September 28-October 4: Sales increase despite decline in outdoor sales

Index at a Glance

- All Avero Index: Sales up 1%, no change in open units

- Midwest: Sales up 1%, no change in open units

- Northeast: Sales up 2%, open units increase 2%

- South: Sales up 2%, no change in open units

- West: Sales down 1%, open units increase 1%

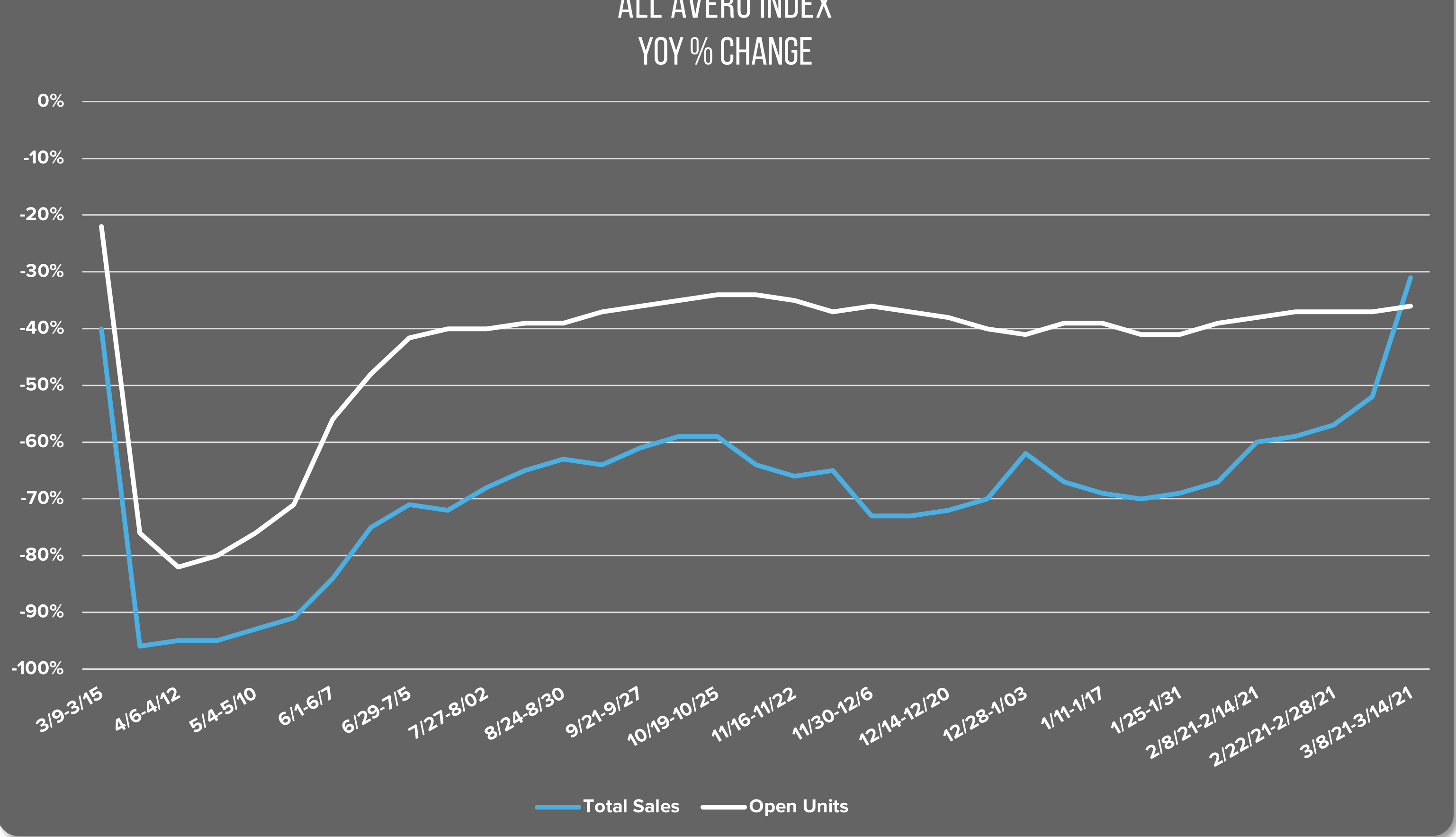

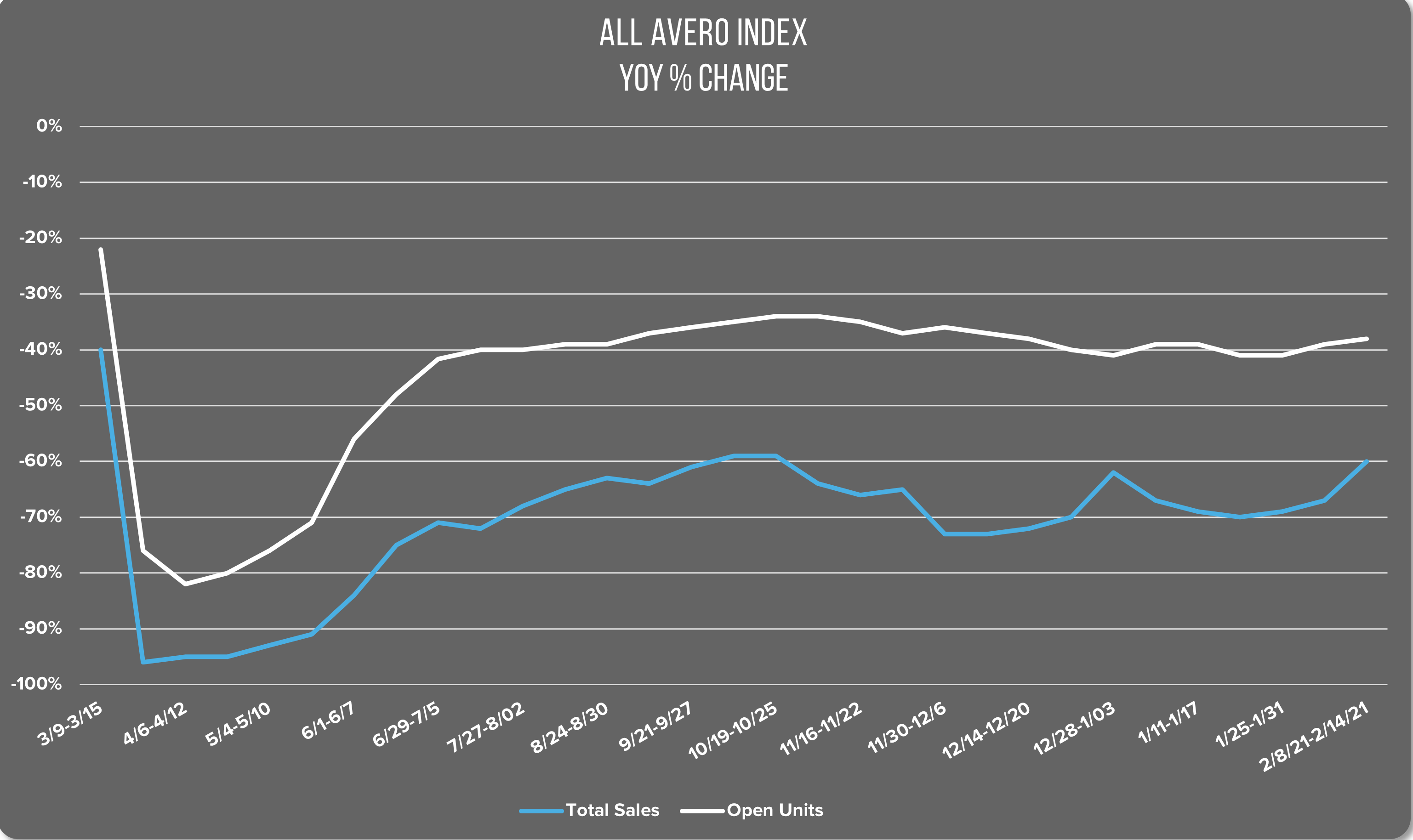

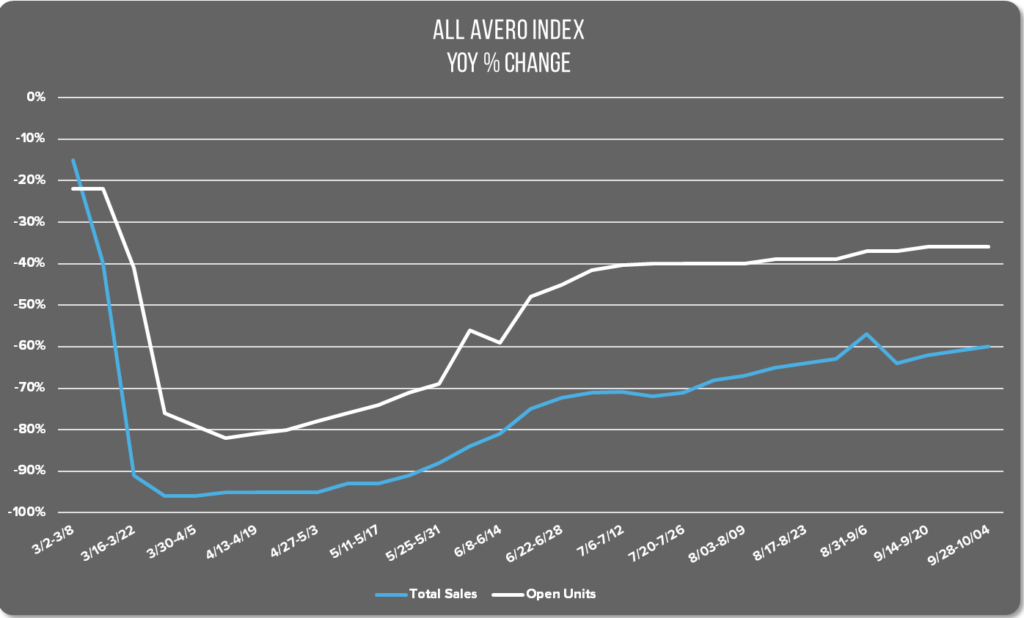

Nationwide Restaurant Performance

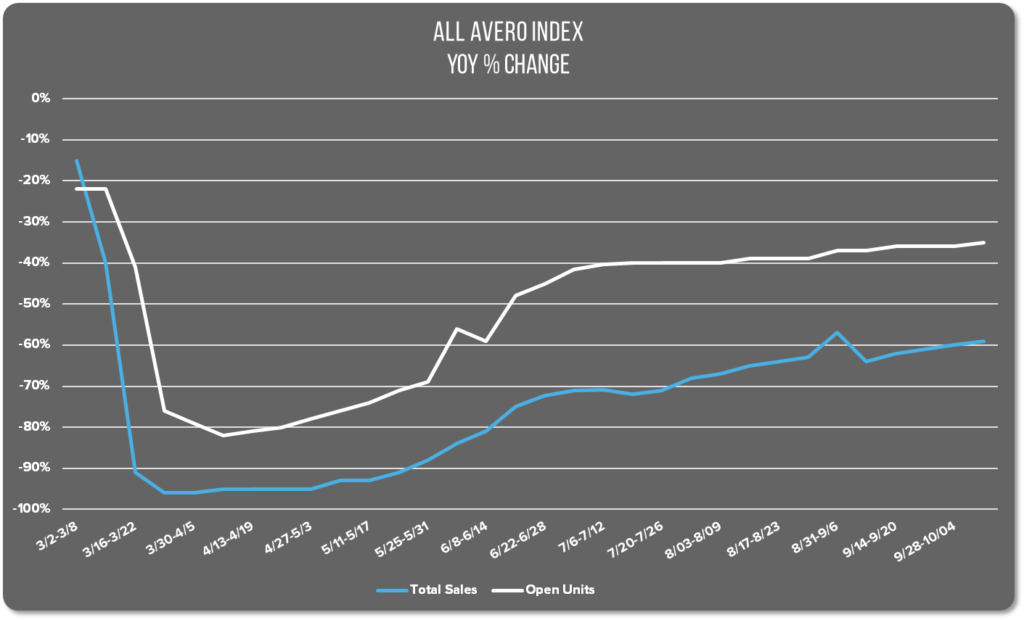

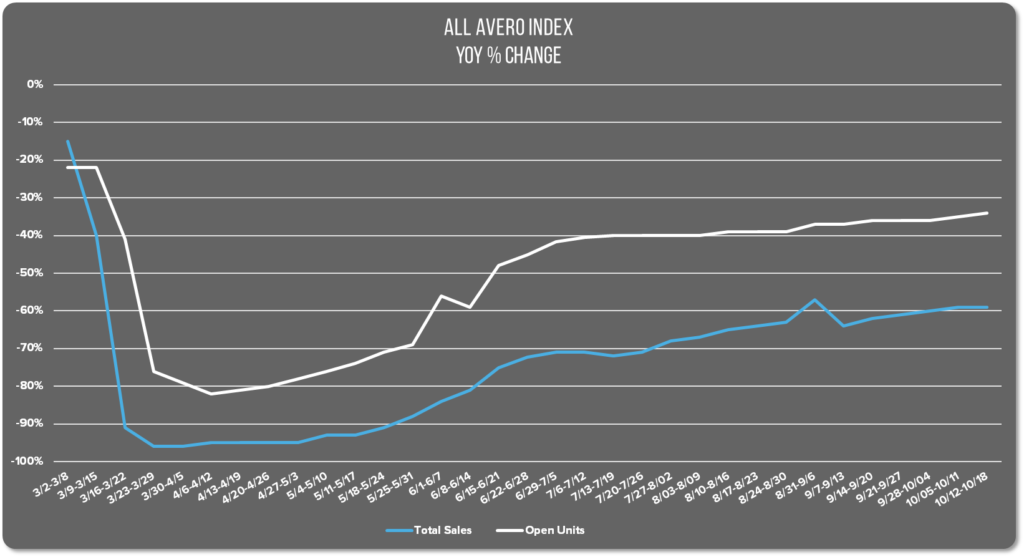

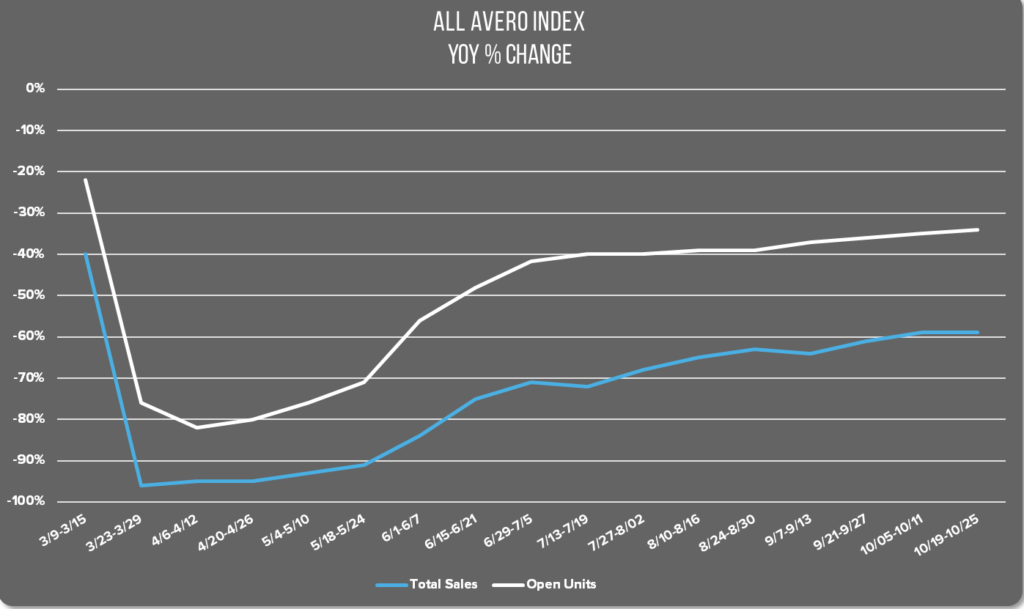

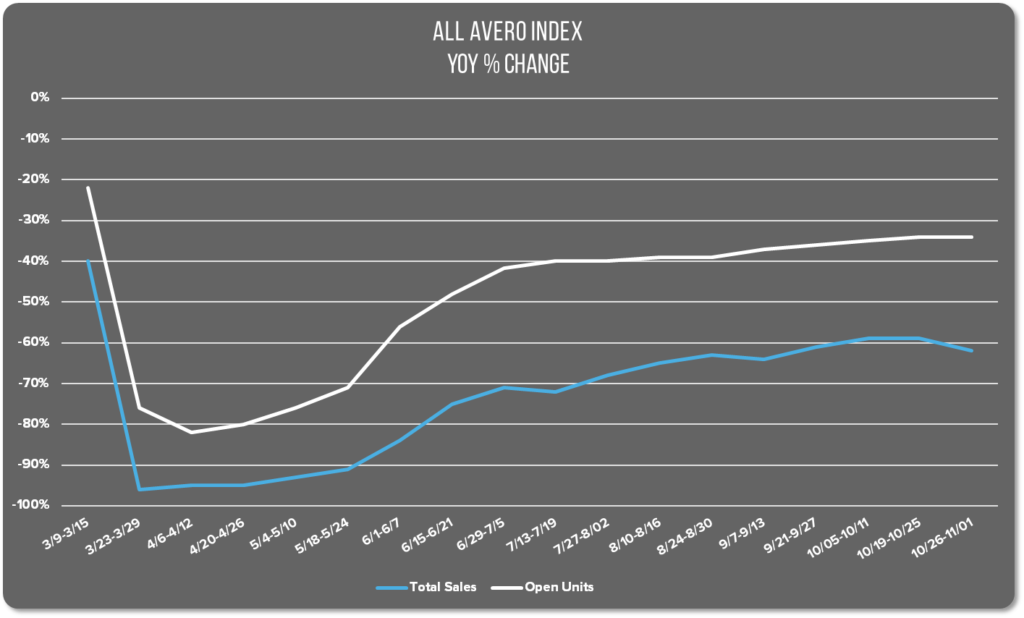

