AUGUST 3-9: U.S. SEES MODEST INCREASE IN RESTAURANT SALES

Index at a Glance

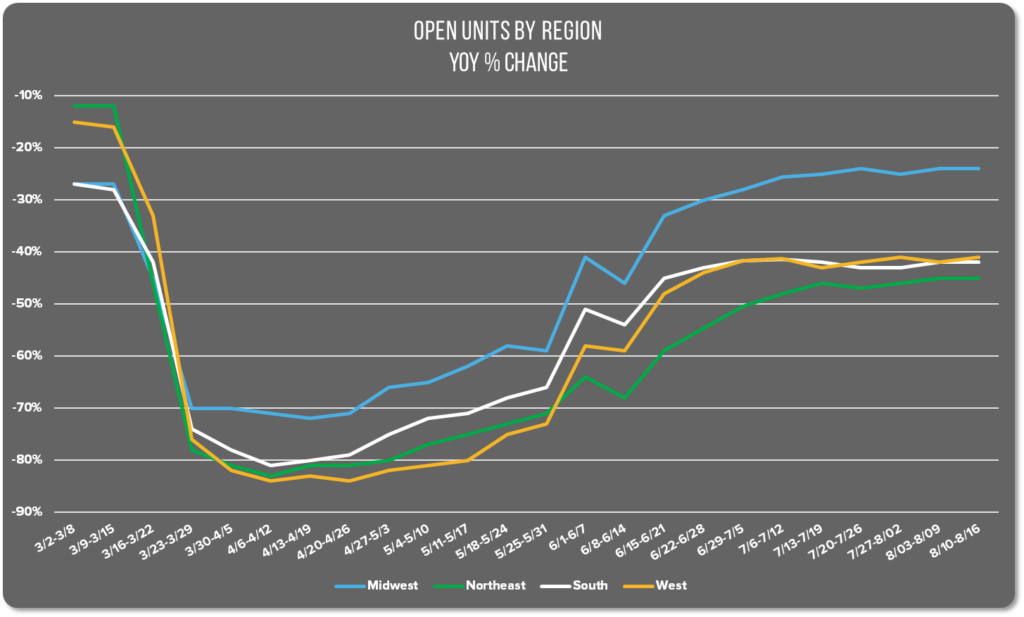

- All Avero Index: sales up 1%, no change in open units

