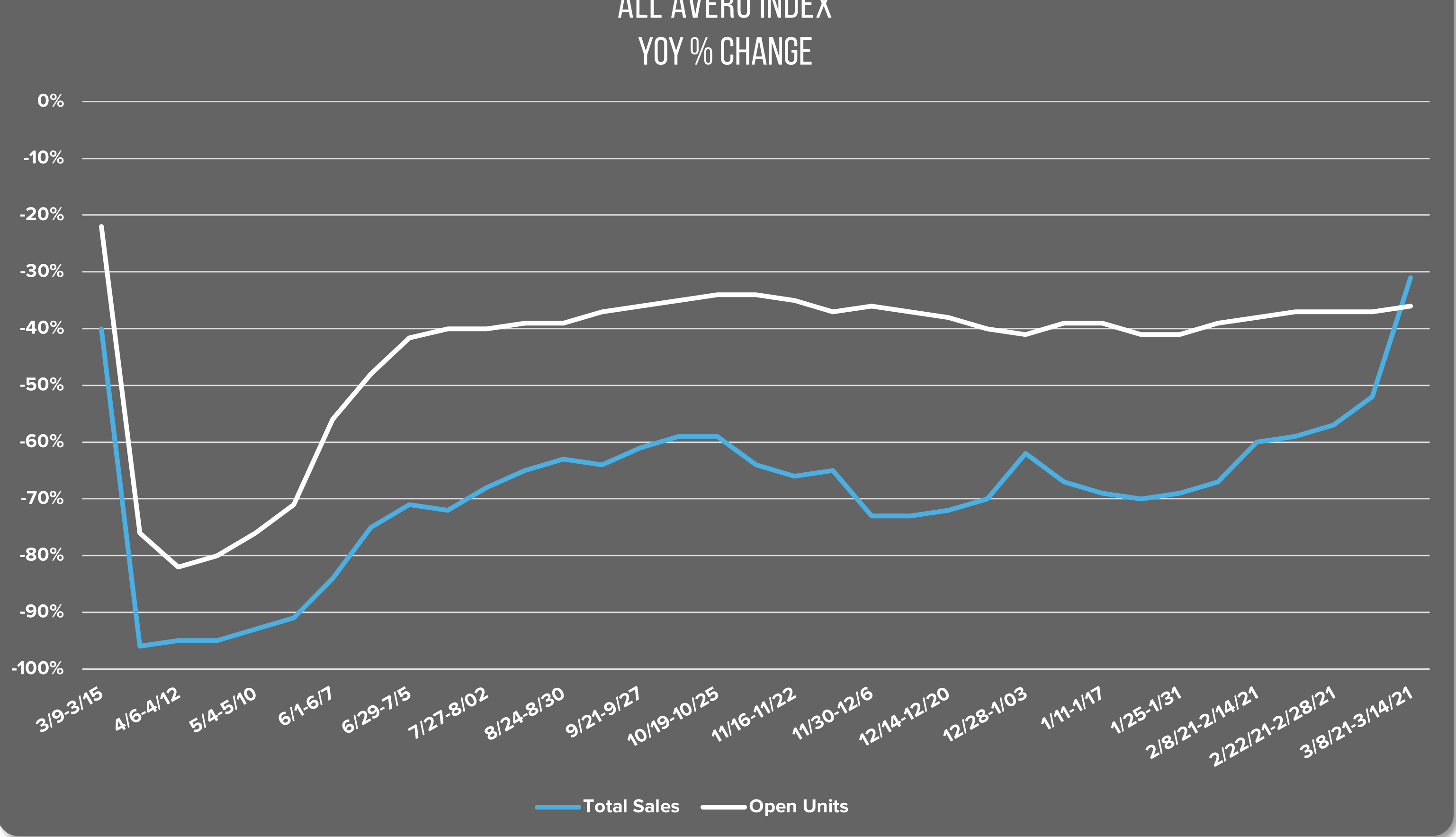

Below, you’ll find our archive of weekly Avero Index data and analysis for the month of June.