National Restaurant Sales increased 1% last week with no change in the number of open units. National sales remain 40% below the same week last year.

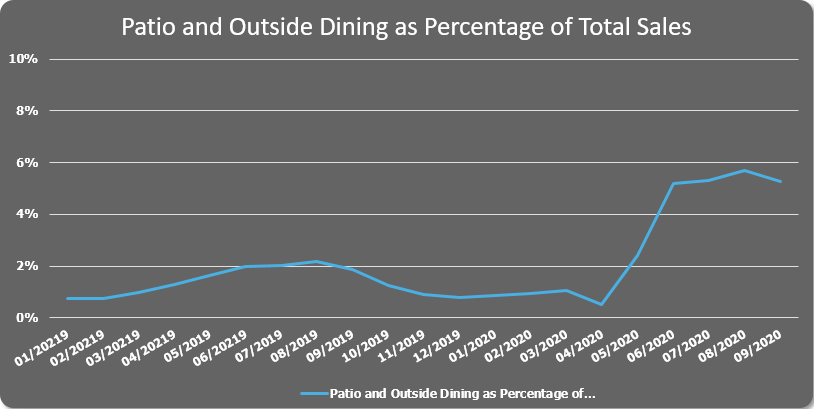

A 1% increase in national restaurant sales may be slight, but we see it as a win considering that outdoor sales have begun to slow in many regions as autumn sets in, bringing cooler temperatures. We took a closer look at outdoor patio sales last week and found that they are more than double than the same period last year.

Outdoor sales have been a lifeline for restaurants during the global Covid-19 pandemic. They have helped make up for capacity restrictions that most restaurants have faced as part of the ongoing effort to curb the virus outbreak. Since the onset of the US outbreak in March, temperatures have gotten warmer, and hence, outdoor dining has flourished. As temperatures cool, so does the potential revenue from outdoor restaurant sales.

In the graph below you can see the slight rise in sales during warmer months in 2019, in contrast with the sharp rise and continued high rate in outdoor sales in 2020. Outdoor dining peaked in August and began to decline again in September.

With total sales still growing last week, we can infer that the trend among many states, of relaxing restrictions on restaurants and increasing indoor dining capacity, is helping make up for the slight loss in outdoor sales for the time being.

