JANUARY 4-17: NATIONAL RESTAURANT SALES RETURN TO PRE-HOLIDAY LEVELS

Published 1.21.21

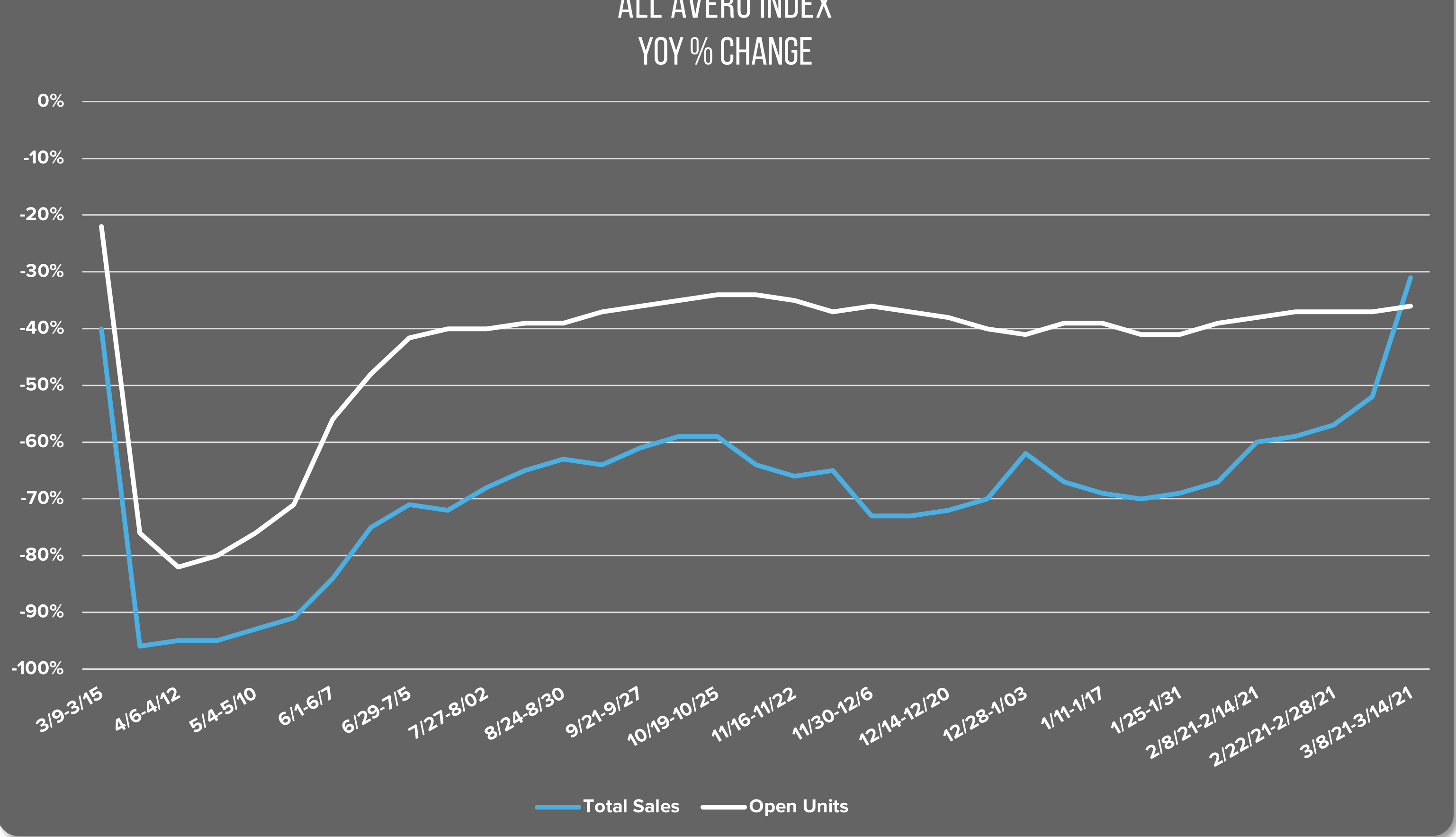

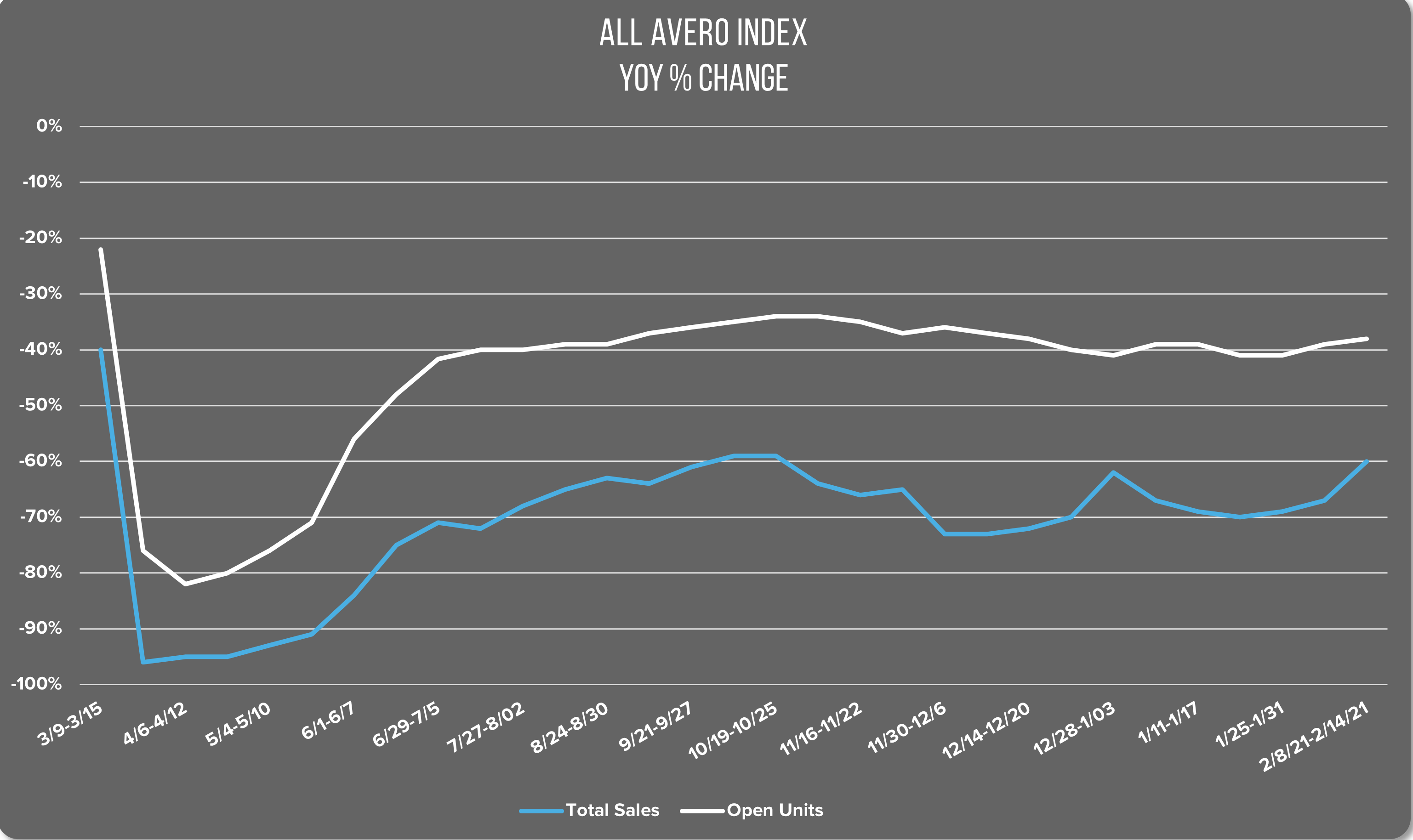

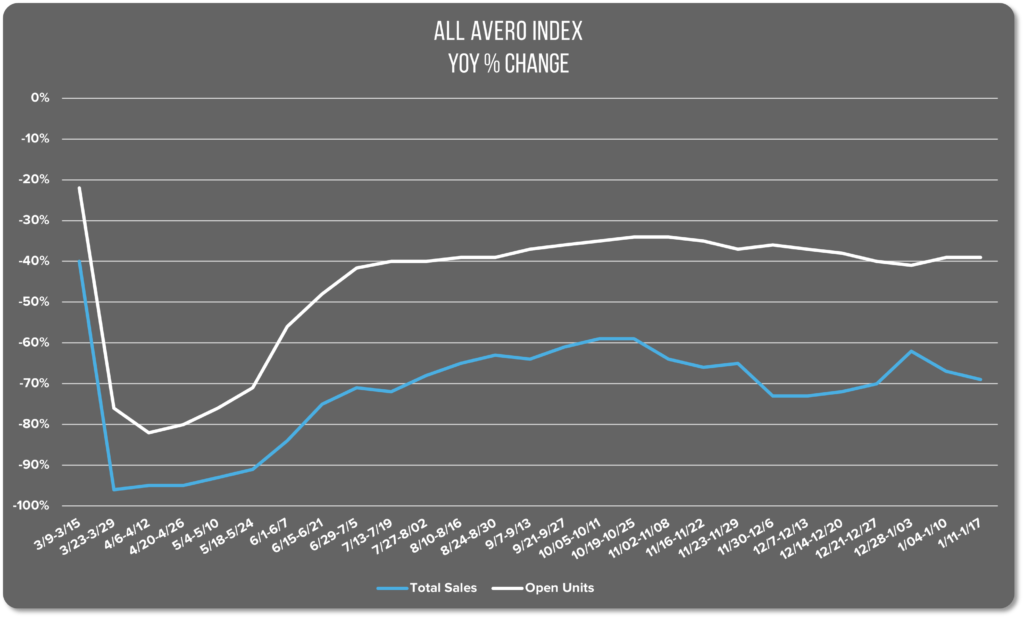

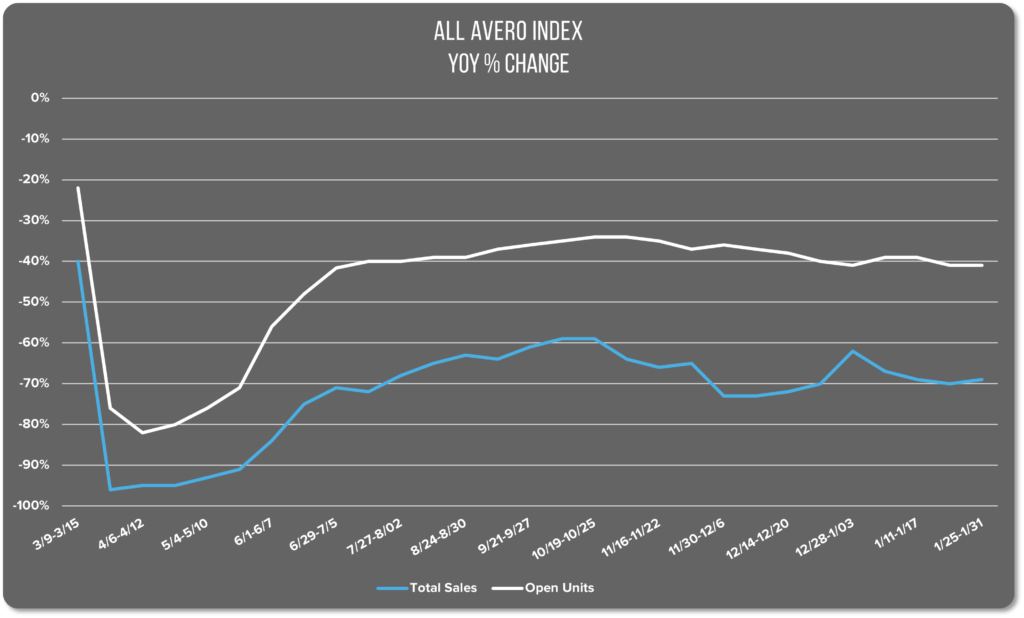

Index at a Glance

- All Avero Index: Sales down 7%, open units up 2%

- Midwest: Sales down 1%, open units up 4%

- Northeast: Sales down 2%, open units up 3%