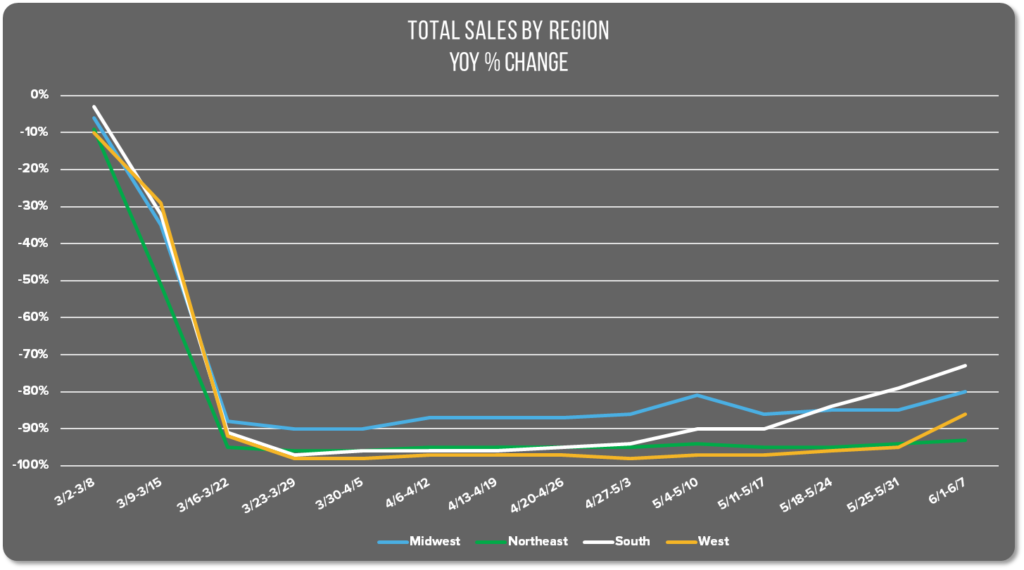

June 1 – June 7: Sales Rise During Nation-wide Protests

Over the past week, the nation has been gripped by protests against police brutality in all 50 states. During a time of such turmoil, continued relaxation of lockdown restrictions still appear to dominate as the driving force of recovery in the F&B industry. Sales rose more over the past week than in any other week since stay-at-home orders began. It’s heartening to see that our industry can continue to recover while people demand the need for urgent social change. Avero is optimistic on both fronts.