Regional Restaurant Performance

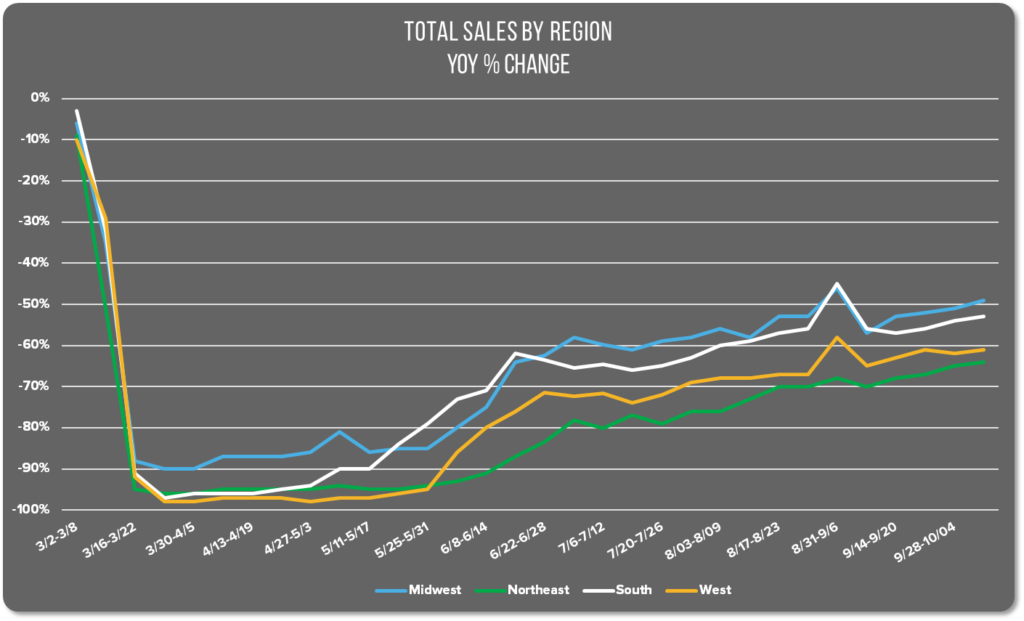

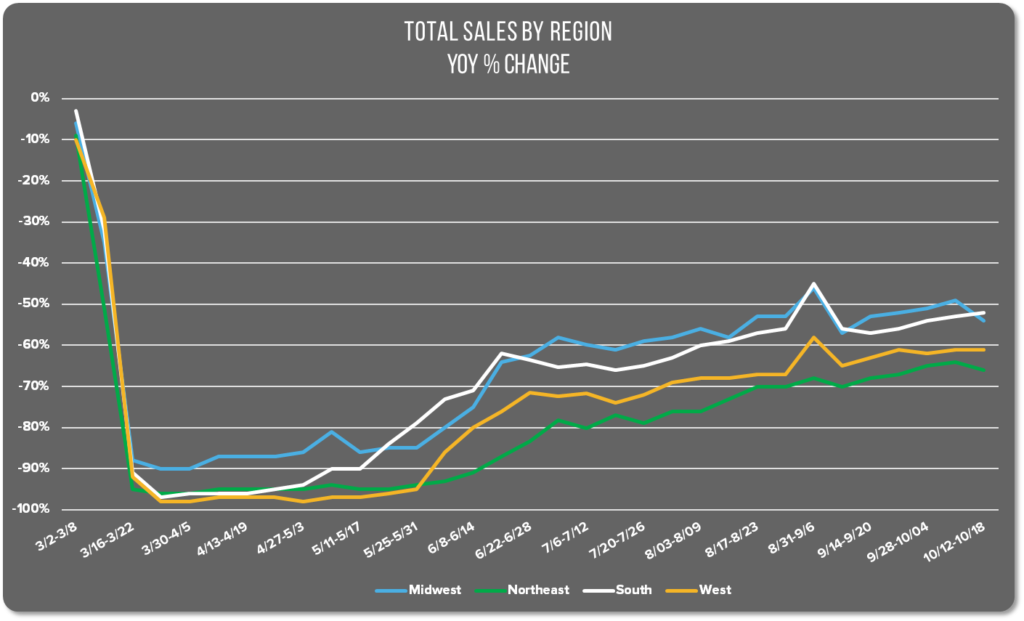

Restaurants in most regions saw a slight sales increase last week, except for the Western region where sales decreased by 2% despite a 1% increase in the number of open units. Wildfires in California have continued to burn across a record 4 million acres—an area larger than the state of Connecticut. The burned acreage doubles last-year’s record for the most land burned in a single year in California.

Restaurants in most of California are under severe restrictions on indoor dining. Indoor dining is still prohibited in Los Angeles, though Orange County and San Diego County relaxed restrictions last month to allow 25% of capacity indoors. Thick smoke from the fires causes a significant health risk and has covered much of the West for weeks, driving people indoors and perhaps, away from restaurants.

The Northeast region was last week’s winner with 2% higher restaurant sales and a 2% increase in the number of open units. Gains in the region can likely be tied to the lifting of the ban on indoor dining in New York City that had been in place since June.

Restaurants in the South saw a 2% sales increase with no change in the number of open units. We’re glad to see a slight sales increase in both the Northeast and the South as both will face challenges this coming week due to new restaurant closures and restrictions in NYC, and hurricanes heading for the South.

Restaurant sales in the Midwest grew by 1% with no change in the number of open units. Several states in the region are pushing forward with plans to further relax restrictions on businesses including restaurants despite a wave of new coronavirus cases. Iowa, Minnesota, Wisconsin, Indiana, and North and South Dakota have all reported record (or close) numbers of new infections, though none have plans to roll back restrictions at this time.

Stay tuned for more national restaurant sales trends next week.

October 5-11: Restaurants see third consecutive week of 1% sales growth

Index at a Glance

- All Avero Index: Sales up 1%, open units up 1%

- Midwest: Sales up 2%, no change in open units

- Northeast: Sales up 1%, no change in open units

- South: Sales up 1%, open units up 1%

- West: Sales up 1%, open units up 1%

Nationwide Restaurant Performance

National restaurant sales trends continue upwards, though at a slow pace. Last week marked the third consecutive week of 1% sales growth across all restaurants in the All Avero Index. The number of open units also grew by 1% last week. The number of open units increased 1%. There has been no growth in the AAI for the number of open units in the prior three weeks.

