Below, you’ll find our archive of weekly Avero Index data and analysis for the month of July.

June 29-July 5: Covid hotspots in U.S. see drop in restaurant sales

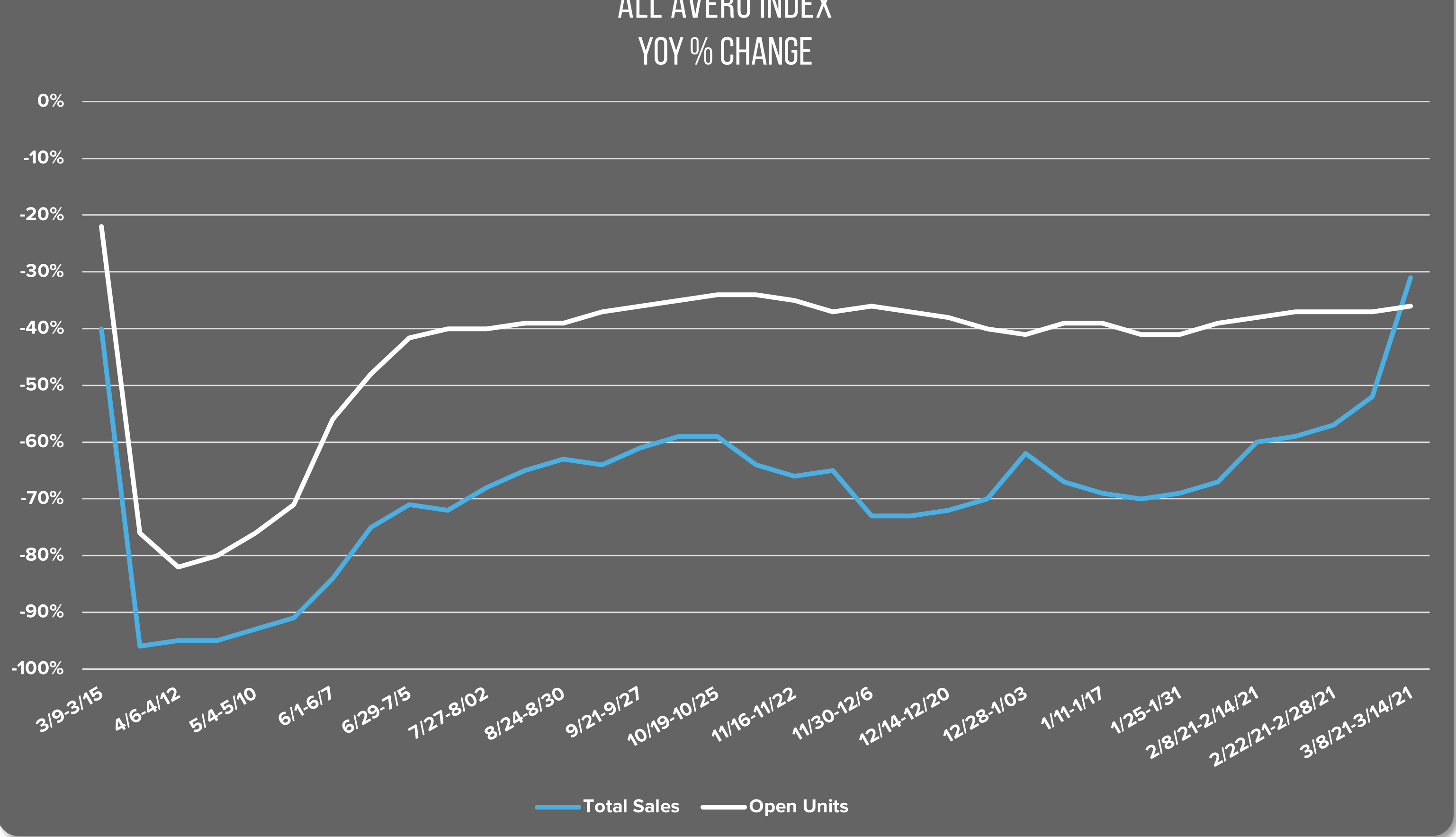

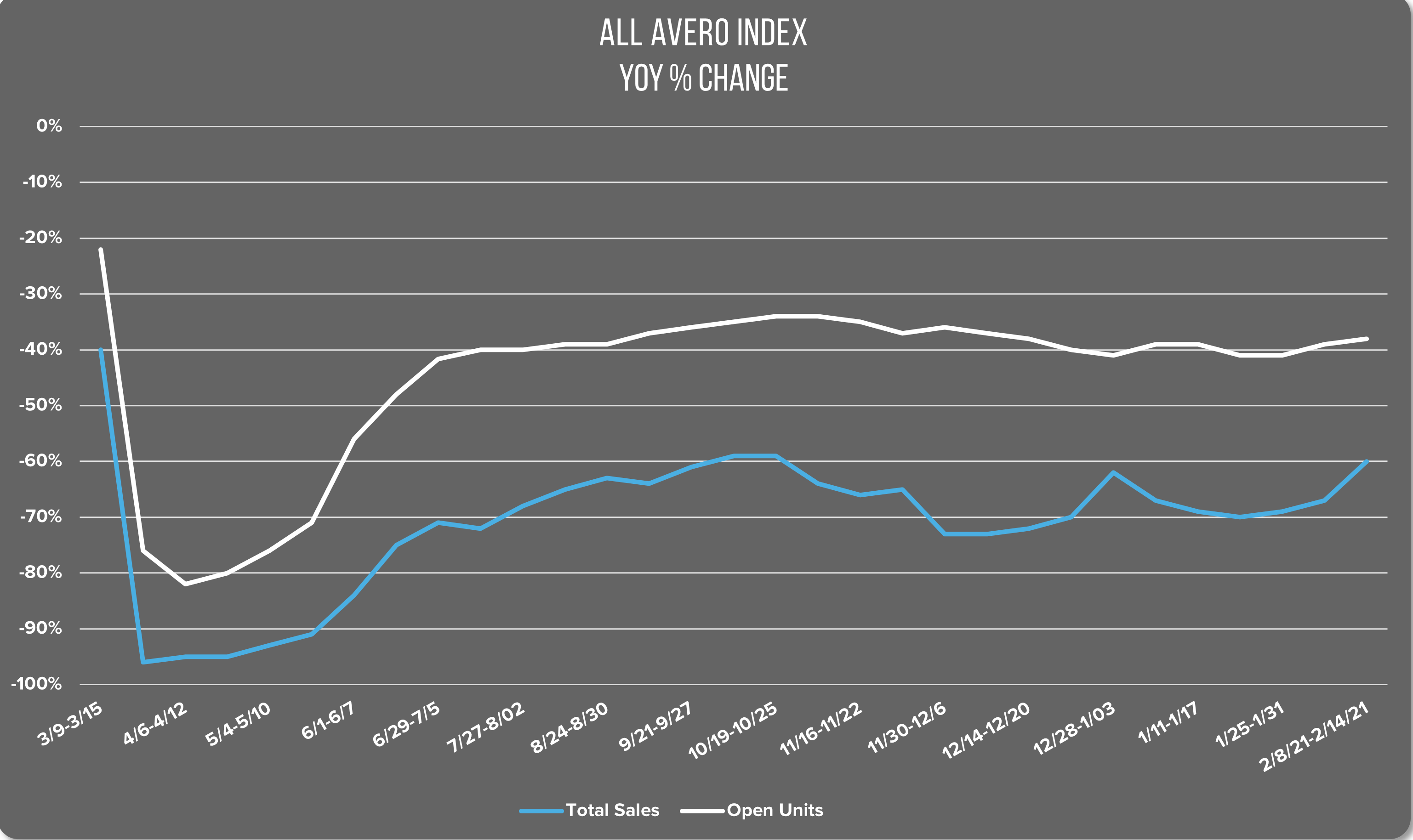