- Midwest: sales up 2%, open units up 1%

- Northeast: no change in sales, open units up 1%

- South: sales up 3%, open units up 1%

- West: sales up 1%, open units down 1%

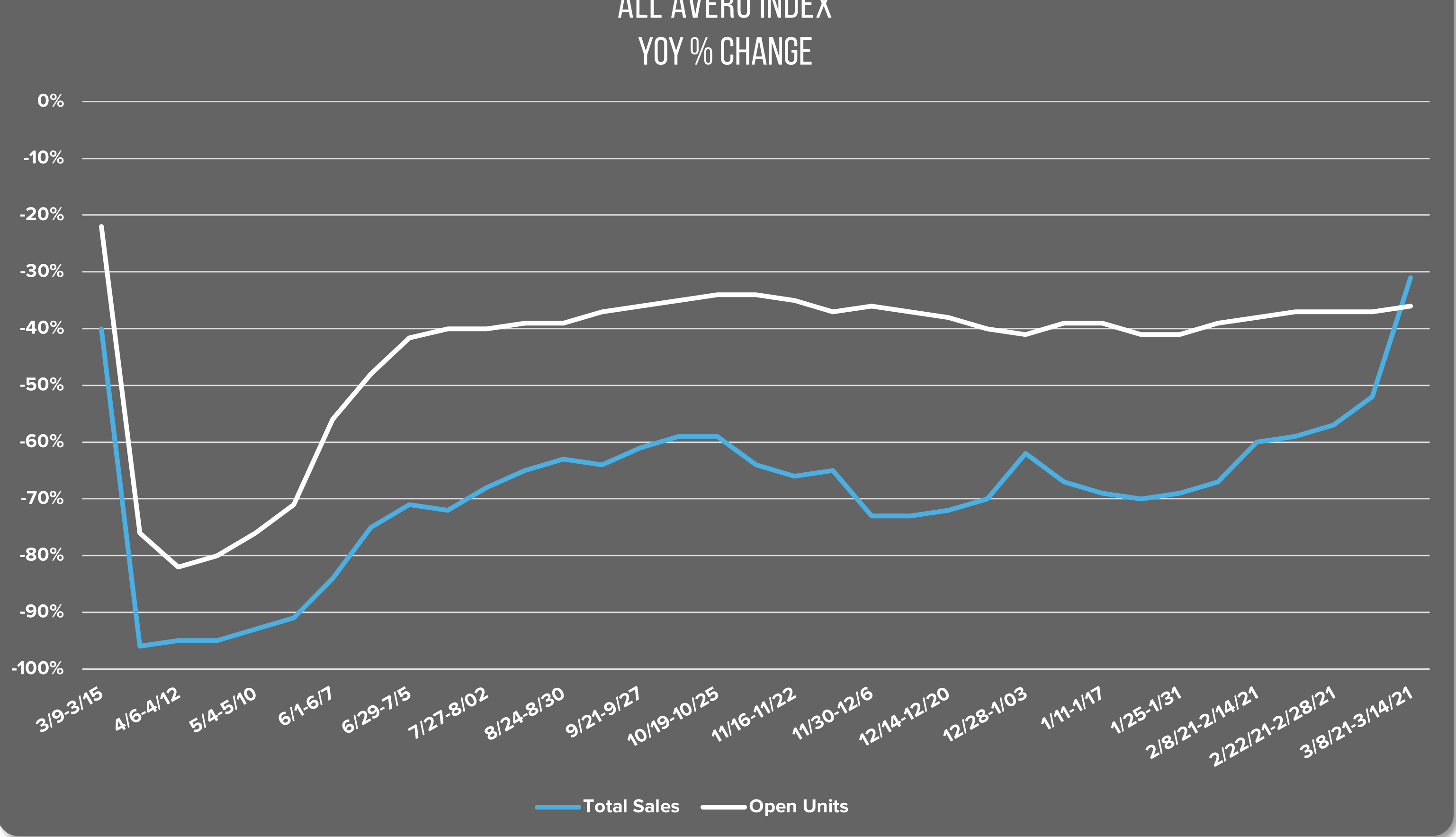