Regional Restaurant Performance

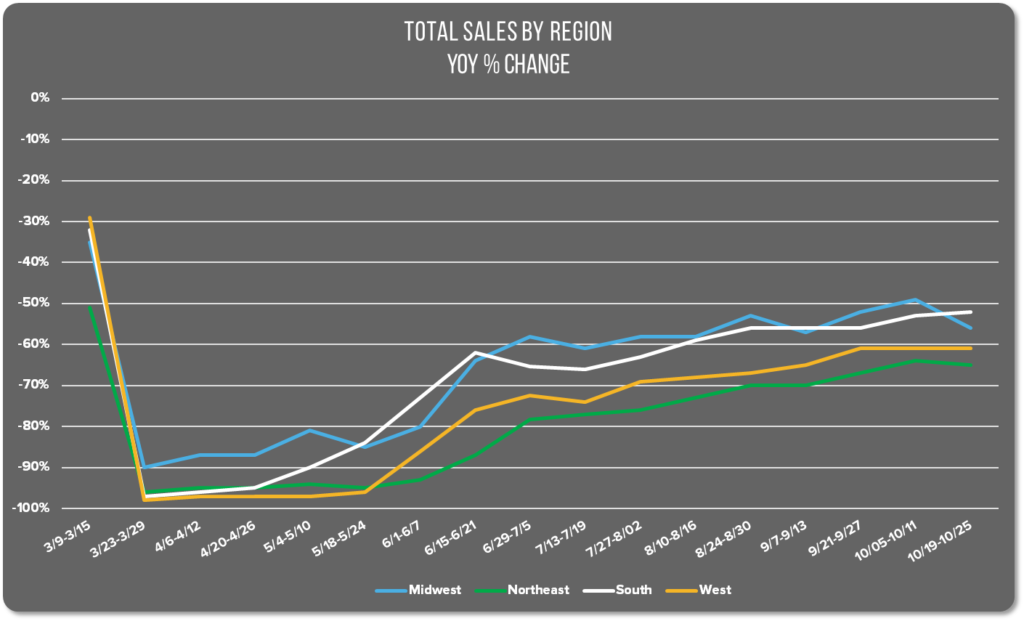

Regional sales largely reflect the AAI performance as well. With every region showing a 1% sales increase except for the Western region which grew 2% last week. That is welcome news considering that last week the West was down 1%, partly due to ongoing wildfire activity in the area. This week they recovered that loss and grew sales 1% in line with the rest of the region.

The Midwest and the Northeast saw no change in the number of open units. This is slightly surprising considering that New York City recently gave restaurants the OK to open indoor dining at 25% capacity. However, days after the reopening date, Mayor Bill de Blasio announced a new shutdown for 9 neighborhoods including parts of Queens and Brooklyn that prohibits all on-premise dining. Perhaps new restaurant openings canceled out new closures in the city.