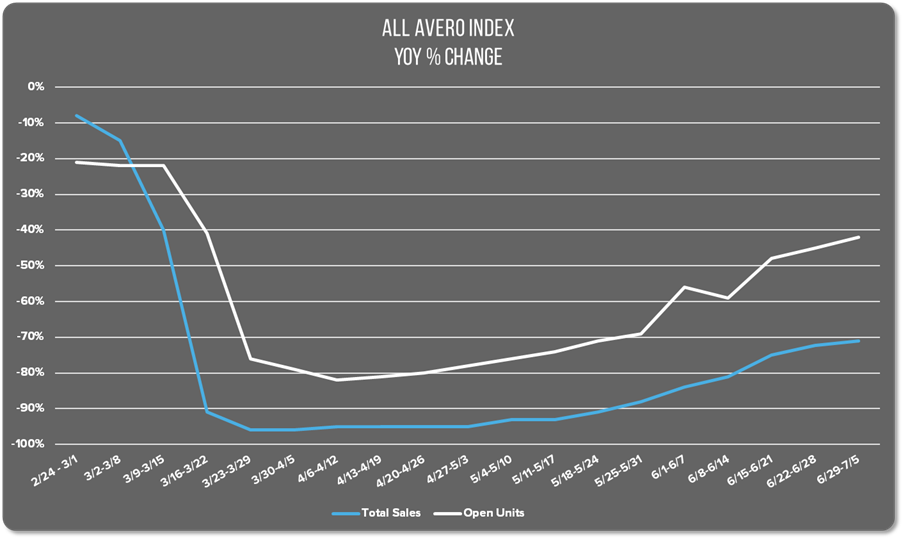

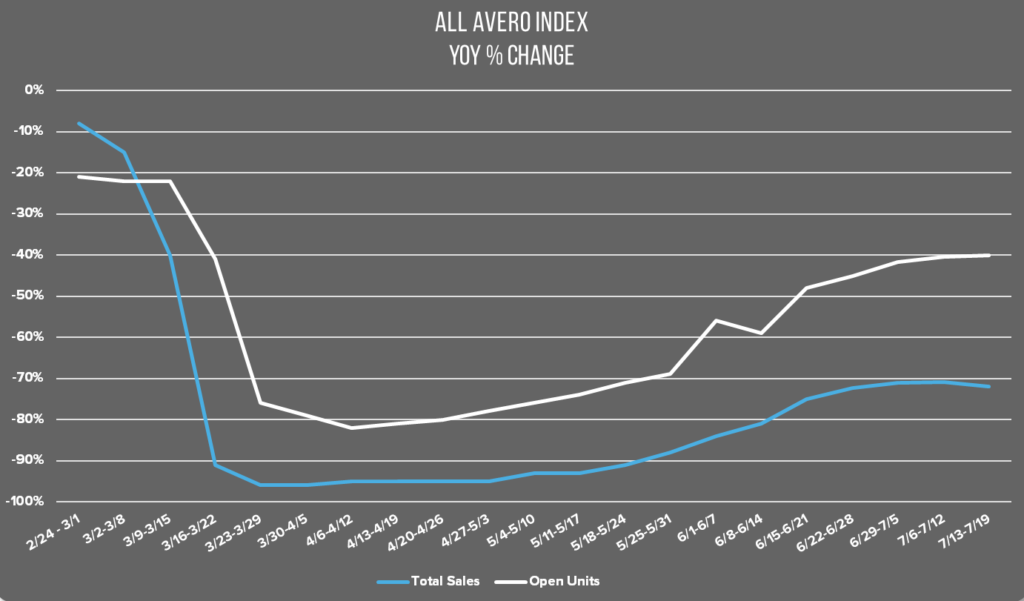

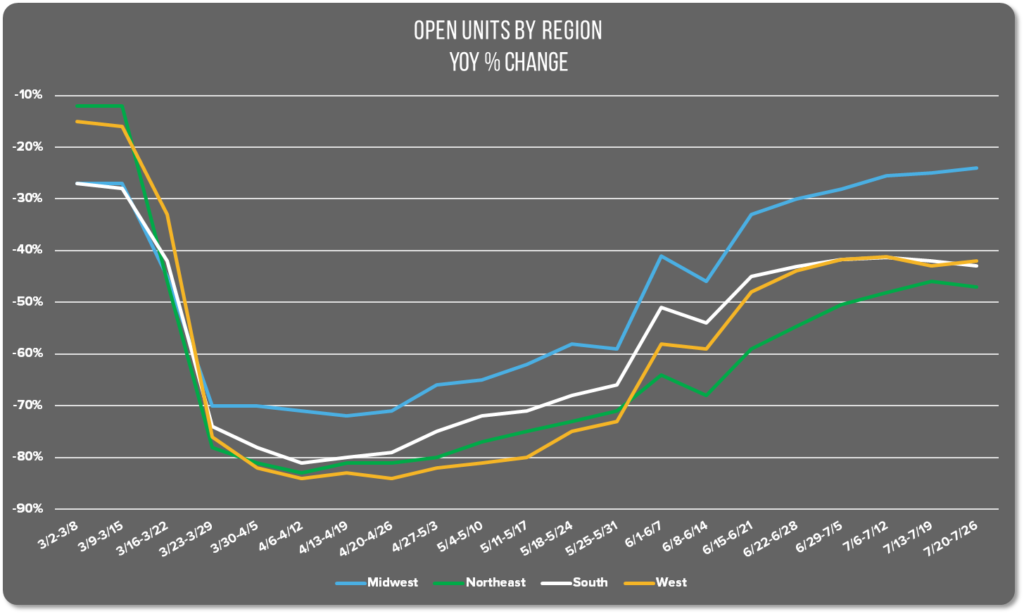

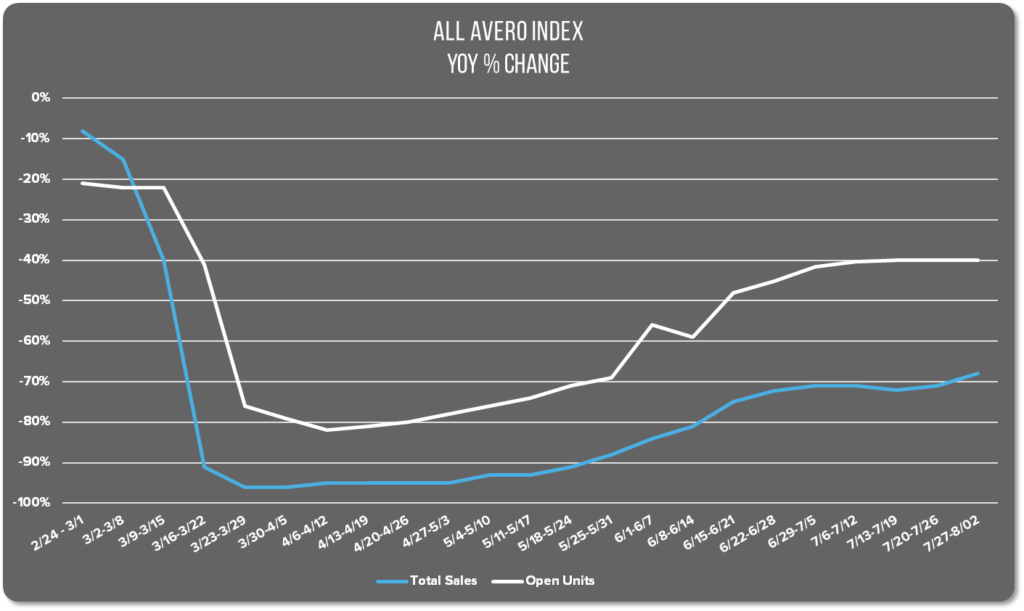

Over the past week, concerns about Coronavirus in the US have reached new heights, with recorded positive cases increasing drastically across the country. We saw this concern reverberate in the F&B industry as well. Despite reopenings in major markets like NYC, nationwide the number of open units increased only 3% vs. last week. Sales trailed close behind with a meager 2% increase.