- South: Sales down 14%, open units up 1%

- West: Sales down 8%, no change in open units

Nationwide Restaurant Performance

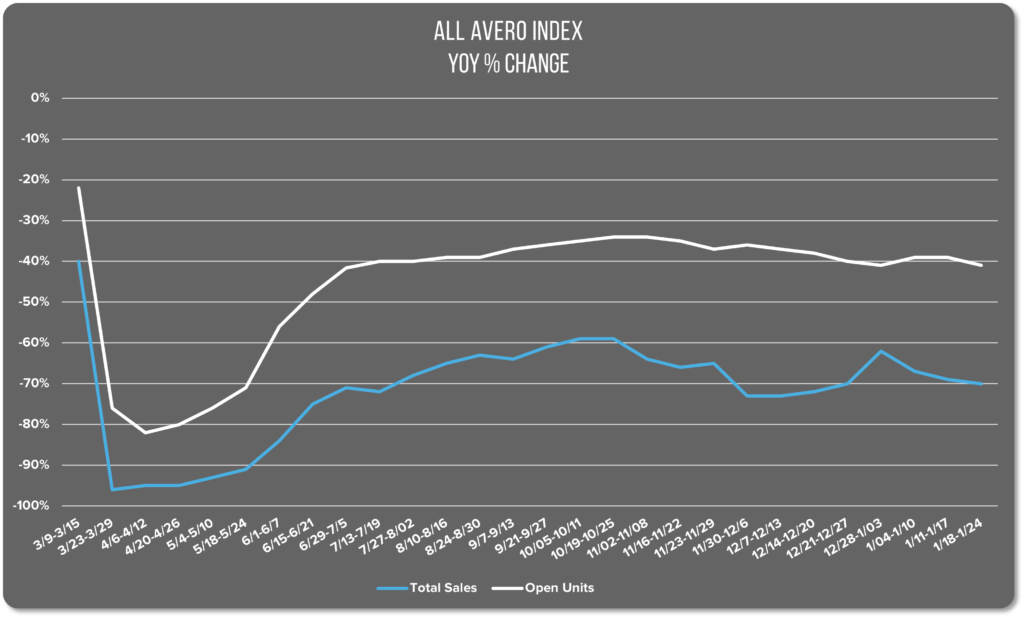

Restaurant sales fell over the past two weeks. The All Avero Index shows sales 7% lower since January 3, 2021. The percentage of open units rose 2% over the same period. Though we never like to see sales decline, it’s helpful to view current sales levels in relation to the holiday sales spike.

From before Christmas, until after the New Year, sales rose 11% on the AAI. It’s normal to see a sales boost during the period including the holidays and for things to level out again in the week’s following. This year, following the expected post-holiday dip, sales remain 4% higher than they were going into the holiday season. We’re calling it a win.