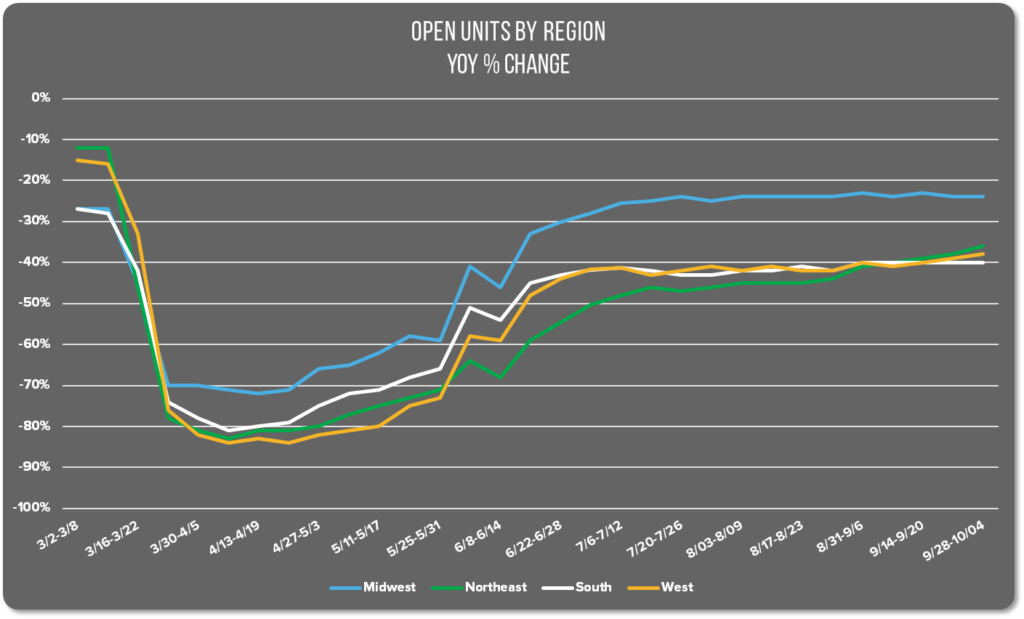

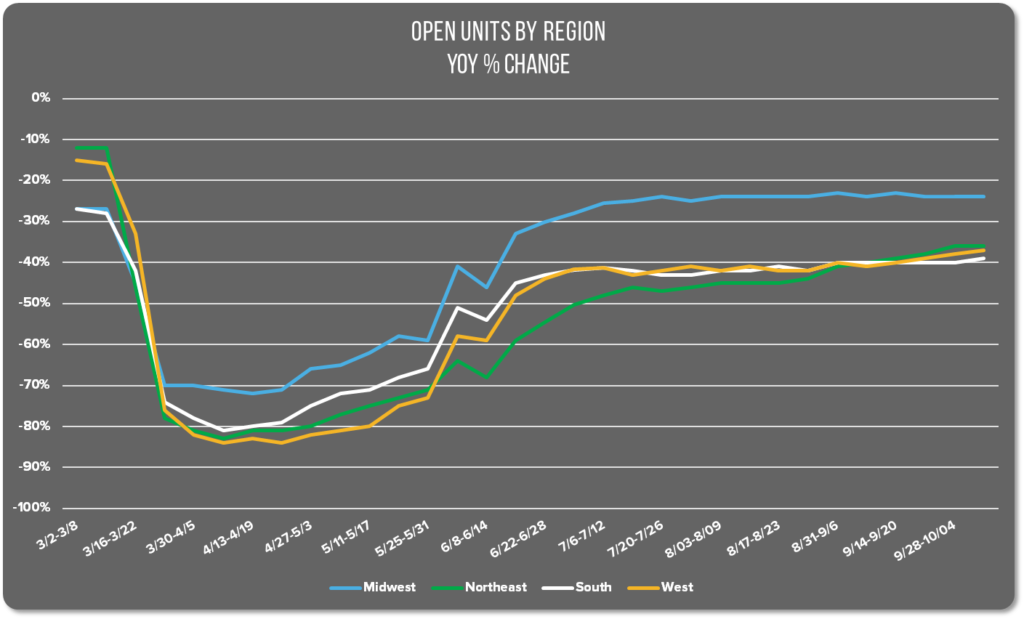

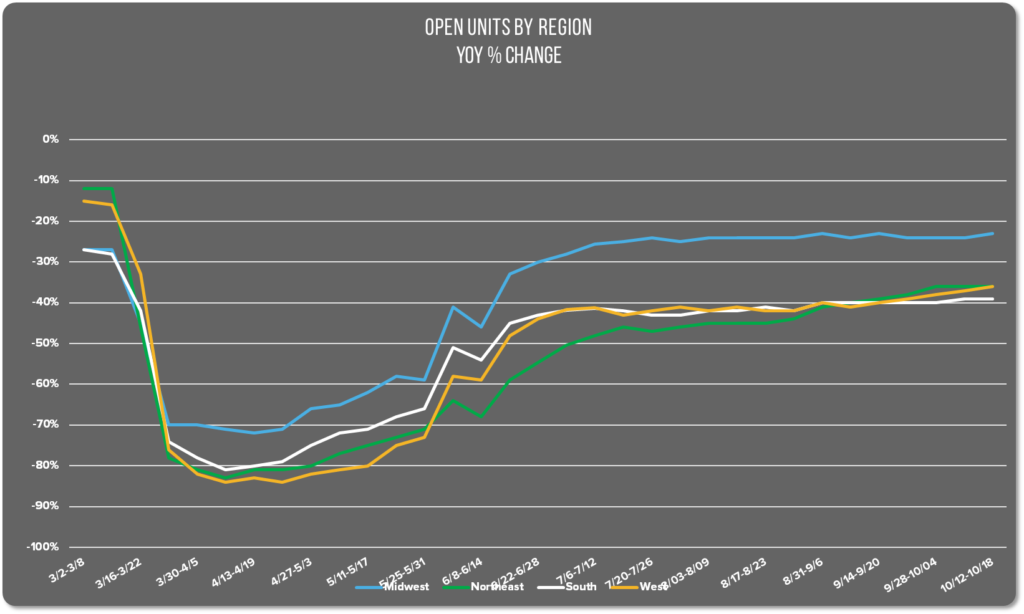

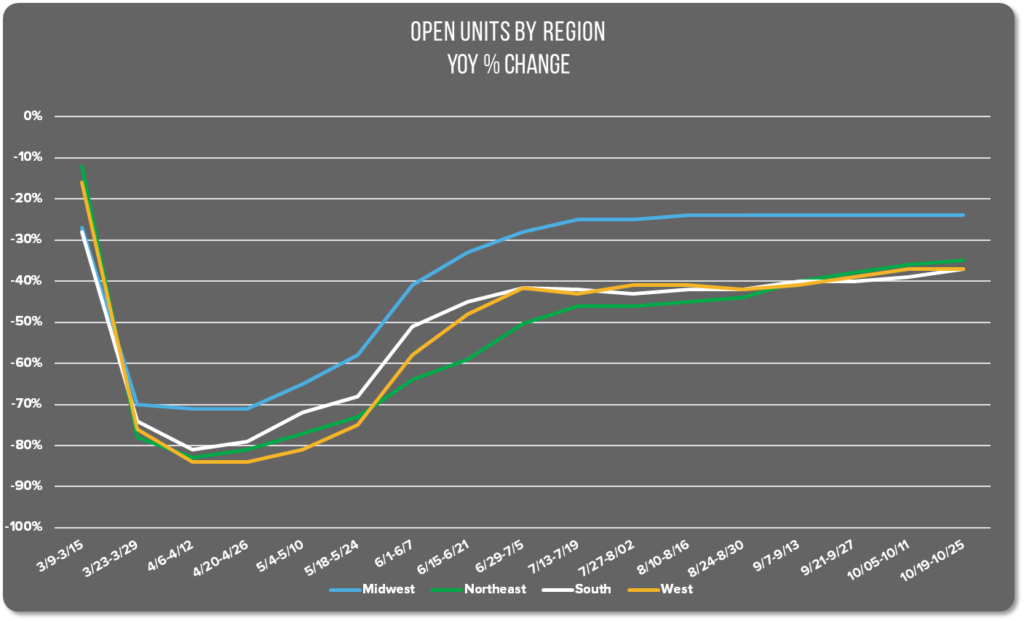

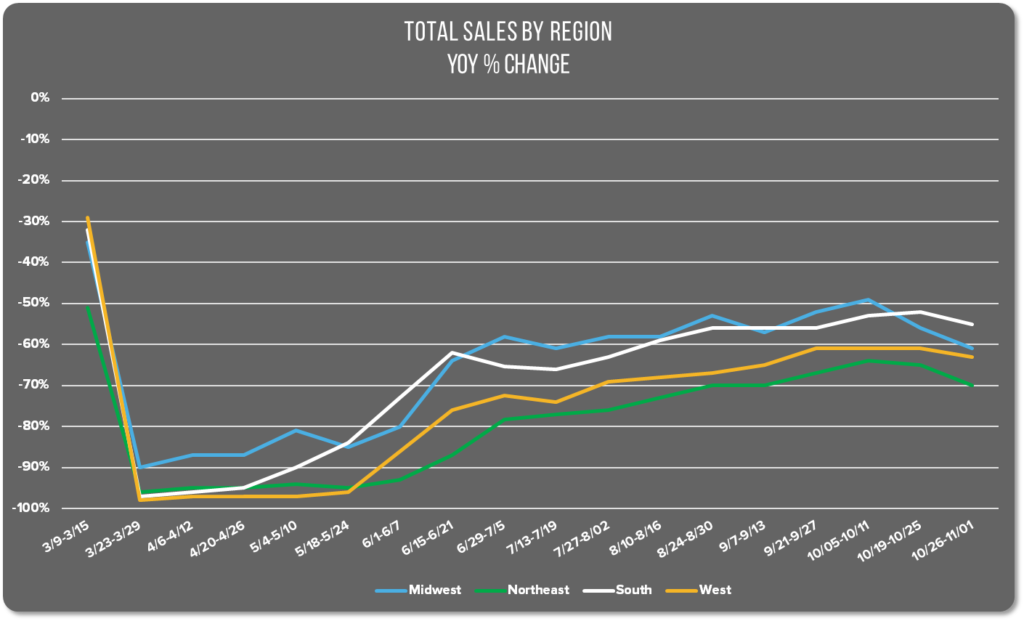

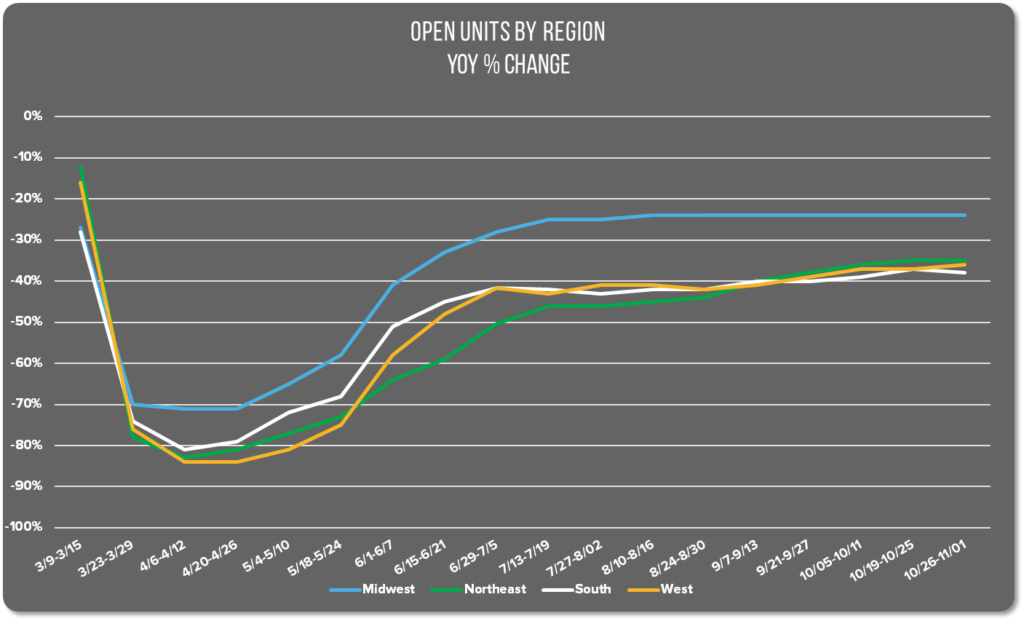

The West and South both saw a 1% increase in the number of open units. Looking at the visual graph it appears as though restaurant openings generally plateaued across all regions mid-summer. Though the number of open units was initially the worse in the West, the Northeast held the bottom spot for the majority of the time. The Midwest has consistently dominated in terms of the number of open units. But overall, the trend was fairly consistent among all regions.