Regional Restaurant Performance

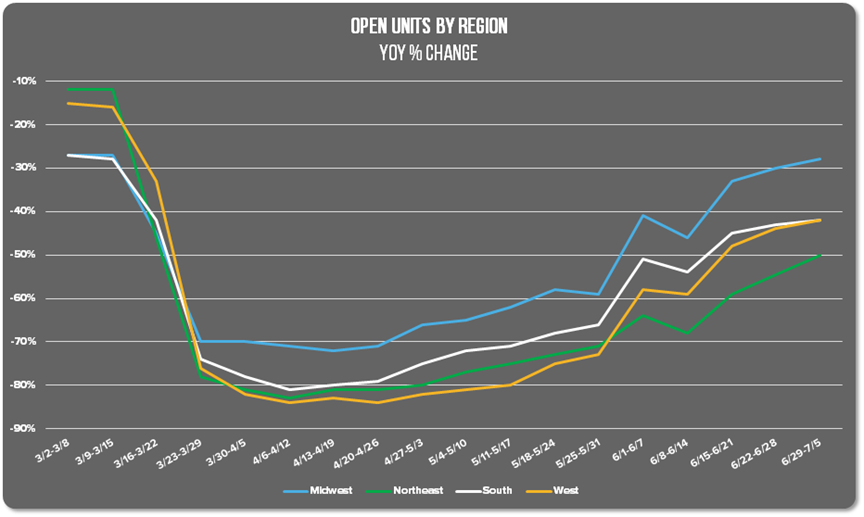

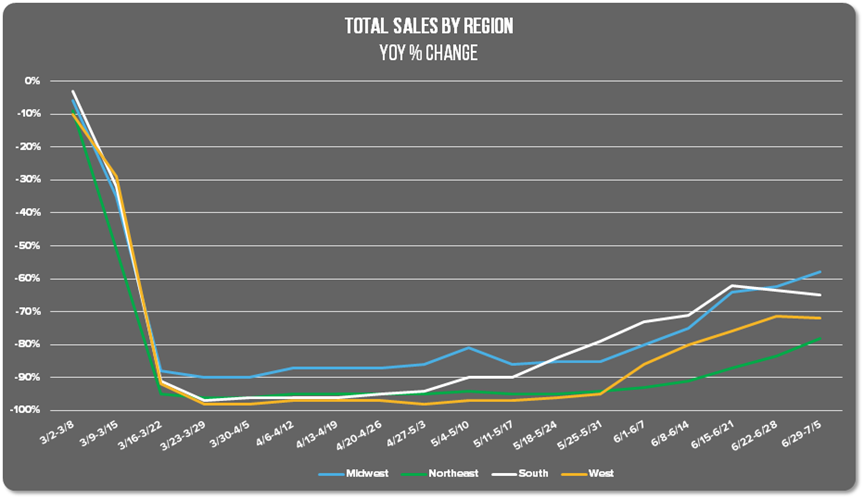

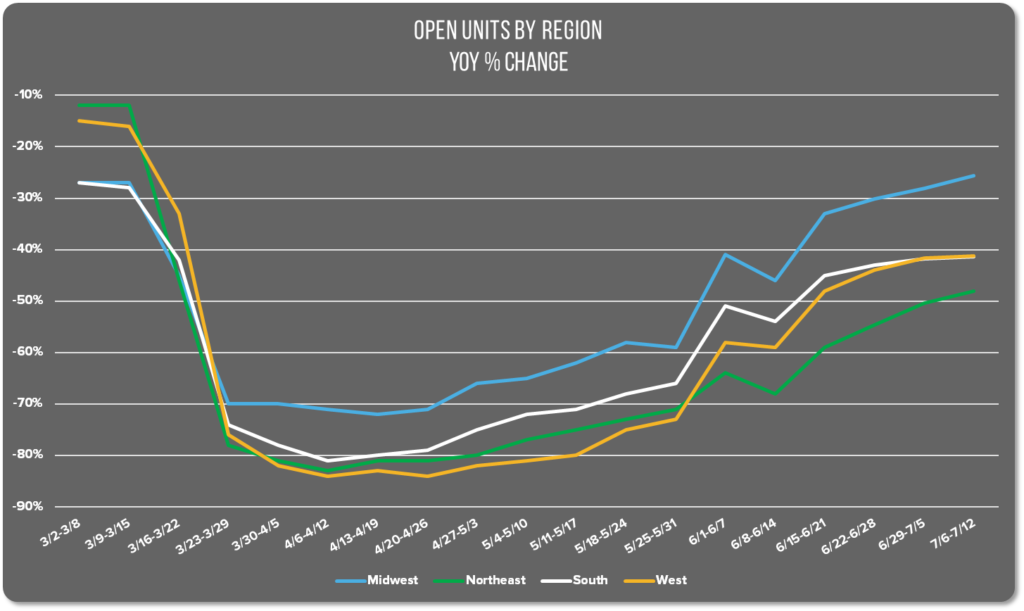

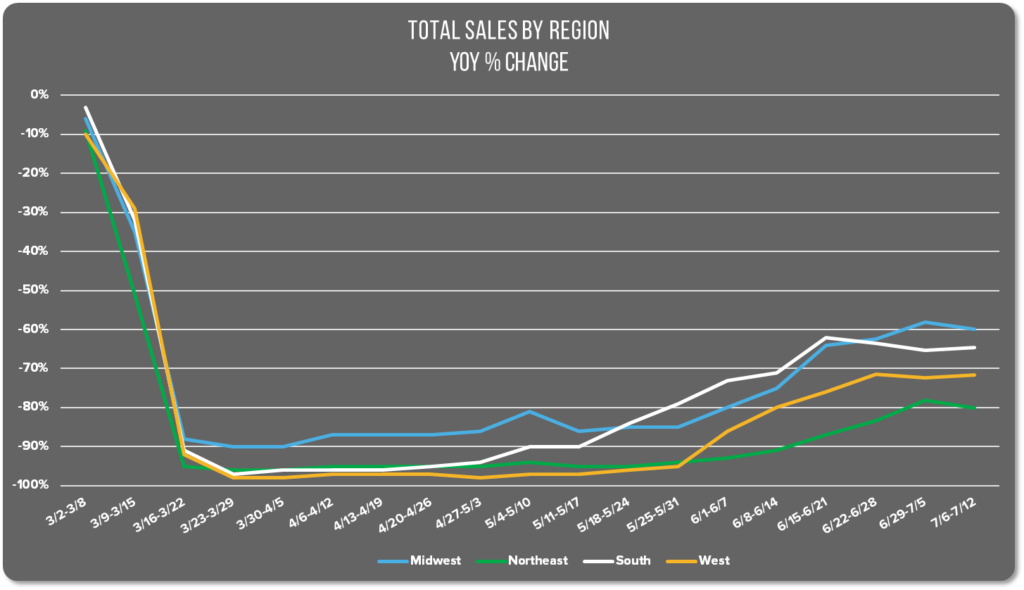

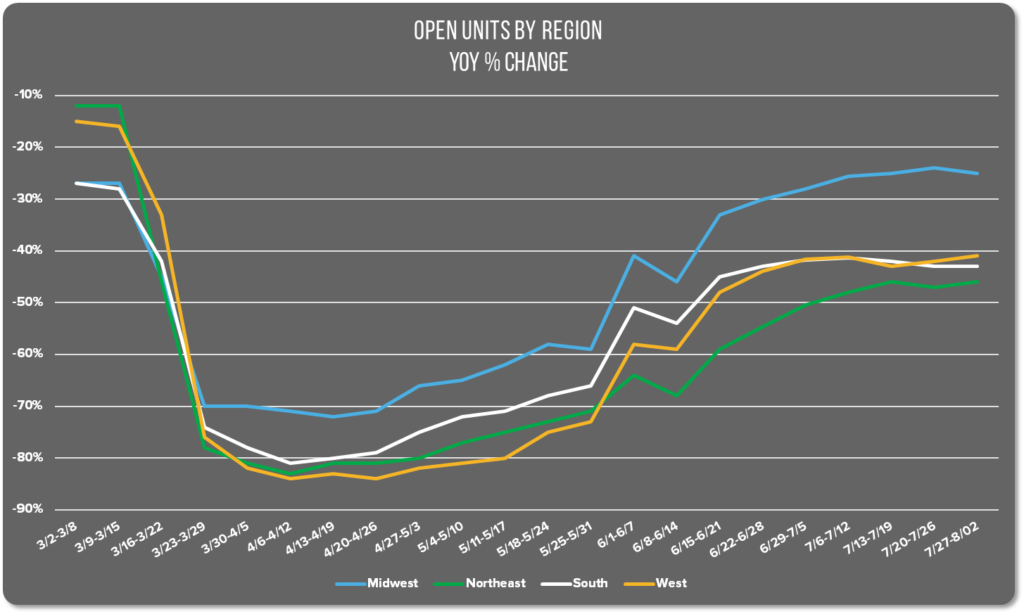

Breaking this down by region, it’s easy to see trends based on individual states’ status in the outbreak. Due to rising cases in the South, states like Texas and Florida have now renewed previously lifted restrictions in major cities. This was reflected with only a 1% increase in open units across the region. In addition, despite the holiday weekend we observed another small dip in sales vs. the previous week.

The West saw a similar trend as sales dropped by 1% despite a 2% increase in open units. With Covid-19 cases rising drastically in California and hospitalizations up 88%, Governor Newsom recently shut down bars and restaurants that had previously reopened. Between closures and public caution, it’s unsurprising that diners appear to be eating out less.

In contrast, the Northeast continued its recovery with a 5% increase across the board compared to last week. This was likely driven by NYC restaurants, where outdoor spaces reopened recently for the first time since initial closures. While the Midwest had a similar 4% sales increase, open units remained relatively stable at 28% down YoY vs. 30% down the previous week.

Overall, it will be interesting to see how these trends continue playing out over the coming weeks. Concerns about secondary Coronavirus outbreaks continue dominating conversations across the US, and will no doubt affect the industry’s recovery as well.

Will areas that seem to have the virus under control continue their slow and steady reopenings? Or will rising cases in other states result in secondary closures in these major markets as well? We’ll check back in next week to take a look at the numbers. In the meantime, check out our Reopening Guide for considerations you can take when reopening.