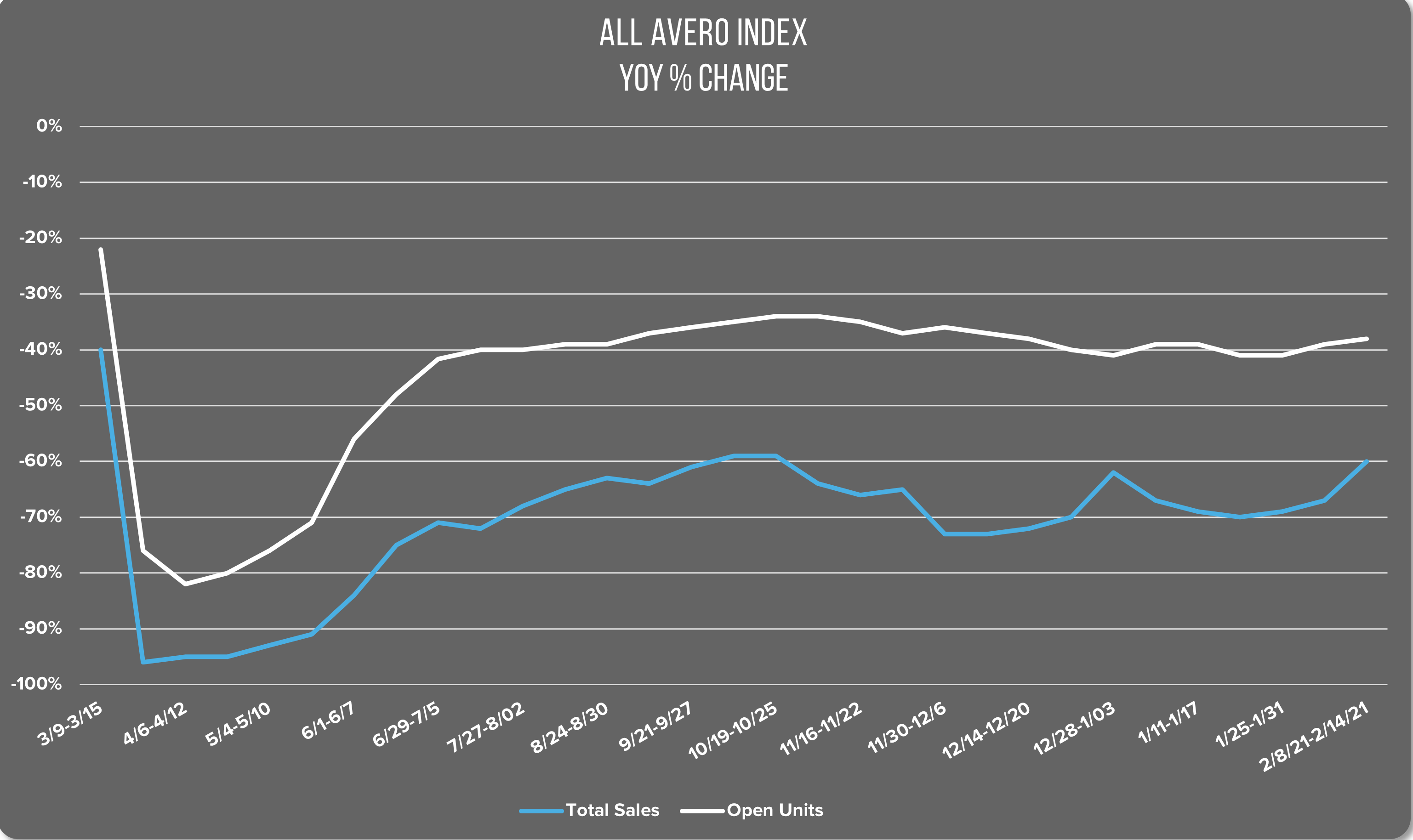

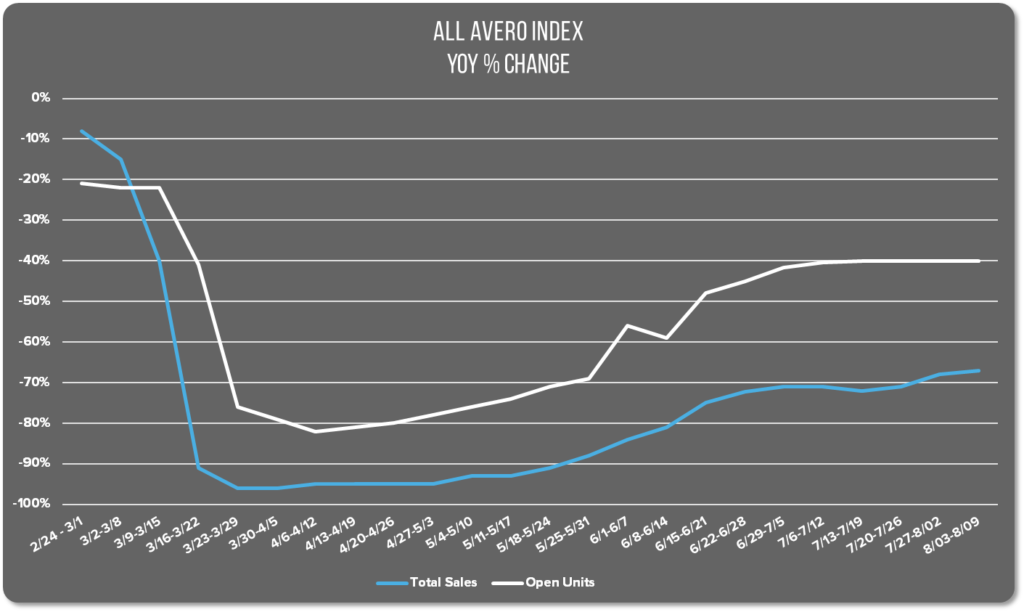

Nationwide Restaurant Performance

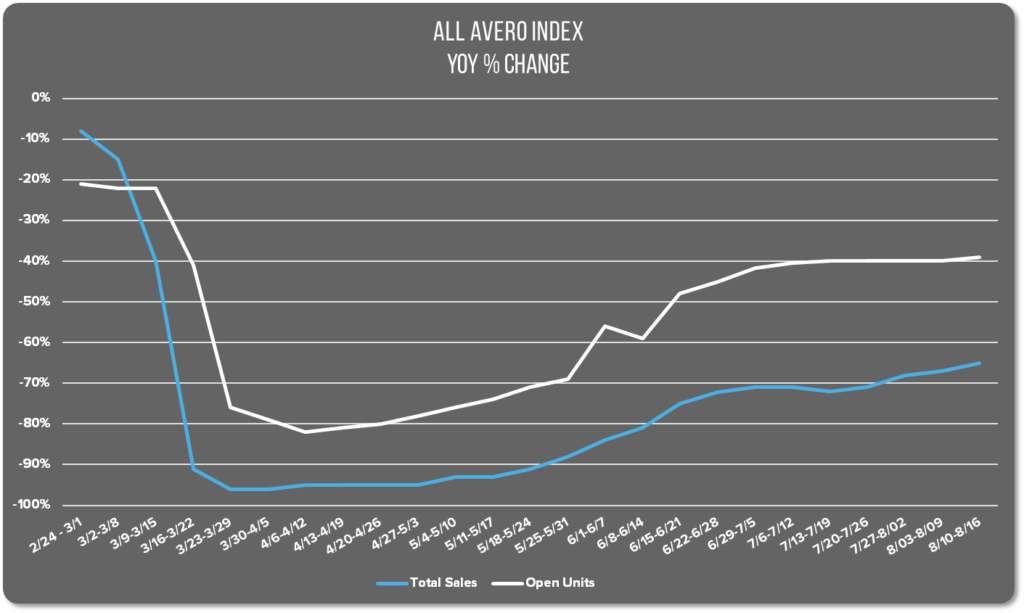

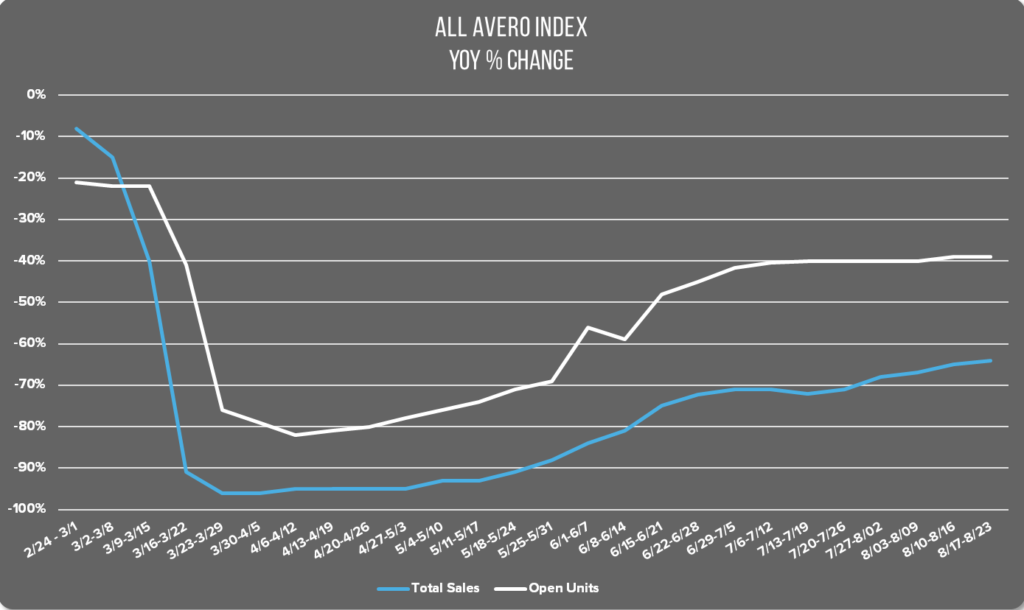

The first full week in August turned up a slight increase in restaurant sales in the US. The All Avero Index shows a 1% growth overall with no change in the number of open units.