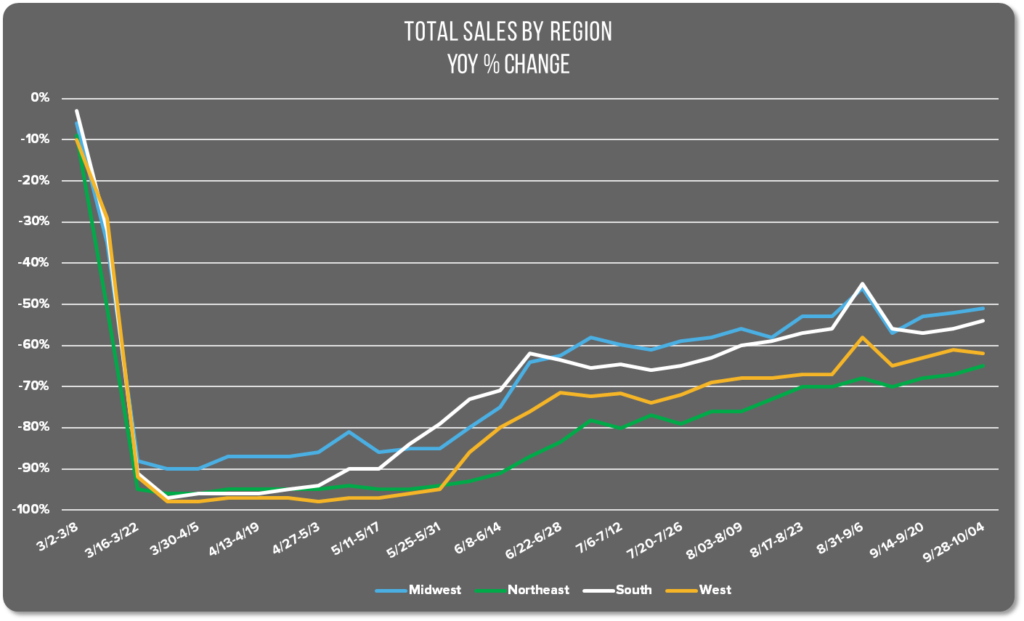

Conversely, the sales performance graph shows a lot more variability between regions in any given week. Some regions show a peak in the same period that others show a valley. This tracks with the variability of coronavirus hotspots across the country. That regions experienced a rollercoaster of increasing and decreasing infections is reflected in the visual graph.

National media outlets are buzzing with the news that Coronavirus cases have been steadily rising in most states for the past month. More than 20 states have hit a new high in their seven-day average of case counts. Forty states have seen an increase in week-to-week cases, with the largest surge in Midwestern states. Three states in the Midwest, Indiana, Minnesota have hit a new average high everyday for the past eight days. The increase has health experts concerned as we head into the coldest months of the season where conditions are more favorable for viral spread.

Outdoor dining is going to continue to be an important source of revenue for many restaurants across the country. Those in colder regions will obviously face more challenges. To that end, we’ve put together some tips for extending your patio season in unseasonable weather and how to plan ahead for different types of weather conditions.

Stay tuned for more national restaurant sales trends next week.

October 12-18: Restaurant sales fall 5% in the Midwest

Index at a Glance

- All Avero Index: No change in sales, open units up 1%

- Midwest: Sales down 5%, open units up 1%

- Northeast: Sales down 2%, no change in open units

- South: Sales up 1%, no change in open units

- West: No change in sales, open units up 1%

Nationwide Restaurant Performance

There was no significant movement in national restaurant sales last week. We’re reporting no increase or decrease in sales, though the number of open units grew by 1%. Last week we reported rising Covid-19 cases in 40 states with several states hitting new records for daily case totals. As cases rise, local regulations on restaurants and changes to consumer behavior often follow. That shift seems to be reflected in this week’s index report.

Regional Restaurant Performance

Regionally, restaurant sales varied quite a bit. Sales fell significantly in the Midwest, coming in 5% below last week. The number of open units rose by 1%.

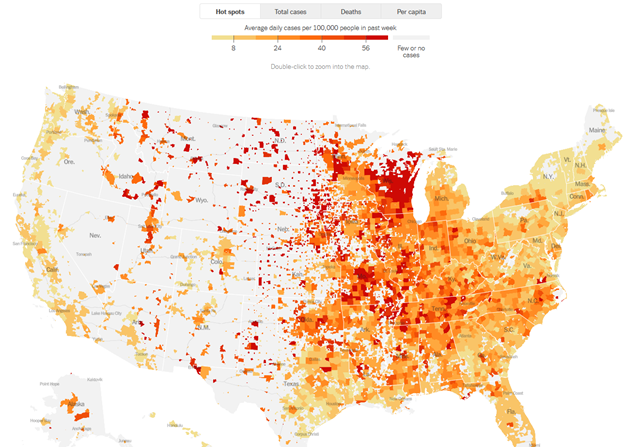

The Midwest has been struggling with rising coronavirus cases for several weeks. The image below from The New York Times Map and Case Count shows that the bulk of red areas which represent the highest case counts appear in the central part of the country with outliers in the South and the West.

North Dakota’s cases are skyrocketing. They’re currently seeing an average of 900 cases per million. According to a Financial Times database, if the state was a country, it would currently be listed as the worst coronavirus outbreak in the world. South Dakota’s cases are not far behind.

Sales in the Northeast fell as well by 2% with no change in the number of open units. Though on the whole the Northeast has managed to keep numbers in the yellow to orange category, major cities in the region are taking action to mitigate rising case numbers.

Boston is closing all in-person schools. Washington D.C. is launching a district-wide opt-in contract tracing program using mobile phones. Philadelphia’s Health Commissioner Dr. Thomas Farley attributes rising cases in the city in part to a sense of complacency combined with cooler temperatures and more gatherings indoors. Though he views indoor dining as a high-risk activity, he said the city is not seeing evidence that restaurants are a significant factor in the increased spread.

Max Bennett of Patch.com writes, “When discussing contract tracing and dining, Farley said people who have been contacted report a low percentage of eating out at restaurants during the time they might have been exposed.”

Restaurant sales in the Southern region grew by 1% with no change in the number of open units. Miami-Dade public schools report that three weeks into the school year, 100 students and staff members have tested positive. Cases in Broward County and the Florida Keys are on the rise.

The largest school system in Atlanta, Georgia remains closed keeping over 100,000 students online. Several other Georgia counties will also continue with online school as infections numbers in the state rise.