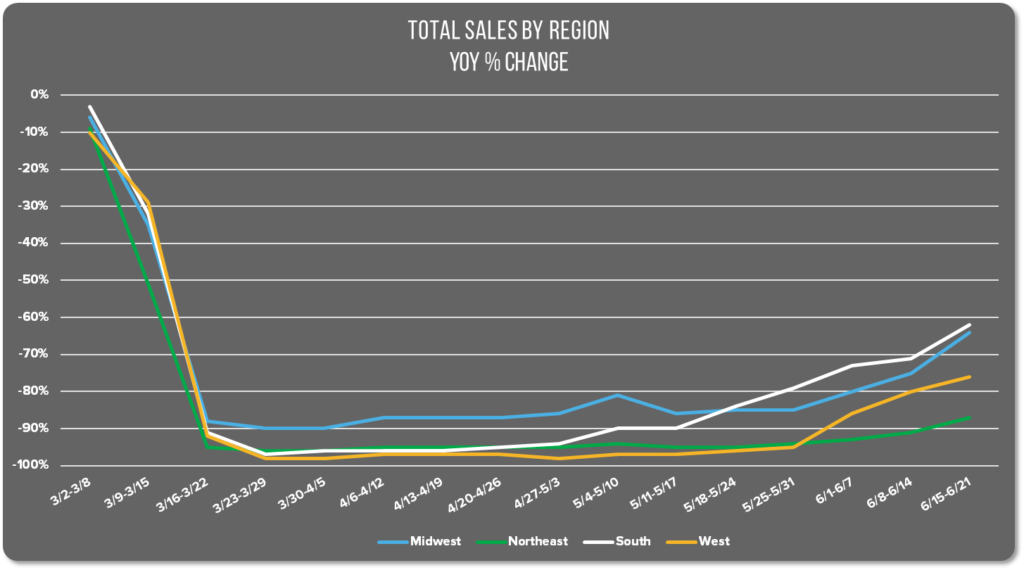

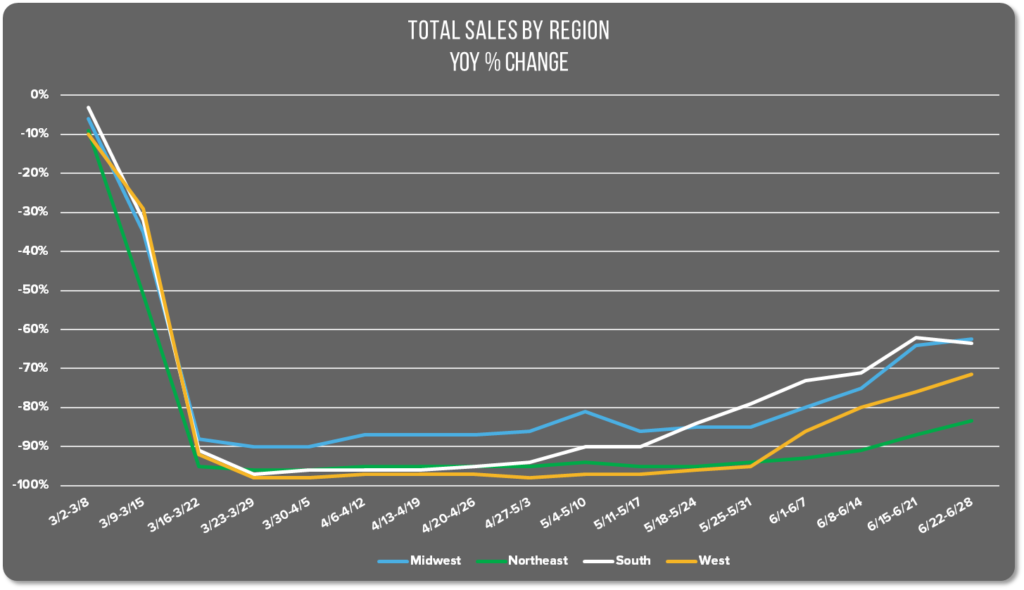

The West saw the largest single increase in sales, with YoY numbers increasing by 10% points versus the previous week. This is likely driven in part by reopenings on the Las Vegas strip. The Midwest saw a slightly smaller jump, ringing in at a 5% point increase over the same time period. Meanwhile, the South continued its steady recovery with a 4% point increase week over week.