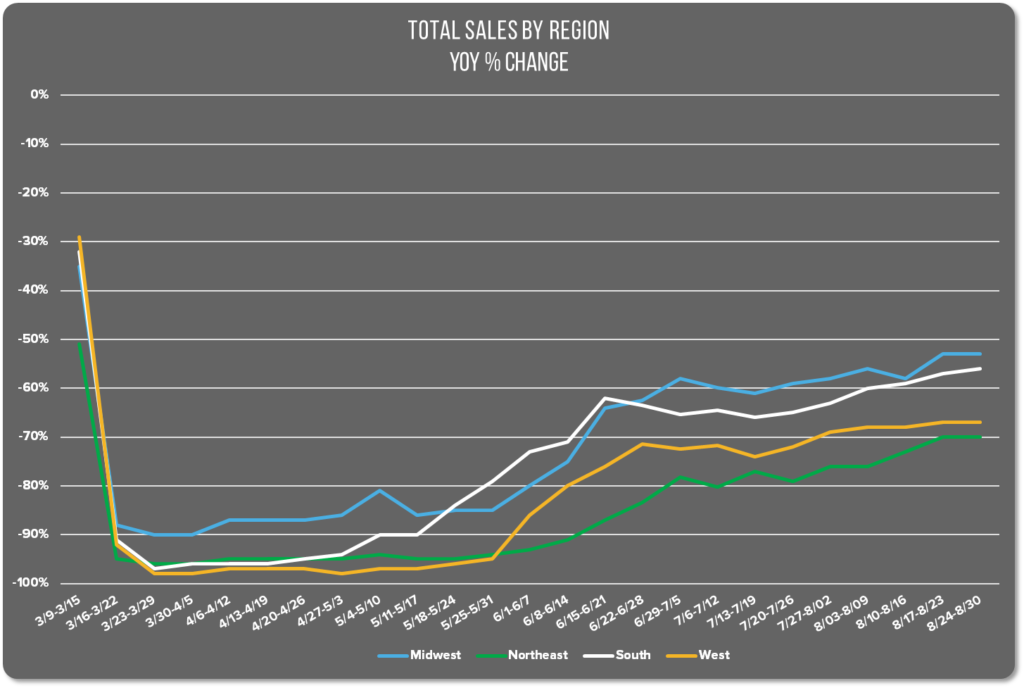

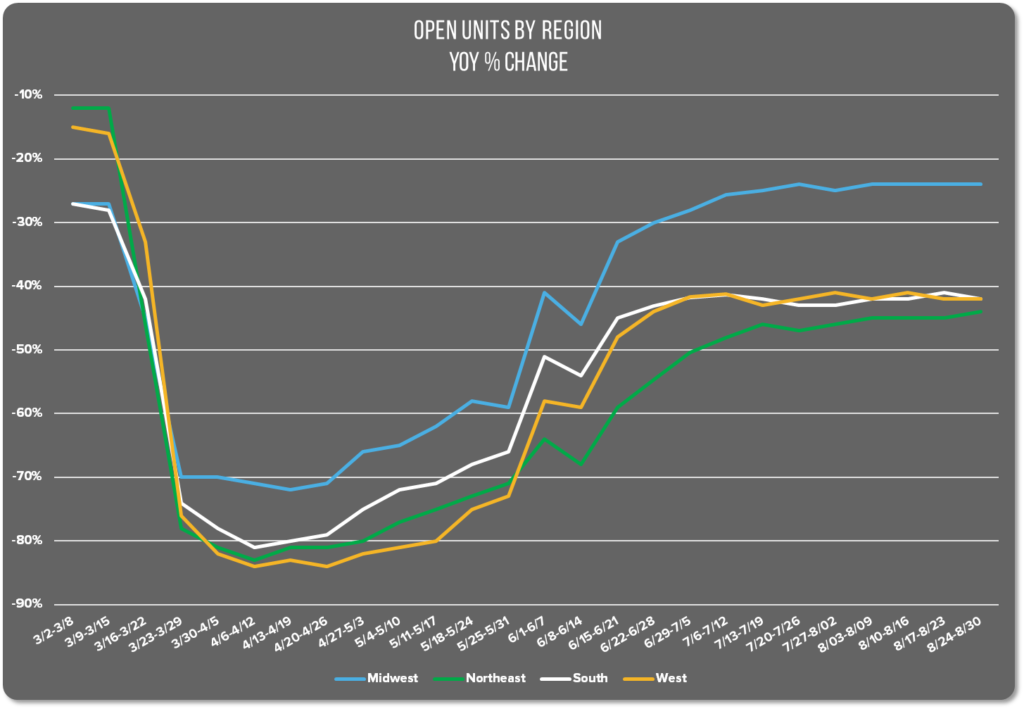

Improvement is always welcome, no matter how modest. But the big picture is that restaurants are still operating drastically below normal YoY. As of this week, only 60% of restaurants are open compared to last year, and sales are still 67% lower than usual.