In Forth Worth, Texas, restaurants are permitted to operate at 75% of capacity indoors. Beginning October 14, bars in Tarrant County were allowed to reopen at 50% capacity. Bars remain closed in Dallas County. Tarrant County meanwhile reported its highest number of Covid hospitalizations since early August.

In the West, we saw the opposite: no sales increase, but a 1% increase in the number of open units. California’s Covid-19 numbers remain stable with a test positivity rate at 2.5% according to the latest briefing by Governor Gavin Newsom.

Stay tuned for more national restaurant sales trends next week.

October 19-25 Restaurant sales hold steady as another Covid-19 wave begins

Index at a Glance

- All Avero Index: No change in sales, no change in open units

- Midwest: Sales down 2%, open units down 1%

- Northeast: Sales up 1%, open units up 1%

- South: No change in sales, open units up 2%

- West: No change in sales, open units down 1%

Nationwide Restaurant Performance

Restaurant sales remained flat last week for the second week in a row, according to the All Avero Index. There was no change in the number of open units. National restaurant sales have held steady at 41% below normal for the past three weeks.

The bad news is that Coronavirus cases in the US have surpassed the high levels seen this summer. The average daily case count has climbed 41% in the past two weeks according to NPR.

The good news is that despite higher case counts, the mortality rate is lower than it was at the beginning of the pandemic. Health officials are hesitant to say whether this is a coincidence or a lasting trend, but either way, positive outcomes after infection are rising. This is likely due to several factors, including a shift in the demographics of who is getting sick. Young people who have a higher survivability rate represent the bulk of the current cases. Additionally, doctors have more experience in treating Covid-19 patients and better treatment strategies than they did earlier this year.

Another positive factor is that cities seem to be handling outbreaks with more precision than they did in the first wave. Instead of blanket shutdowns on all non-essential businesses we’re seeing more localized shutdowns, and targeted restrictions. The Avero Index supports this observation as it does not reflect a wave of restaurant closures in any region.

Regional Restaurant Performance

The Midwest leads the losses again this week. The Avero Index shows a 2% dip in sales in the Midwest. Combined with last week’s performance, the Midwest has lost 7% of restaurant sales in two weeks. They also saw a reduction in the number of open units by 1%.

That fits with the Midwest’s increasing struggle to keep the virus in check. Last week in Wisconsin, Governor Tony Evers activated a field hospital to expand treatment capacity. Wisconsin currently has the second highest per-capita infection rate following North Dakota. Meanwhile, North Dakota has given up quarantining students, abandoned contract tracing, and Governor Doug Burgum has resisted a state-wide mask mandate. Kentucky’s Governor, Andy Beshar, said the numbers in his state require revisiting the hospitalization surge plans created in March.

The Northeast region fared better, showing a sales increase of 1% and a 1% increase in the number of open units. Restaurant sales in the Northeast have consistently remained farther below normal than any other region since May.

In the South, restaurant sales remained steady last week with no substantial increase or loss. The region did see an increase in the number of open units by 2%. The percentage of open units has largely remained steady in the South, aside from some minor 1-point fluctuations over the summer. Since July, the South has increased the number of open restaurant units by 6%.

Restaurant sales in the West did not change compared to the prior week. The region did see a decrease in the percentage of open units by 1%. Covid-19 cases are on the rise across the West as well. Restaurants in Denver, Colorado were given notice of the return to 25% capacity restrictions indoors. City officials have warned citizens that another stay-at-home order could be issued if the trend continues.

Nevada’s 14-day positivity rate has climbed to 8.4%. The World Health Organization recommends a rate of 5% or below. The highest positivity rate occurred in April when it reached 14.6%. Nevada Governor Steve Sisolak recently reduced restrictions on businesses on October 1st, allowing gatherings of up to 250 people indoors. Today, he warned citizens that they may have to go back to stricter guidelines soon if they aren’t able to reduce the infection rate.

With coronavirus numbers trending in the wrong direction, it’s encouraging to see restaurant sales remaining fairly steady. Although everyone in this industry would love to see a return to normal, the fact that we aren’t losing ground as we head into November is a huge win. Perhaps even if we weren’t able to avoid a second or third wave of infections, we’ll at least be able to avoid a second or third complete shutdown.

Check back for more national restaurant sales trends next week.

October 26 – November 1: Virus positivity is up, restaurant sales are down

Index at a Glance

- All Avero Index: Sales down 3%, no change in open units

- Midwest: Sales down 5%, no change in open units

- Northeast: Sales down 5%, no change in open units

- South: Sales down 3%, 1% decrease in open units

- West: Sales down 2%, 1% increase in open units

Nationwide Restaurant Performance

National restaurant performance was down 3% last week in terms of sales, though there was no significant change in the number of open units. Since mid-September, the trend in national restaurant sales has been slowly ticking up for the most part. The past two weeks we have reported no change in the All Avero Index, despite the growing number of new coronavirus cases.

This current trend holds true to the pattern we’ve seen in the past regarding rising Covid-19 cases and the response in restaurant sales. Customers appear to let their guard down a bit and new cases and restaurant sales both rise for a period of time. At first, F&B business remains relatively steady. Then, once concern over the rising rate of new cases sets in, customers retreat to more protective measures and restaurant sales fall again.

We saw this pattern first in July, over the period many have dubbed “the second wave.” New infections began to rise in the lead up to the Fourth of July holiday and grew sharply the week following the holiday before beginning to wane again. Restaurant sales rose in tandem with new infections through the holiday but fell off again quickly as people scaled back their activities and exposure in response to the Covid trajectory.

In September we saw a similar pattern around Labor Day. Sales rose all through September, peaking over Labor Day weekend, and then fell sharply again as a surge of new Covid-19 cases began making headlines.

Following both of those incidents, restaurant sales recovered and continued to grow overall. Let’s hope that trend will remain true in this latest instance as well.

Regional Restaurant Performance

Restaurant sales are down in every region this week. The Midwest is taking the biggest hit with a 5% drop in sales and no change in the percentage of open units. The Northeast had the exact same performance: 5% sales dip and no change in open units. The loss is felt more deeply in the Midwest since this week marks the third consecutive week of sales losses. Losses in the Midwest totaled 12% in October.

The West and South had similar performance last week. In the South, sales are down 3% with a 1% decrease in the number of open units. In the West, sales are also down by 2%, but they did see an increase in the number of open units there. That is good news since the West lost 1% of open units last week. Despite that brief dip, open units have been growing slowly but surely over the past 5 weeks following the drastic wildfires affecting much of that region. Since September, the number of open units in the West has grown 5%.

Last week’s Halloween celebrations could increase the positivity rate of Covid-19 over the coming days. One study found that 42% of American’s opted to skip the traditional celebration gatherings. That potentially leaves 58% who didn’t. NBC reported about police breaking up a 400 person party in Brooklyn on Friday, followed by a 550-person party in New York City Saturday. Crowed streets were documented in West Hollywood, Orlando, and many other major cities. Will Halloween become the super-spreader event experts warned us about? Time will tell. Check back next week!