July 6-July 12: Revolving door of closures takes a toll on sales

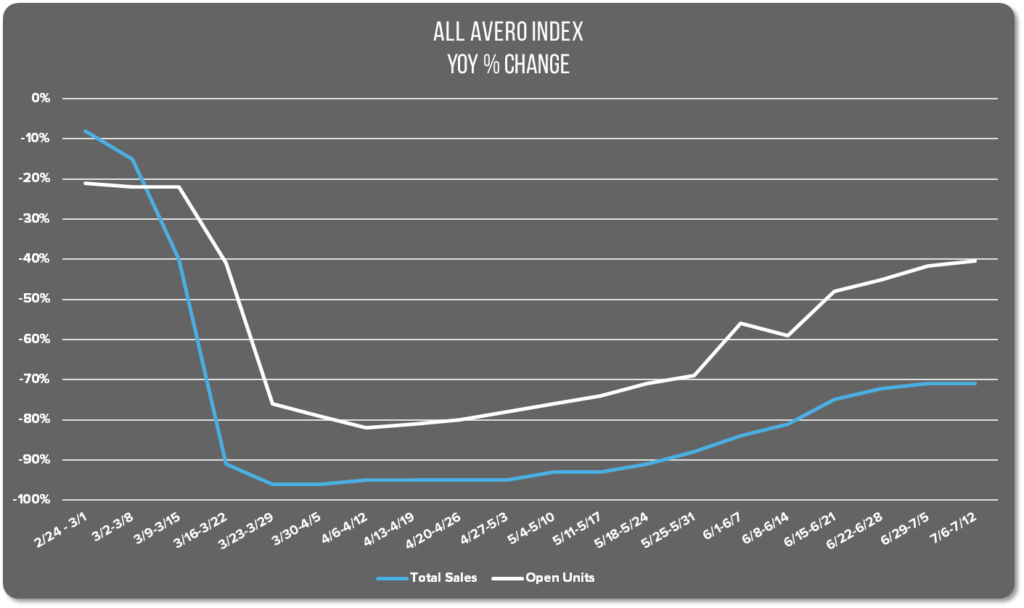

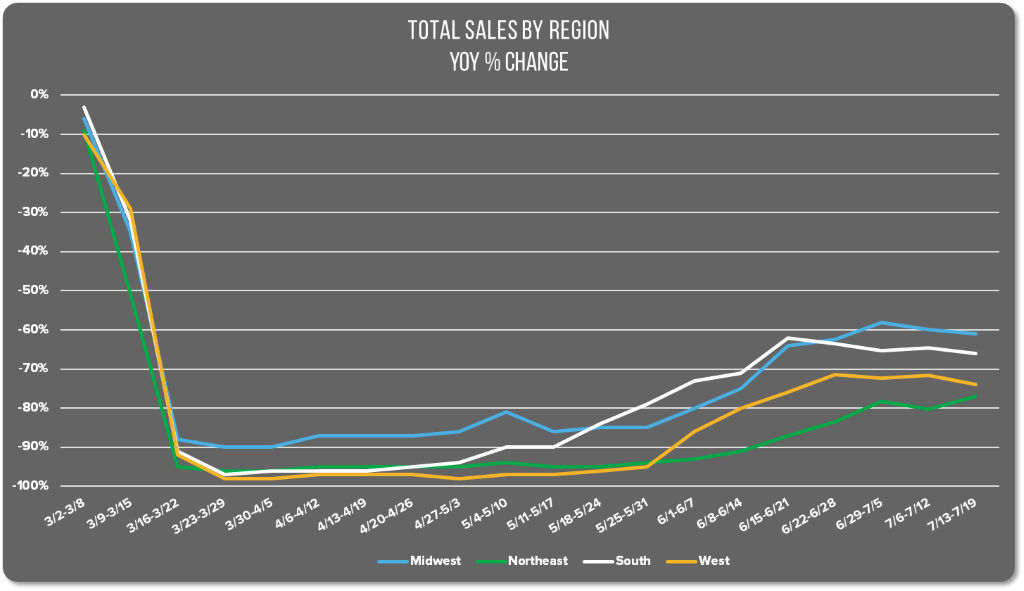

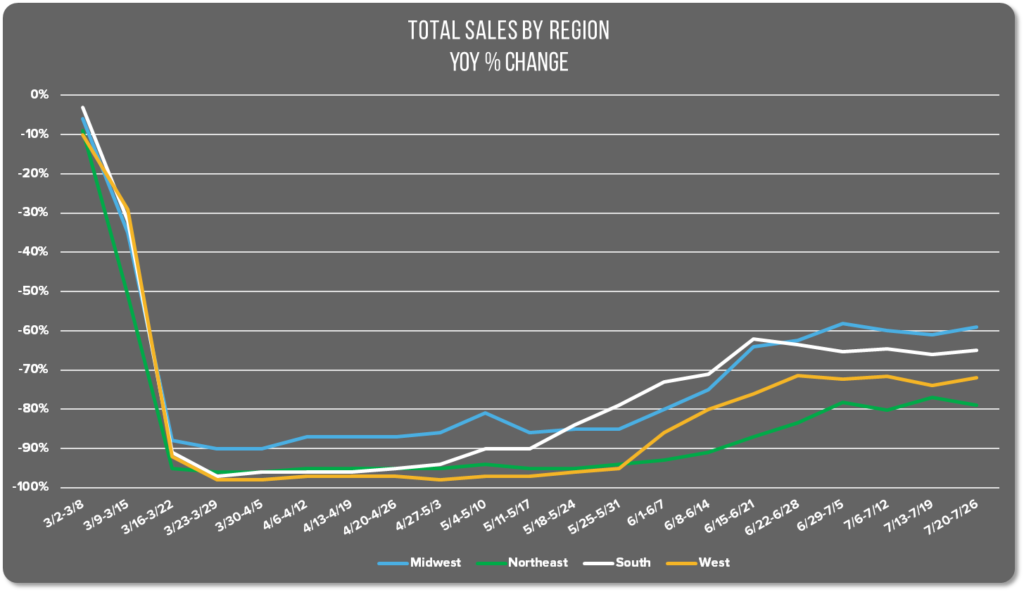

The second week in July remained steady in terms of both restaurant sales and the number of reopened units. There was no percentage point increase in total sales in the All Avero Index. There was only a1% increase in open units, though some regions did slightly better overall.

Regional Restaurant Performance

The Northeast and Midwest regions both saw an increase in open units by 2%, and a 2% decrease in sales. Earlier in the summer, states in both regions moved into a new phase of reopening that includes restaurant dining. Many restaurants have experienced setbacks after reopening as regional surges of Covid-19 caused many to temporarily close again.

In St. Louis, for example, an uptick of 300+ new coronavirus cases impacted three popular downtown bars. Management opted to temporarily close the establishments once again after a customer and two employees fell ill with the virus.

In Chicago, indoor dining resumed July 3rd at 25% capacity as part of the phase four reopening plan. Two days earlier, two popular restaurants operating under the outdoor dining provision closed in response to exposure to Covid-19.

The Southern and Western regions each saw a 1% increase in the number of open restaurants. That slight increase in openings failed to yield a complimentary increase in sales. New dining restrictions in response to rising infection rates in these areas likely contributed to flat sales across both regions.

California Governor Gavin Newsom closed indoor dining in restaurants and bars in 23 counties, including five in Central California. The order came just ahead of the 4th of July holiday weekend.

