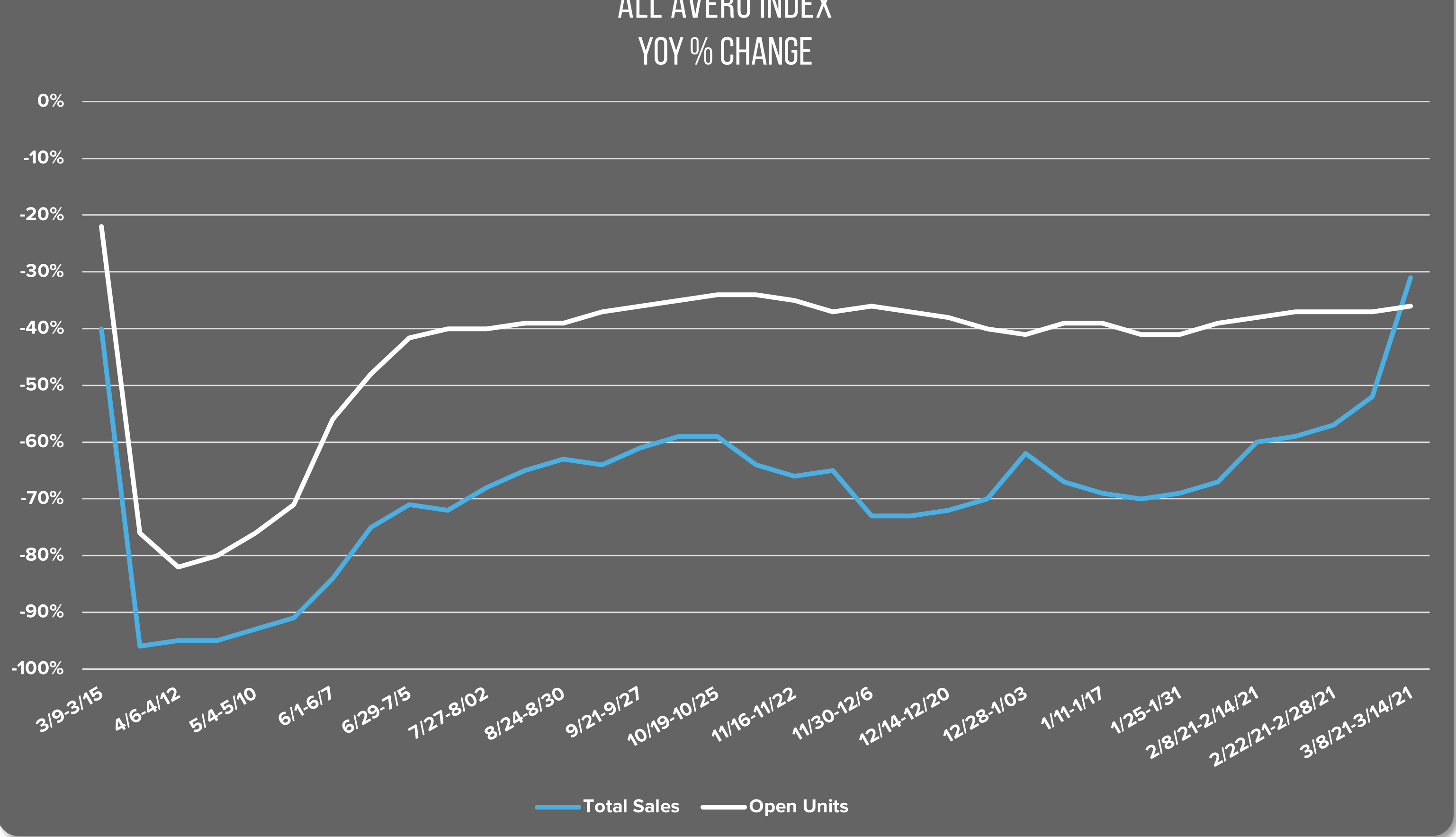

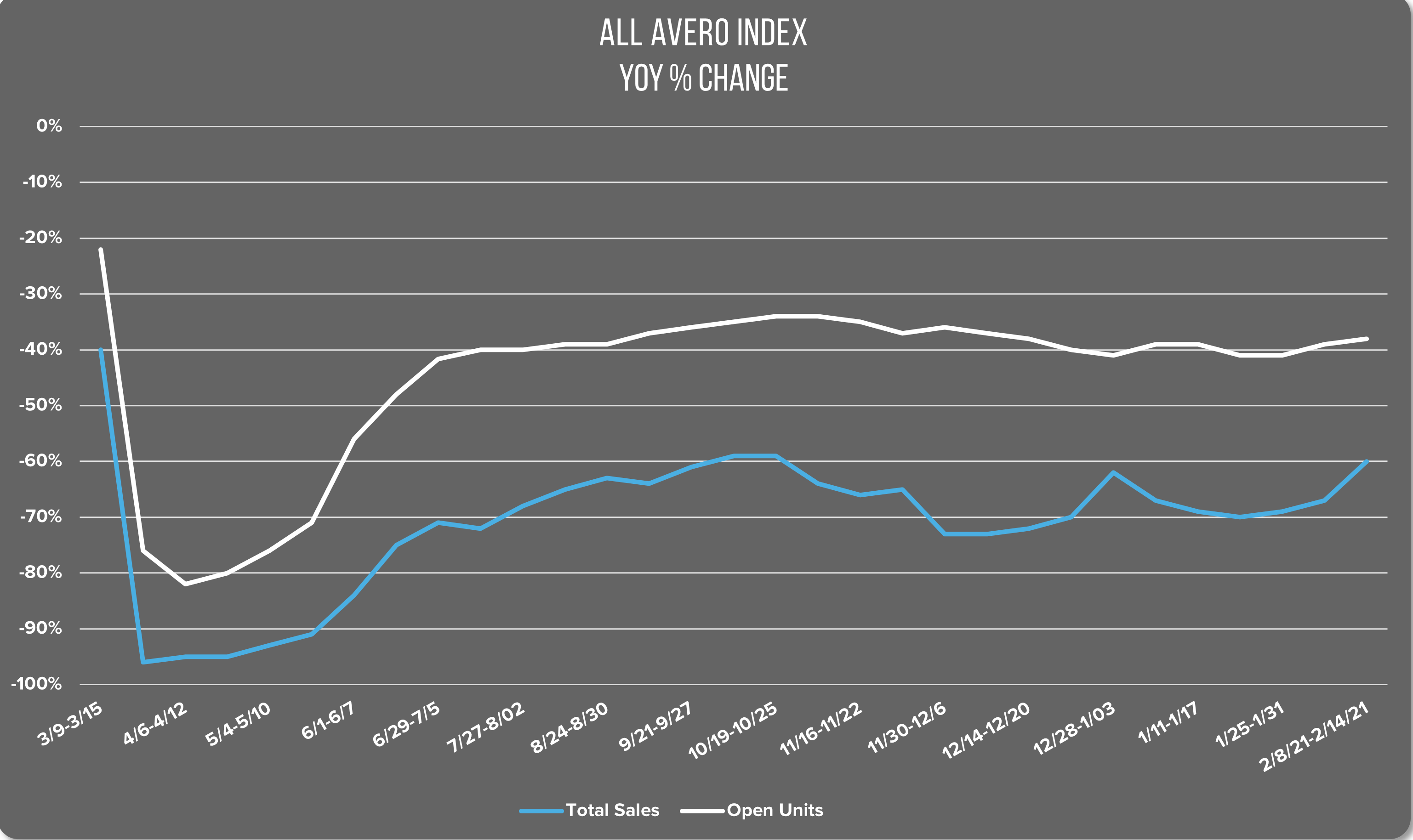

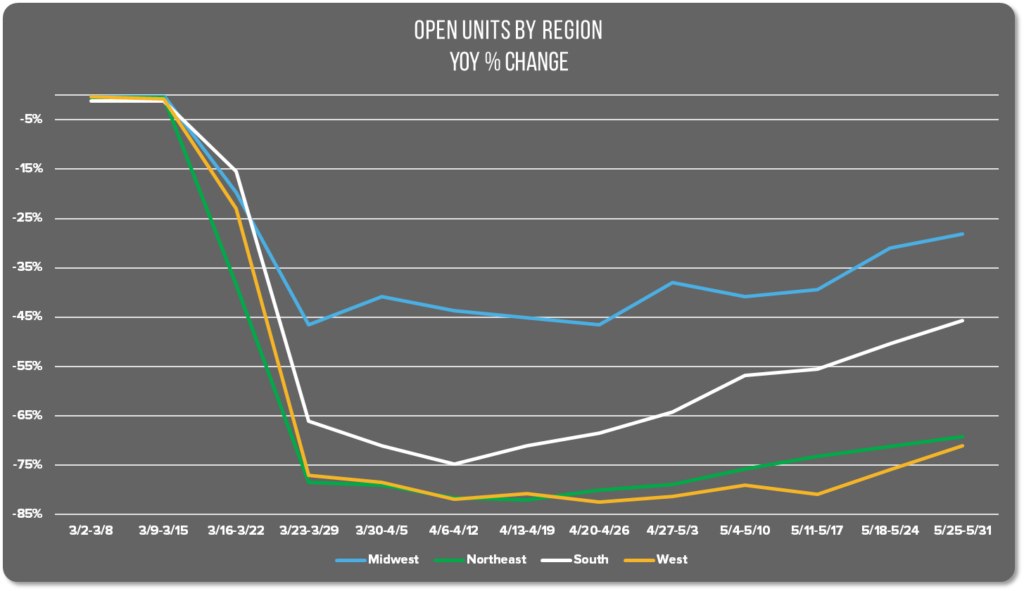

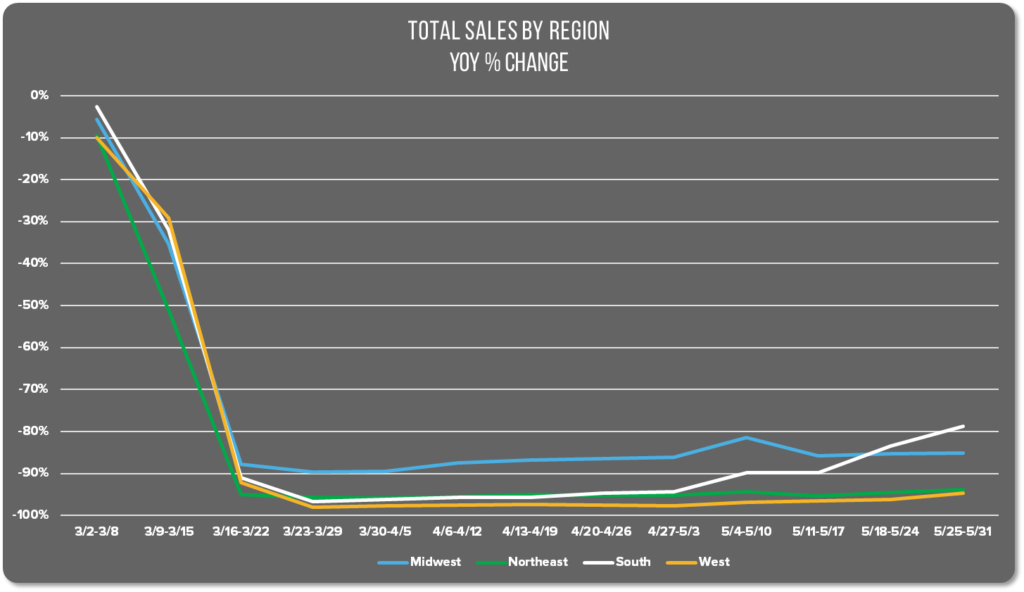

In this week’s Avero Index post, we have analyzed weekly trends for May across the country. Stay-at-home orders are a state-by-state decision in the US, which was clearly reflected in behavioral trends by region. Areas less affected by the pandemic, such as the South and Midwest, began their reopening process and saw sales start to rise sooner. The Northeast and West continue to lag behind in both open units and total sales.

As we run you through the numbers, keep in mind that Avero’s index only captures revenue entered into the POS system. As we noted in our last post, this means that our figures may not reflect third party orders made through online platforms.

Openings in the South & Midwest Soar