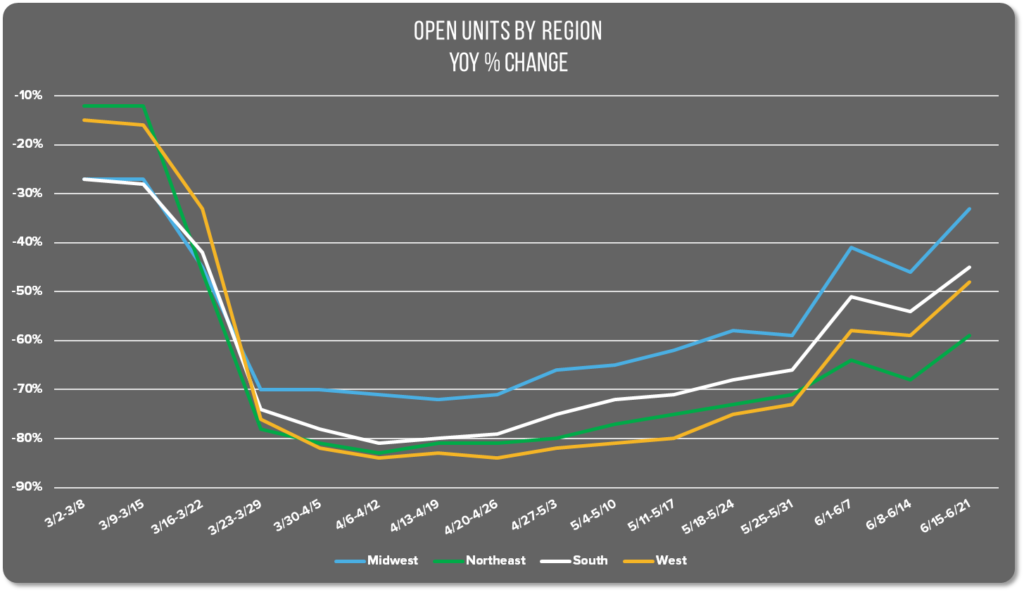

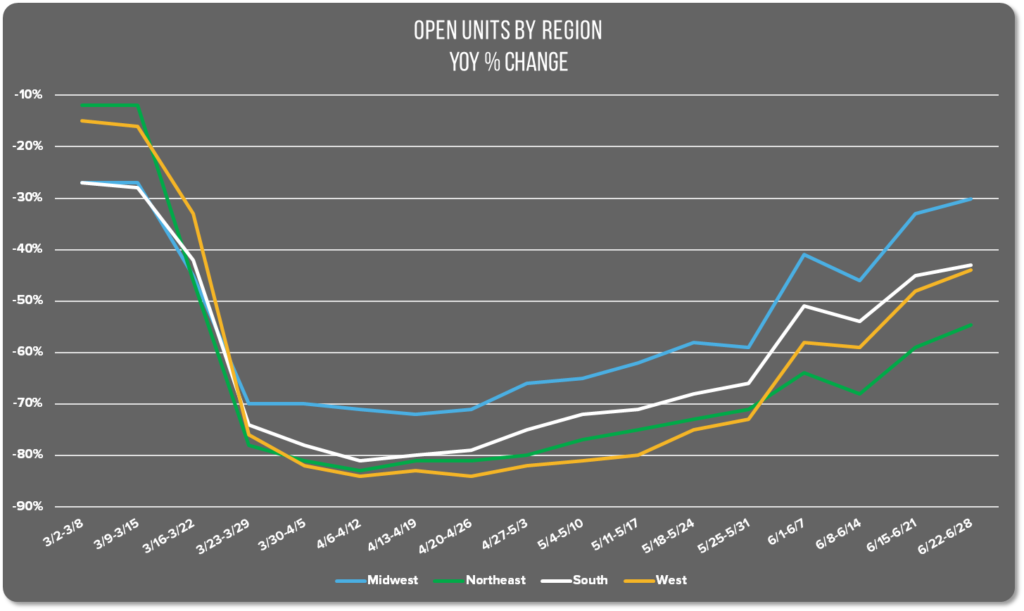

While the Northeast continues lagging behind, they still saw a 7% point increase in open units over the last week. All other regions saw at least a 15% point increase in reopened businesses over the same time period.

Still, reopening alone isn’t enough. Margins in the F&B industry are notoriously razor-thin, and as we see above, the increase in sales doesn’t match up to the increase in open units. Businesses that open their doors are likely taking a large financial hit, so remember to support local restaurants whether you’re staying home or joining protests in your city.

We’ll report back next week with more (hopefully positive) news on the latest trends. Until then, we hope you are all able to stay safe, healthy, and well-fed!

* You may notice our graphs changed a bit since our last index post. To continuously improve the quality of our analysis, we expanded our data set to include additional small and independent customers. Moving forward, we’ll continue using this new data set so you can see trends unfold throughout the US’s recovery.