Arizona Governor Doug Ducey announced an executive order to reduce indoor dining to 50% of capacity on July 9th. That same day the state reached a benchmark of 2,000 deaths from Covid-19.

Nevada Governor Steve Sisolak announced an order to close all bars that do not serve food. The order also restricts seating to six people per table in both Reno and Las Vegas, among other counties. The order took effect just ahead of the weekend on July 10th.

Texas reported their highest single-day record for new coronavirus cases (10,028) on July 7th, and their highest single-day death toll (98) on July 8th. No new orders were issued regarding resaurant closures, but with those headlines in the news and state and local officials urging folks to stay home, it’s not surprising that restaurants continue to suffer.

The revolving door of openings and closures we’re seeing demonstrates that a governmental go-ahead for resuming operations doesn’t protect restaurants from future closures while the virus remains uncontained.

It’s important for restaurant operators to take extra precautions when reopening in order to prevent a subsequent closure. We’ve been collecting best practices from our customers and have shared them in Avero’s Restaurant Reopening Guide. Check it out and let us know if you have additional tips to share. Stay strong out there friends!

July 13-19: Northeast alone shows positive restaurant growth

This week, the All Avero Index shows a 1% decrease in sales and no increase in open units. Though national restaurant sales have been gradually rising since the onset of summer, growth stalled last week and fell this week as large portions of the country struggle with rising Covid-19 infections.

Regional Restaurant Performance

Restaurant sales fell 1% while Covid-19 cases continued to rise in the South last week. Unfortunately a 1% decrease was also seen in the number of open restaurants.

The Midwest fared only slightly better, coming in with a 1% decrease in sales also, but a 1% increase in the number of open units. Covid cases in Minnesota are also on the rise, showing the second largest single-day increase in July so far. Illinois also saw their largest one-week average since early June last week.

In the West, sales and open units both decreased by two percent. Coronavirus cases in sunny California have not slowed despite the governor’s recently renewed restrictions in 23 counties. Los Angeles Mayor Eric Garcetti has warned that a return to stay-at-home orders may be in order, which would have a direct impact on restaurant sales.

Las Vegas set an unfortunate record last Saturday for their lowest number of visitors since casinos reopened in early June. Covid-19 cases in the region increased significantly last week, with over 88% of reported cases occurring in Clark County where The Strip is located.

In the Northeast, new coronavirus cases fell in Maine and New Hampshire and held steady in Massachusetts and Connecticut. In this region, restaurant sales grew 3%, with a 2% increase in the number of open restaurants.

Rising restaurant sales and open units in the Northeast alongside a decrease in Covid-19 cases and deaths in New York are a sign of hope for the rest of the country. No deaths were reported in New York City on Monday and only two were recorded in the state. Considering that over 800 deaths were reported in a single day in April, the current reports are heartening to those looking for signs of national recovery.

We can only hope that steady gains in both coronavirus containment and restaurant openings in New York will be followed by a meaningful and sustained increase in restaurant openings and sales in the region.

July 20-26: Restaurant growth stalls

Index at a Glance

- All Avero Index: sales up 1%, open units – no change

- Midwest: sales up 2%, open units up 1%

- Northeast: sales down 2%, open units down 1%

- South: sales up 1%, units, open units down 1%

- West: sales up 2%, open units up 1%

Nationwide Restaurant Performance

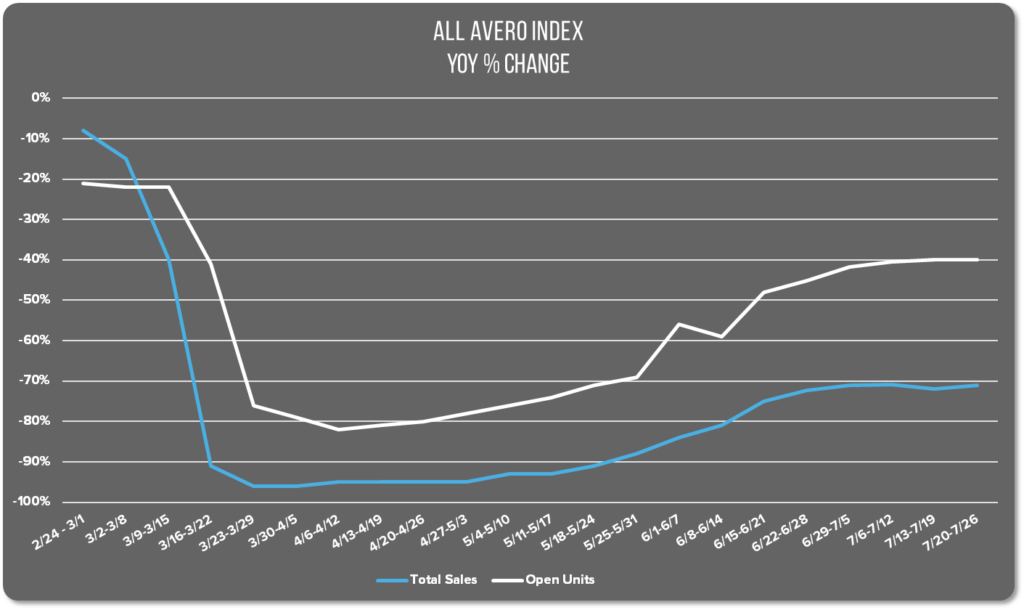

U.S. restaurant sales continue to show very little growth as Covid-19 surges across the nation. In this week’s All Avero Index, sales grew only 1% and there was no point change in the number of open units.

The total number of open units grew over the month of July by 2%, but sales remain at 71% of pre-pandemic levels YoY.