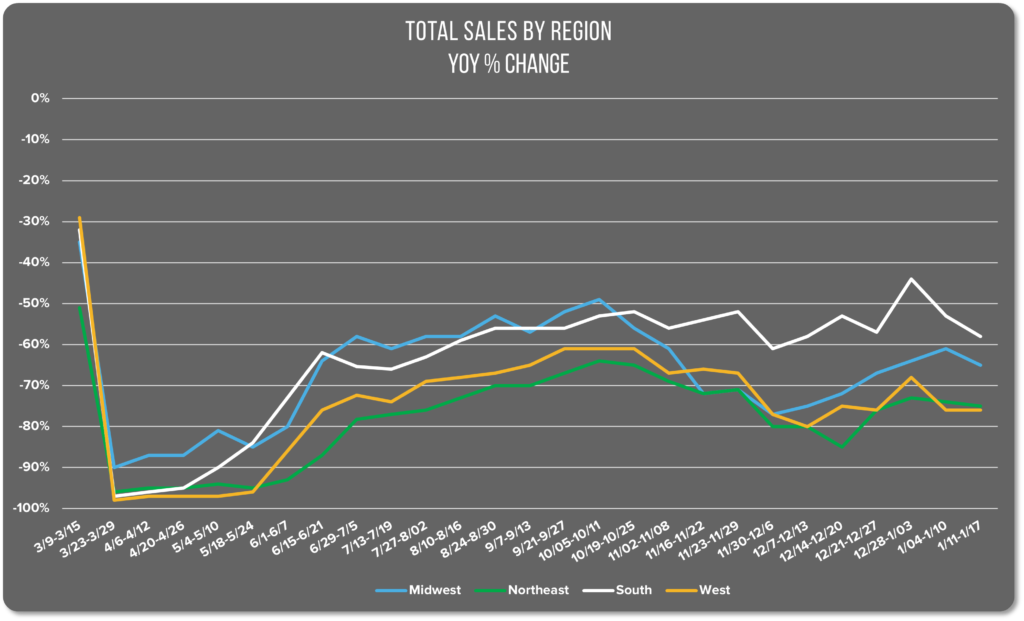

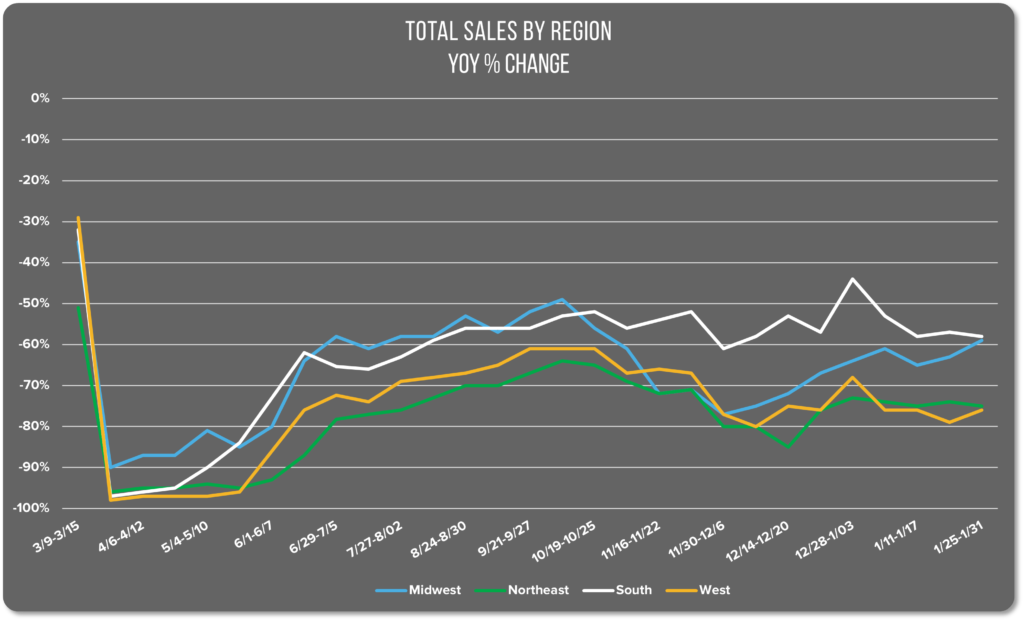

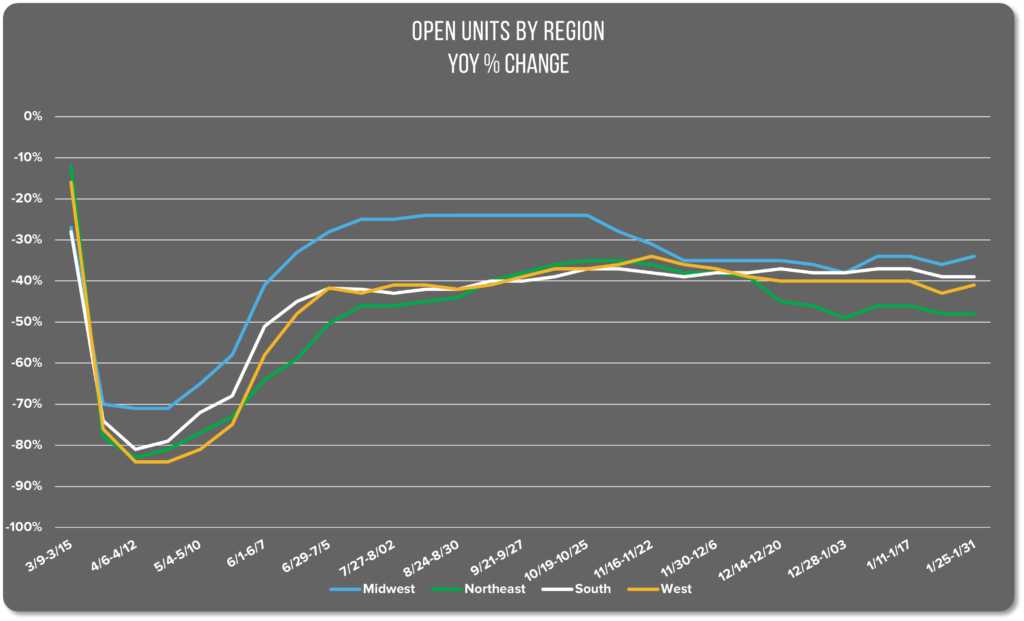

Regional Restaurant Performance

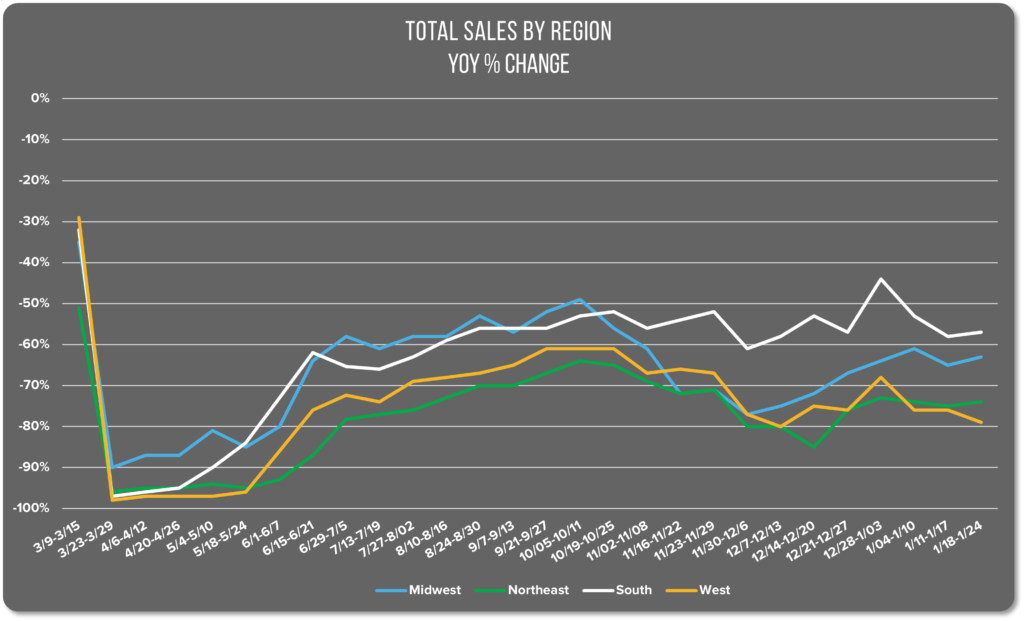

Except the South, every region is performing better than they were heading into the holidays. Restaurant sales in the South fell 14% over the past two weeks. The region had the best performance during the holidays. But sales have fallen back to pre-holiday levels. The percentage of open units grew 1%, which is also 1% higher than it was in mid-December.