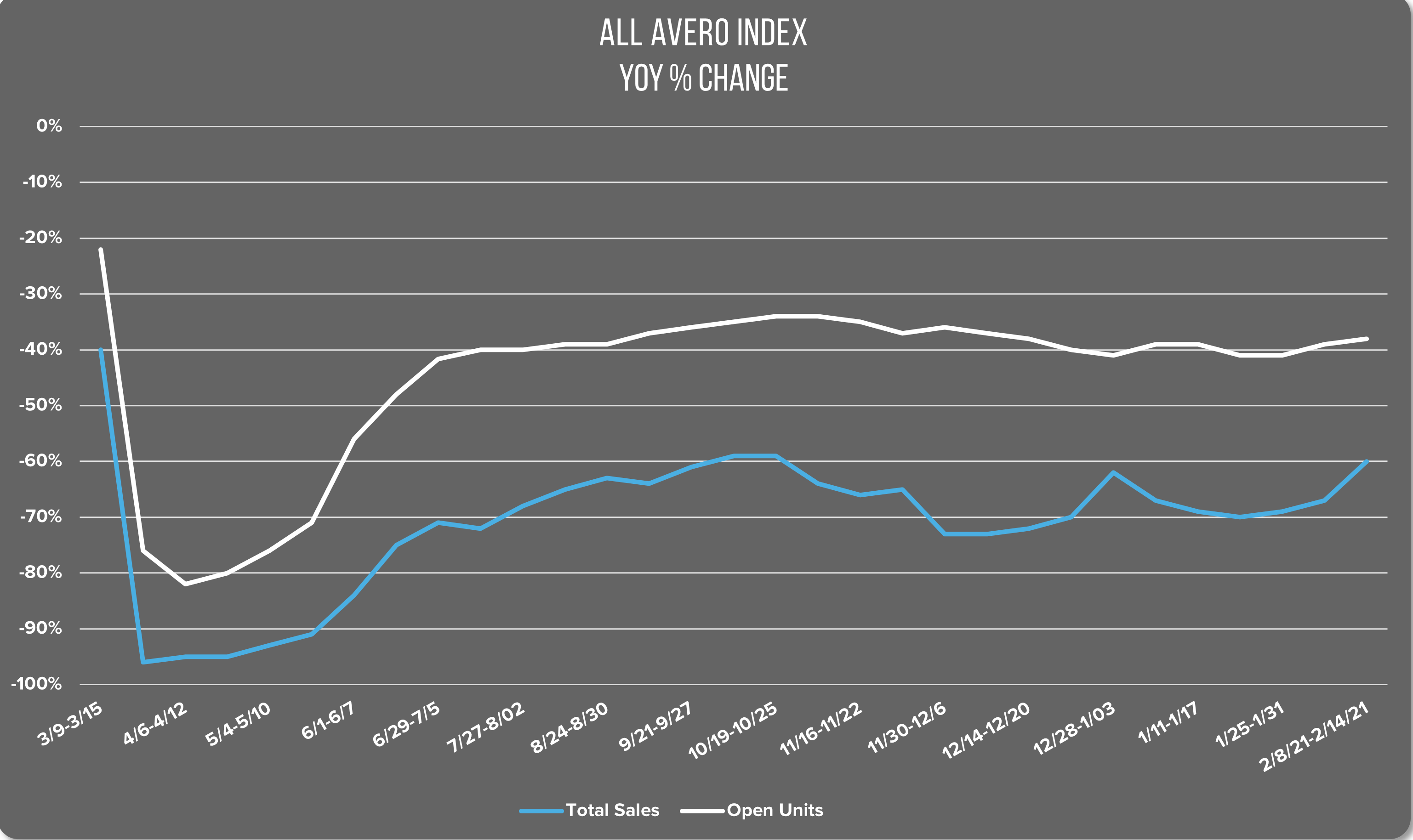

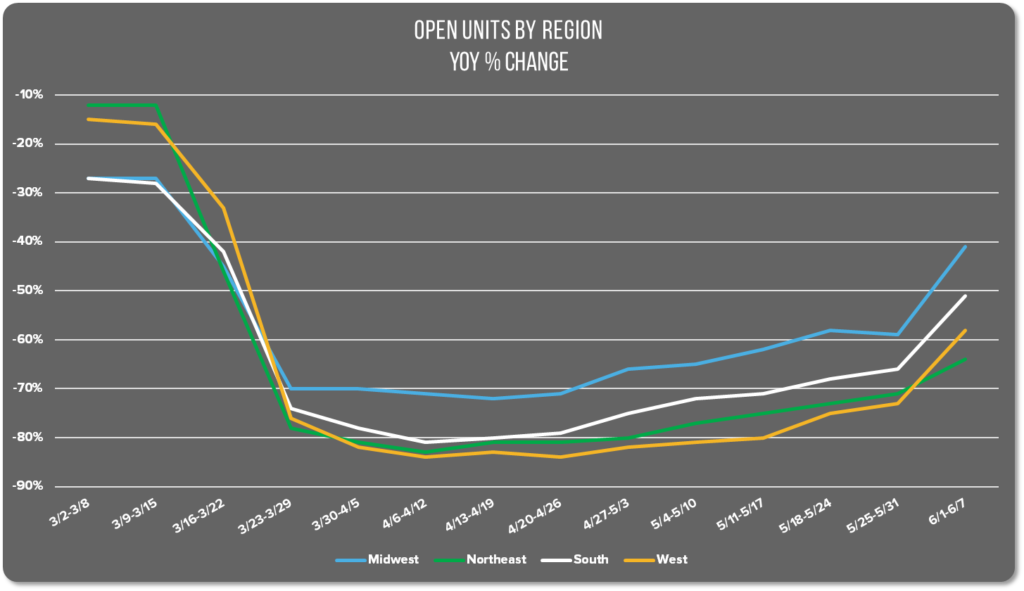

June 8 – June 14: Sales Rise Despite Drop in Openings

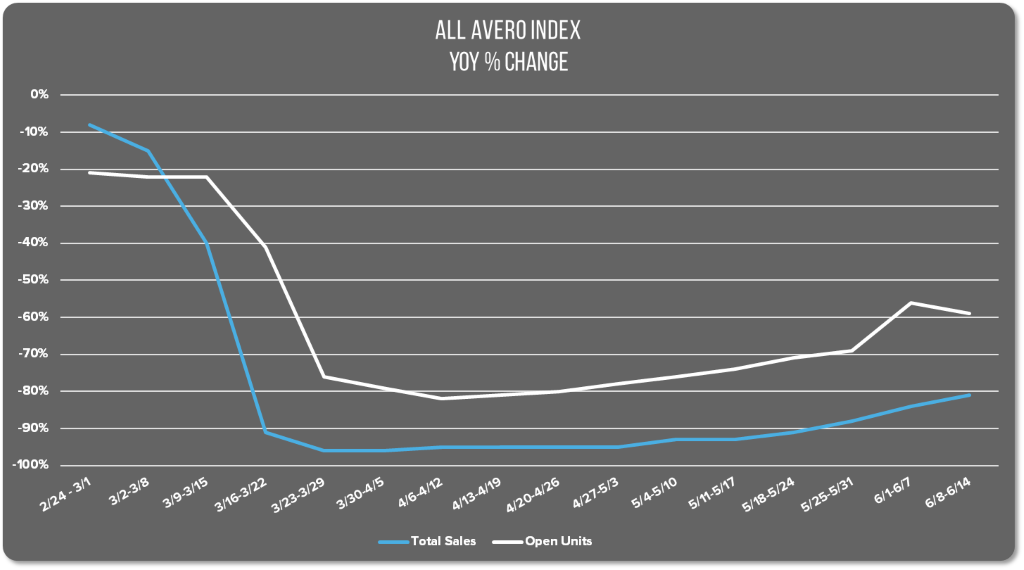

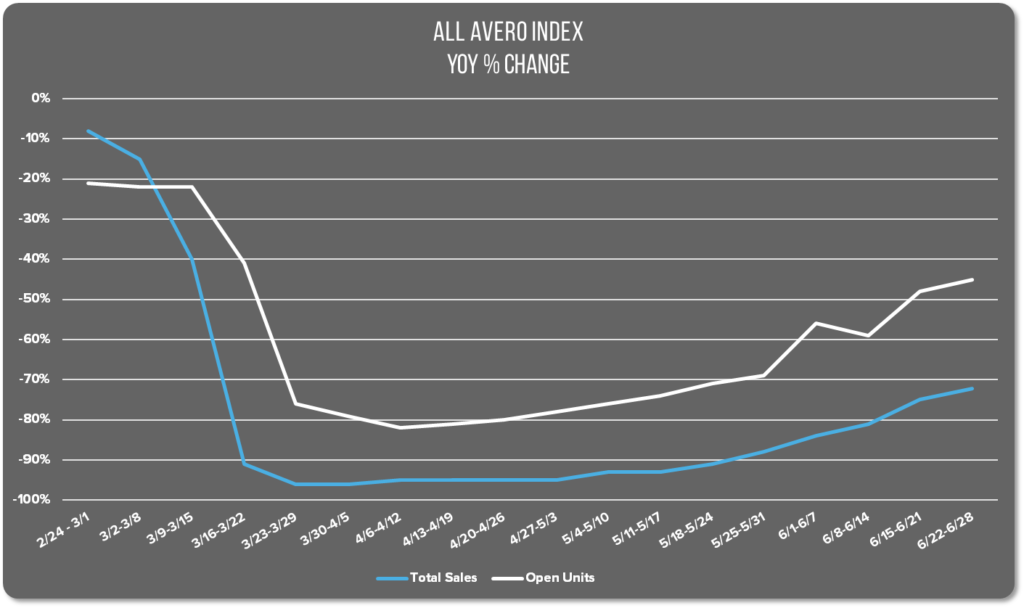

Over the past week, more and more states have relaxed stay-at-home restrictions, giving businesses the option to reopen their doors. However, with Coronavirus cases rising in areas that opened early, there are growing fears about a larger second “wave” of the virus. We saw this reflected in our data as well, with open units falling slightly even as sales continued on a slow path to recovery:

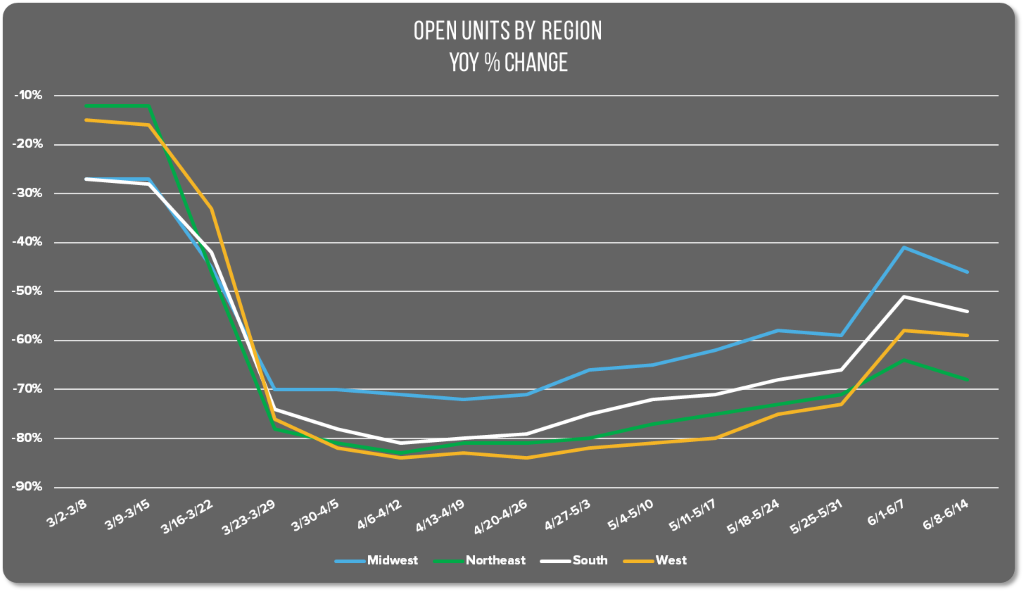

To break this down even further, we can take a look by region. One factor that may be slowing the reopening rate is the many seasonal businesses that are choosing to hold off on opening their operations. Open units in the Northeast dropped 4% points vs. last week, perhaps partially because of its many seasonal markets.

Alternatively, larger drops may be partially due to secondary closures surrounding Coronavirus concerns. Case counts have risen more in the South versus the West, which was quick to close and careful when reopening. The West was correspondingly least affected by last week’s drop, with only a 1% point dip in open units.

The West also saw the largest sales recovery, ringing in at a 6% point recovery compared to the previous week. In contrast, the Midwest saw a 5% point increase in sales despite a 5% drop in open units.

It’s possible that the positive sales recovery corresponds with a rush in many markets to support local black-owned businesses. On the other hand, maybe it’s simply due to increased spending power as many people start returning to work. Whatever the reason, we hope to see continued recovery when we check back in next week.

June 15 – June 21: A Recovery Back on Track

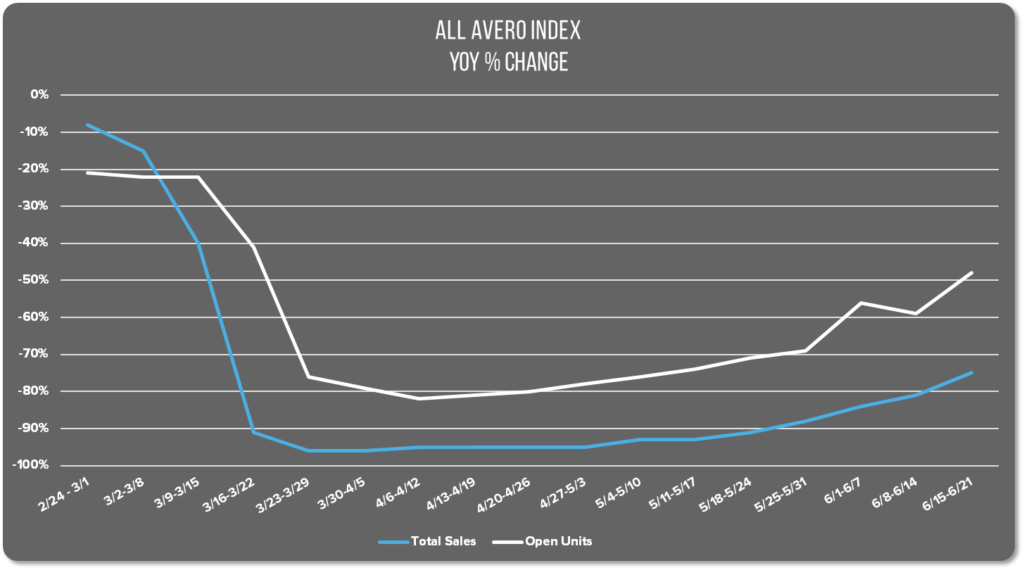

This Monday, NYC moved into Phase 2 of reopening, allowing businesses to set up outdoor socially-distanced dining for guests. As the hub of COVID-19 cases in the US, the city has taken a cautious approach to reopening. The fact that restrictions are finally easing is a marker of how the country is moving forward as a whole. We see this reflected in our index. Open units recovered from last week’s dip to reach a record “high” (relative to the initial drop) of 48% down vs. last year. Sales followed a similar trend, albeit at a slower pace, recovering 6% points to ring in at 75% down YoY:

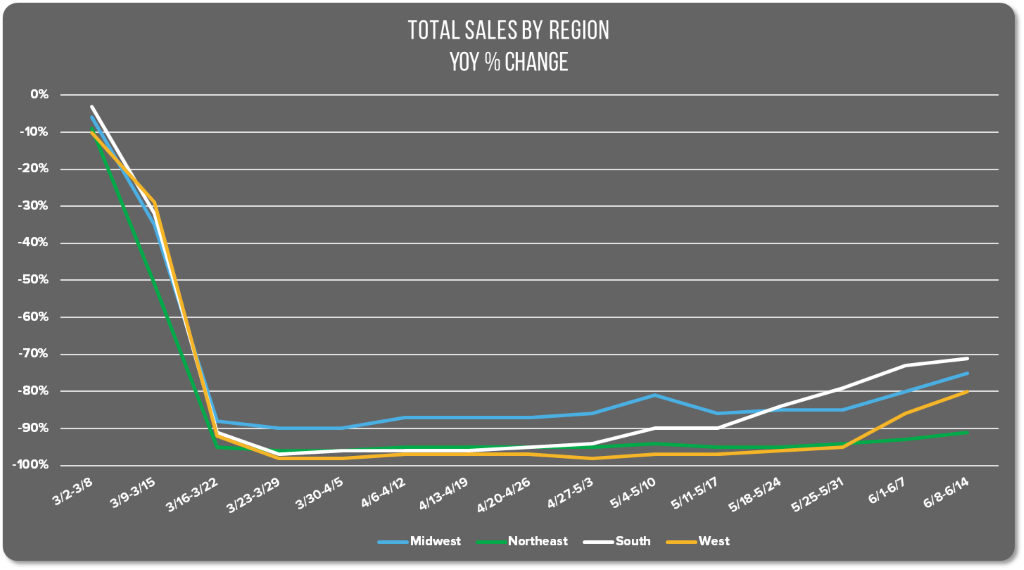

When viewing these trends regionally, we see a consistent trend to reopening. Each region has reached higher rates of open units than any week prior since the pandemic began. The Midwest is still leading the recovery with only 33% of units still recording no sales compared to last year. The Northeast is still lagging behind with just under 60% of businesses still fully closed. We expect to see this change with many more reopenings across Northeastern states this week.

Despite the large positive uptick in open units, however, we continue to see sales performance lag significantly behind. While every region had positive improvement vs. the previous week, even the south saw a 62% drop in sales compared to last year.

Overall, this highlights the fact that even with dining rooms partially opening, people may still be hesitant to eat indoors at restaurants. Most states that now allow indoor dining have set the boundary at 50% of maximum capacity; it tracks that we would expect to correspondingly see revenue at 50% of last year. However, we’re seeing numbers lower than this, meaning there’s still a ways to go before guests feel dining out is worth the risk. We’ll be back next week with the latest trends; until then, check out our COVID-19 Reopening Guide for some tips and tricks on how to best improve safety measures and cash flow in your restaurant.

June 22 – June 28: Recovery Continues on the Coasts, Falters Elsewhere

Over the past week, the restaurant industry’s recovery from the COVID-19 pandemic has continued to steadily tick upwards. Nationwide, both sales and open units rose 3% points versus the previous seven days. While it’s heartening to see reopenings across the country, we’re also seeing regional trends shift as the pandemic continues to develop.

In contrast to previous weeks, coastal reopenings took the lead with Northeastern sales and open units both increasing by 4% points. The West similarly improved, with a 5% point sales recovery and 4% point increase in open units as well. This is likely linked directly to New York’s movement into phase 2 of reopening, which allows outdoor dining. Diners are also flocking outdoors in major markets like L.A. and San Francisco. After the high-profile reopening of The Strip, restaurant traffic in Las Vegas has also continually increased.

In contrast, the Midwest and the South both saw a significant slowing of their recovery – perhaps due to growing safety concerns as positive Coronavirus cases rapidly rise. Open units in each region recovered by only an additional 2-3% points versus the previous week.

Despite new openings in the South, we actually saw a 2% point decrease in sales versus the previous week. We may continue to see this trend as state governments consider slowing and even reversing their reopening measures.

Overall, we hope to continue seeing recovery across the US even if the gains are only small week to week . If your local government continues lifting restrictions and you consider reopening yourself, be sure to check out our Coronavirus Reopening Guide. We’ve put together some tips and tricks on maintaining the safety of your guests and employees via different technologies, redesigns, and safety measures.