While year over year trends are still negative, we’re happy to report a steady uptick in volume week by week. The largest increase was in the South, where open units increased 25% points from the beginning of April to the end of May. This matches what we know about individual reopening plans, with high profile markets like Georgia and Florida reopening first.

Even in parts of the country that remained largely closed, we still observed a small uptick in sales and transactions. In the Northeast, the hub of COVID-19 in the US, there was a 10% point increase in open units and a 2% point increase in sales when comparing the last week in May to the beginning of April. In contrast, the South saw a 17% point jump in sales over the same time period.

These increases may be related to a number of different factors:

- Increases in gatherings over Memorial Day Weekend. Groups may have ordered takeout or eaten out versus cooking for a large group.

- Restaurants continuing to adapt with family style meals and meal kits available for takeout and delivery.

- Increasing confidence in the safety of restaurant food based on emerging evidence about how COVID-19 spreads.

- The effect of stimulus checks on people’s ability to spend.

- Simple fatigue our own cooking – most of us aren’t Michelin star chefs and may struggle with variety when cooking at home.

We’re still far away from “normal,” but it’s encouraging to see the industry on its way to recovery. As you decide whether to reopen, make sure to consider all necessary factors to keep your team and customers safe.

We’ll report back soon on the evolution of these trends during a time of extreme unrest throughout the US. In the meantime, we’re sending best wishes to all our friends and partners in the industry. We hope you are all able to stay safe during challenging times for both the industry and the country.