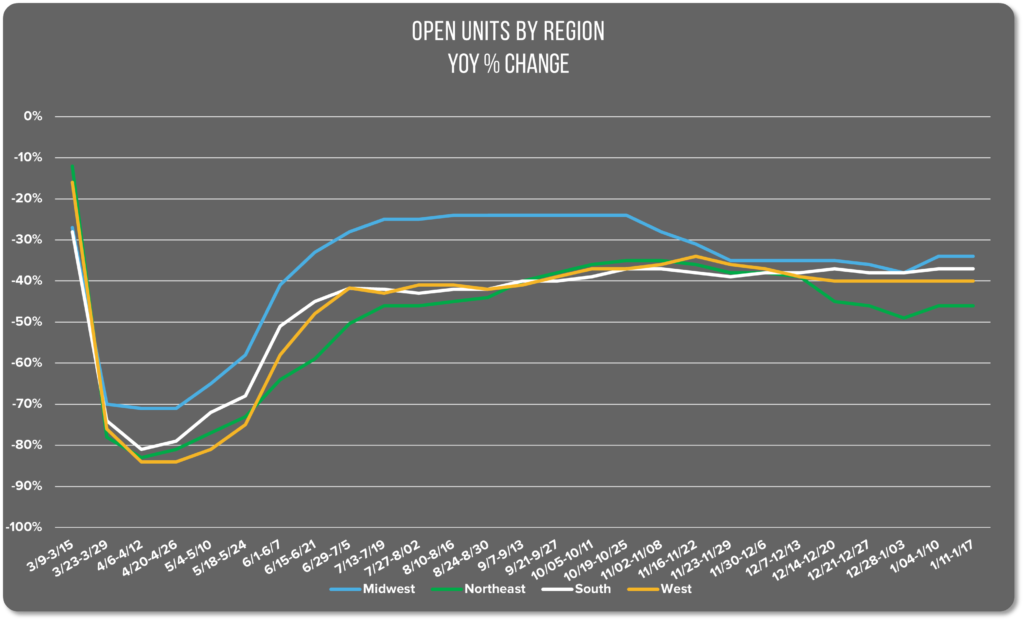

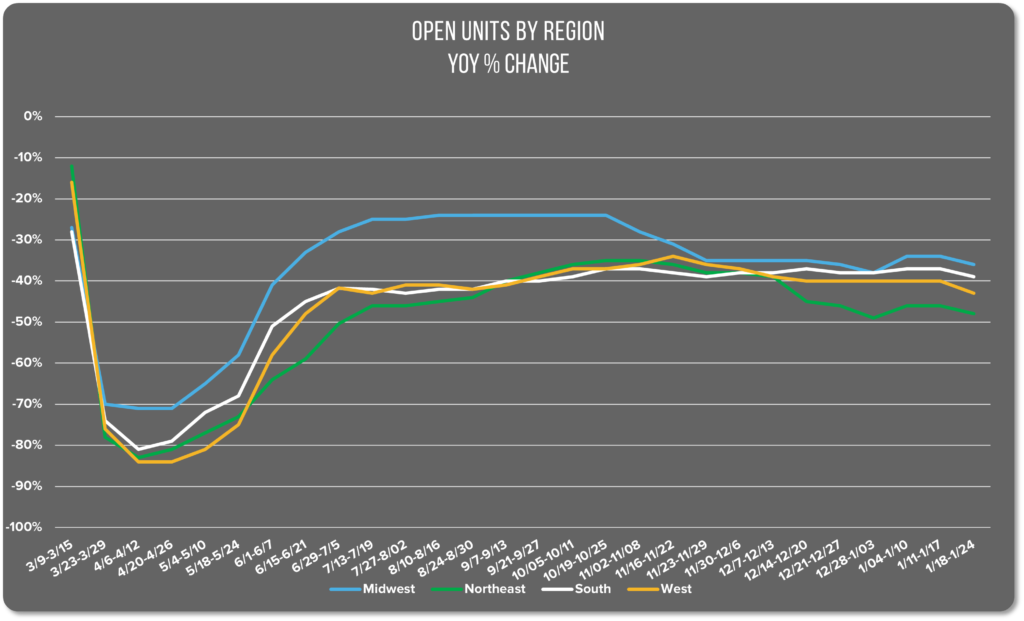

Restaurant sales in the Midwest remain stable. Sales only fell 1% over the past two weeks. That leaves the Midwest with a 10-point advantage over pre-holiday levels. The percentage of open units grew 4%, making up for minor losses over Christmas and New Year’s. Currently, the percentage of open units remains 35% below the same period in 2020, as it has been since late November.

Sales in the Northeast fell slightly but remain 5% higher than they were heading into the holiday season. The percentage of open units has trended in the opposite direction. Currently, the percentage of open units is 46% below normal YoY, a low we haven’t seen in the region since early August.

In the Western region, we see sales falling 8% since our last analysis. Following a holiday bump, that still leaves the region with 4% higher sales than they had going into the holidays. There was no change in the percentage of open units this week. Open units remain 1% below pre-holiday levels and 40% below YoY normal.

Looking Ahead

Which direction will sales go next week? If we take what we know about the direction of the pandemic, and look at the current trend on our charts, it’s likely sales will largely maintain their current levels.

NPR is reporting that we may have passed the peak of the latest Covid-19 wave. Transmission and hospitalizations remain high, but new cases and seven-day averages are declining in most states.

“Based on current trends, the worst appears to be over,” says Caitlin Rivers, an epidemiologist at the Johns Hopkins Bloomberg School of Public Health. “We are headed to a better place.”

Johns Hopkins University reports that the US reached a peak of just over 249,000 cases on January 11th. Though the current rate of 200,000 cases a day is still quite high, it is declining. A CDC spokesman says the organization will not declare mid-January as the peak until the number of new cases declines for several weeks.

In terms of restaurant sales, the next few weeks are a bit of a question mark. If restrictions on restaurants decline in tandem with the infection rate, we would expect sales to increase slightly. Pandemic fatigue is real, and with the vaccine rollout in progress, it’s likely that people will venture beyond their bubbles more frequently. Though it’s also true that restaurant sales tend to be slower during January and February in general, pandemic notwithstanding.

