. We can’t wait to see it happen.