Regional Restaurant Performance

The Midwestern region had their best performance of the summer in the first week of July following the holiday weekend. Over the next three weeks, sales continued to decline slightly. But this week, they recovered a bit, coming in with a 2% increase in sales and a 1% increase in the number of open units. Whereas they ended the 4th of July week at 58% of normal pre-covid YoY performance, they’re currently at 59% of normal sales.

Performance in the South lags behind the Midwest, showing 65% of normal YoY sales this week. That’s an increase of 1% compared to last week, but no change from the beginning of the month. The number of open units fell again by 1% this week, which is also 1% lower than the number of open units at the beginning of July.

The Western region also ends this month with no significant changes since early July. In the first week of the month they showed sales at 72% of pre-Covid normal YoY. The number of open units was 42% of normal. Now, at the end of the month, the numbers are unchanged, despite a slight dip in both performance and open units mid-month. This week sales grew by 2% and units by 1%.

The Northeastern region had the worst performance this week with sales falling by 2% and the number of open units falling by 1%. That said, their performance at the end of July is only 1% lower than it was after the holiday weekend. And 3% more units have opened this month.

Unfortunately, Covid-19 cases are rising in 44 states as of July 28th. Even states, like New York, that had previously reported a drastic decrease in the number of new cases are trending upwards again. Whereas three weeks ago the average number of new cases in New York was 674, this week they’re reporting a daily average of 717 new cases. With this upward trend in most states, it’s difficult to be optimistic that meaningful restaurant recovery will occur soon.

One bright spot however is that seven states are reporting a decrease in the number of new infections per day including Maine, Vermont, South Carolina, Iowa, Utah, Texas, and even Arizona. Three weeks ago, Arizona reported 3,844 average daily new cases, and this week that number fell to 2,663.

With at least one state per region trending downward, we can only hope that positive trend will spread to additional states across the nation.

July 27-Aug 2: Restaurants begin August on positive trend

Index at a Glance

- AAI: sales up 3%, no change in open units

- Midwest: sales up 1%, open units down 1%

- Northeast: sales up 3%, open units up 1%

- South: sales up 2%, no change in open units

- West: sales up 3%, open units up 1%

Nationwide Restaurant Performance

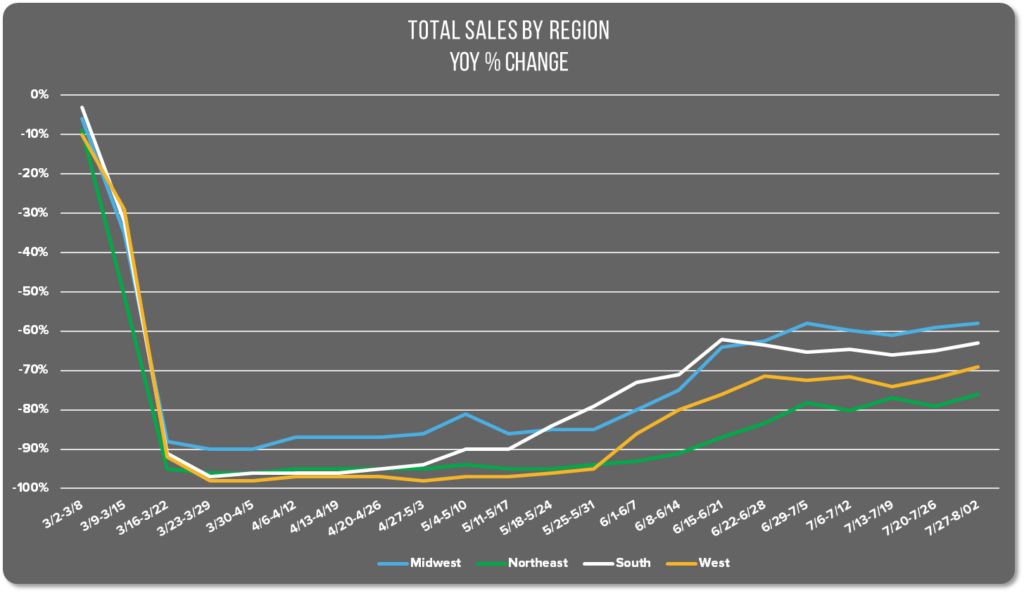

Restaurants across the country saw positive sales growth last week. The All Avero Index shows a 3% growth in sales nationwide. That is the largest gain we’ve seen since June when many regions were beginning to relax Covid-19 regulations for restaurants.

There was no change in the overall number of open units, which suggests that the growth is occurring in individual restaurants, rather than being the result of additional unit openings.

Regional Restaurant Performance

The Midwest was the only region showing a point loss in any category. Though sales were up 1%, the number of open units fell by 1% as well.

We see a similar trend in the South. Sales were up by 2%, and there was no change in the number of open units. Considering that Florida and Texas make up two out of the top three states in the nation with the highest volume of new cases, a sales increase in the South is cause for celebration.

The Midwestern and Southern regions are struggling with recent spikes in new coronavirus cases. Missouri, Montana, and Oklahoma were among states seeing the largest percentage of new cases last week. While Florida, Mississippi, and Alabama continue to outpace other states overall.

Sales in the Northeastern and Western regions were also on par with one another last week. Each region enjoyed a 3% sales increase and a 1% increase in the number of open units.

This comes as a slight surprise given that California reached a 1-day record for the highest number of deaths on Friday. However, they also saw a reduction in new confirmed cases for the first time in 12 weeks. The surge of new cases in California earlier this summer resulted in re-closure of restaurants and bars in many counties last month. It’s likely that the increase in cases will lead to a more modest reopening approach heading into fall.

That’s it for last week. Here’s to hoping we can report more positive gains in the restaurant industry next week!