Whichever way things go, we’ll be here to report it to you.

JANUARY 18-24: CITIES REOPEN FOR INDOOR DINING PUTTING BETTER RESTAURANT SALES ON THE HORIZON

Published 1.27.21

Index at a Glance

- All Avero Index: Sales down 2%, open units down 1%

- Midwest: Sales up 2%, open units down 2%

- Northeast: Sales up 1%, open units down 2%

- South: Sales up 1%, open units down 2%

- West: Sales down 3%, open units down 3%

Nationwide Restaurant Performance

National restaurant sales fell slightly last week. The All Avero Index shows sales down by 2% and the percentage of open units down 1% since last week. Sales volume on the AAI has hovered around 70% below normal for the past several weeks. The last time we saw sales consistently 70% below normal for multiple weeks was in July when the weather was warm. At that time, Covid-19 infections had risen sharply, spurring talk of a second wave. In retrospect, that “wave” was a little riffle compared to the tidal wave we’re experiencing now.

Nationally, the US has surpassed 25 million infections and is on track to hit 500,000 Covid-19 deaths by early February according to projections from the Institute for Health Metrics and Evaluation at the University of Washington. Currently, 44 US states are at the highest Covid-19 risk level. However, as of this week, cases are declining in all but four states—North Carolina, Nebraska, Rhode Island, and New Hampshire.

Declining infection rates bode well for national restaurant sales, which are likely to rise as business restrictions fall again. If we’re currently seeing the same level of restaurant patronage as we were in July when infection rates were lower and the weather was warm, it stands to reason that we’re unlikely to see sales fall significantly below current levels.

Regional Restaurant Performance

Sales were up 2% last week in the Midwest though the percentage of open units fell 2% as well. These figures include sales seen over the weekend in Chicago as indoor dining reopened there for the first time since October. Eased restrictions now allow 25% capacity or up to 25 people maximum, whichever is less.

Though many restaurant operators jumped at the opportunity to resume indoor dining, many others are using a wait and see approach, citing concerns about a resurgence of infections as new, more contagious variants begin taking hold. The effort and cost of pivoting from takeout only to indoor dining is more difficult for some restaurants that are opting to hold off for the time being.

The Northeast saw a 1% growth in sales and a 2% dip in the percentage of open units. Restaurants remain closed in New York City, though Governor Andrew Cuomo has promised to reveal a reopening plan for five boroughs by the end of the week.

Philadelphia resumed indoor dining on January 16 at 25% capacity. Like Chicago, the restrictions also include limiting tables to four people from the same household.

In Washington D.C., restaurants were set to reopen on January 15th. Mayor Muriel Bowser extended the ban another week in the wake of the violent insurrection at the Capitol which raised security concerns for inauguration week. Restaurants opened on the 22nd and are currently celebrating Metropolitan Washington Restaurant Week Winter 2021 which includes special discounts and a diner rewards program. Perhaps we’ll see a welcome sales boost in this region in next week’s report.

Sales are up 1% in the Southern region with a 2% decrease in the percentage of open units. Currently, 84% of counties in Florida remain a red zone, though there has been a slight reduction in the rate of community spread since early January. Last week the White House included Florida in a White House Coronavirus Task Force Report, recommending that bars, indoor dining, and gyms be closed to curb the spread of the virus. Since Thanksgiving, the total number of Covid-19 deaths has increased by 60% and hospitalization increased by 40%. Governor Rick DeSantis, however, has not announced a plan to implement any business restrictions and is unlikely to do so.

The Western region saw a 3% sales decline last week accompanied by a 3% decline in open units. In California, Governor Gavin Newsom lifted the state-wide stay at home order. In Los Angeles, dining remains closed though outdoor dining with restrictions is set to resume this weekend. Outdoor dining has already reopened in Orange, Riverside, San Bernardino, and Ventura counties.

On January 12th, Nevada Governor Steve Sisolak extended restaurant restrictions for 30 more days, citing ongoing high levels of infection in Washoe and Clark counties. Restrictions include limiting capacity to 25%, There is good news in Nevada, however. The state has promised to move hospitality workers up the line in prioritizing vaccine recipients. The state’s 301,700 hospitality workers, including casino employees, will be 4th in line, though there is no current estimate for when it be available. Encore at Wynn Las Vegas, an Avero customer, has been named as a vaccination site.

That’s all for this week’s report. Stay tuned for more updates as we continue to track the effects of the pandemic on our beloved hospitality industry.

JANUARY 25-31: JANUARY CLOSES WITH SALES 70% BELOW NORMAL YOY

Published 2.3.21

Index at a Glance

- All Avero Index: Sales up 1%, no change in open units

- Midwest: Sales up 4%, open units up 2%

- Northeast: Sales down 1%, no change in open units

- South: Sales down 1%, no change in open units

- West: Sales up 3%, open units up 2%

Nationwide Restaurant Performance

National restaurant sales and the number of open units remained stable on the All Avero Index last week. We saw a 1% increase in sales, making up for the slight dip the previous week. There was no change in the percentage of open units.

Sales remained fairly steady throughout the month, hovering around 70% below normal. A Statista analysis of seated restaurant diners from late February 2020, through January 25, 2021, based on OpenTable data shows a 65.91% decline year over year (YoY).

The Statista figure largely lines up with the All Avero Index, though our data does not distinguish between in-person dining and takeout/delivery in this instance. Avero’s metric for January 25th is 69% below normal YoY. The takeaway point is that restaurants continue to operate at a significant deficit of customers and sales revenues.

Regional Restaurant Performance

The Midwest continues to outperform the All Avero Index. The Midwest region saw a 4% increase last week, resulting in their best performance since October 25th. The increase places the region at 59% of normal YoY, a 10-point lead on the All Avero Index’s performance. Additionally, the percentage of open units in the region grew 2%.

The Northeast on the other hand, consistently underperforms compared to the All Avero Index. Last week, they lost 1-point, landing 75% below YoY levels. There was no change in the percentage of open units in the region.

The Southern region remains the top performer compared to other regions, edging the Midwest out by one point currently. Sales fell 1% last week and are slightly lower than they were in the fall. Currently they’re 58% below normal YoY, whereas in the fall they saw sales around 52% of normal for several weeks in October and November. The percentage of open units is the same as last week at 39% below normal YoY.

Restaurant sales in the Western region grew 3% last week, returning to their “new normal” of the past two months. Sales are currently 76% below normal YoY. Between late July and early December, sales remained firmly in the 60s, never falling to 70% below normal until December, when they jumped to 77%. Winter sales have clearly been struggling in the West, though open units grew 2% last week.

That’s all for this week’s report. We will be making a slight change to the format of the Avero Index analysis going forward. We’re archiving past reports by month to make it easier to find reports for a particular month in 2020. Watch for that change and stay tuned for more hospitality industry performance insights.