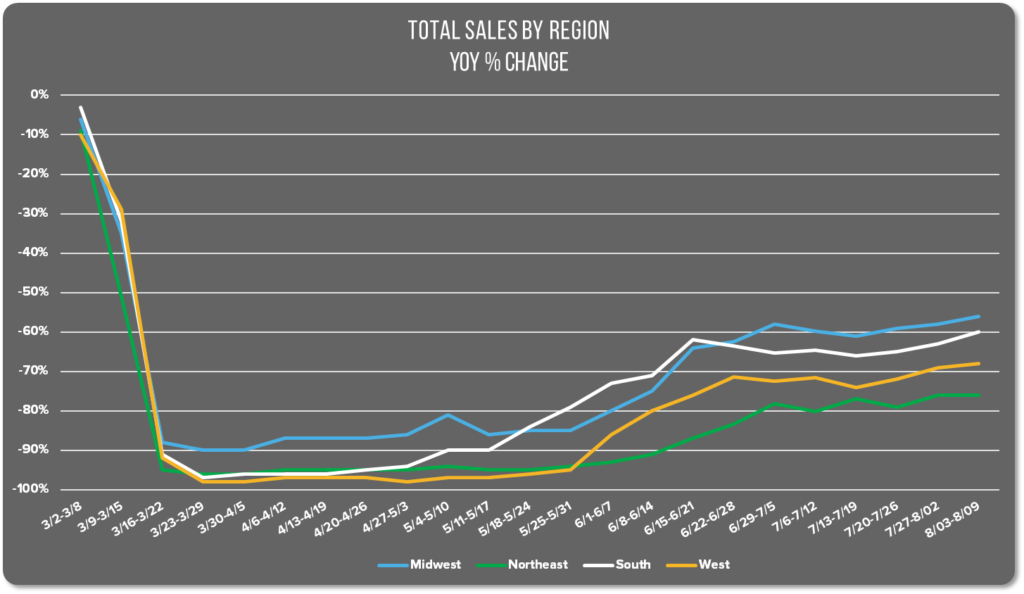

Regional Restaurant Performance

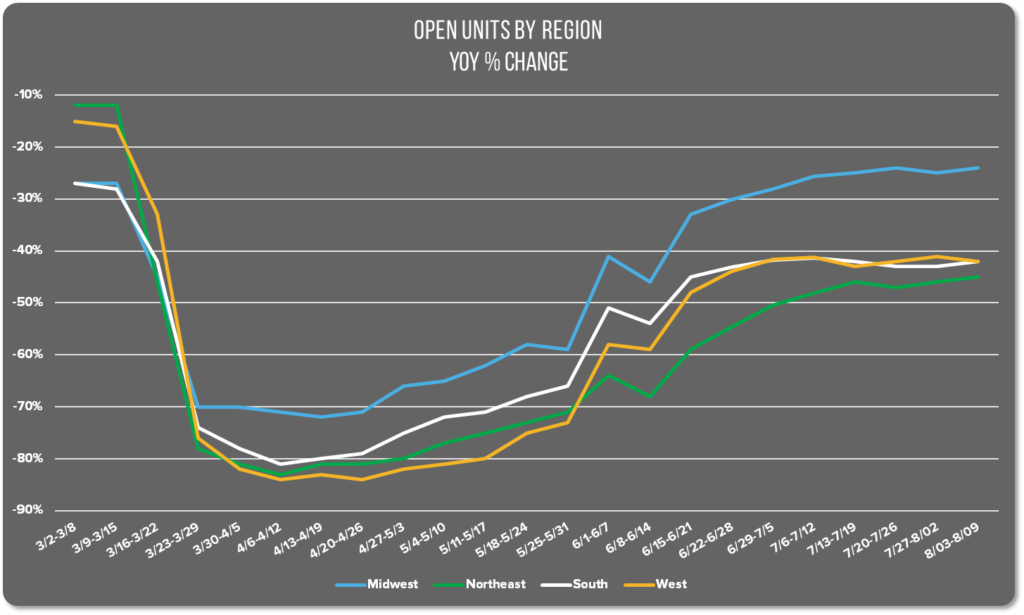

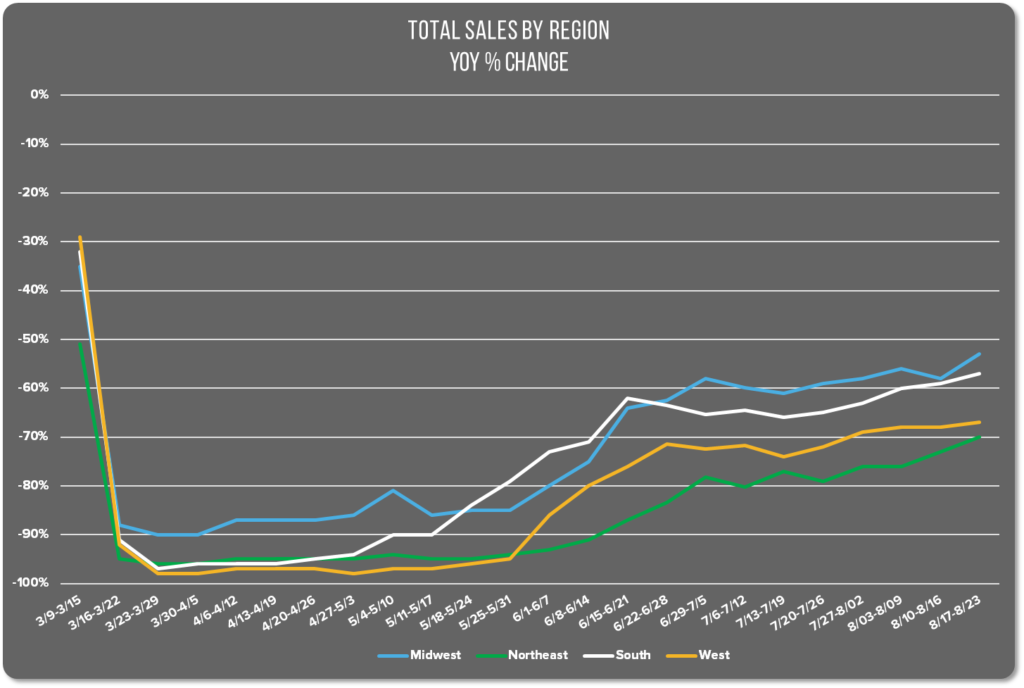

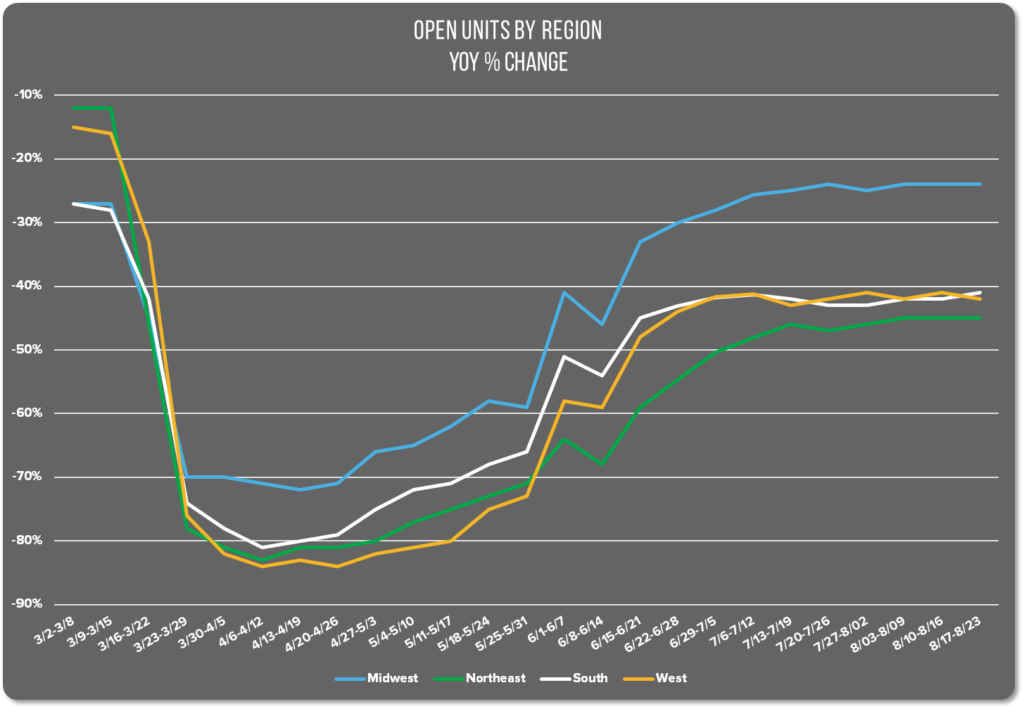

The Midwestern region’s restaurant performance improved compared to last week. Sales were up 2% and the number of open units also increased by 1%. The Midwest boasts the most reopened restaurants out of all regions on the index. Our data shows open restaurants at 25% below normal YoY (see third graph below).

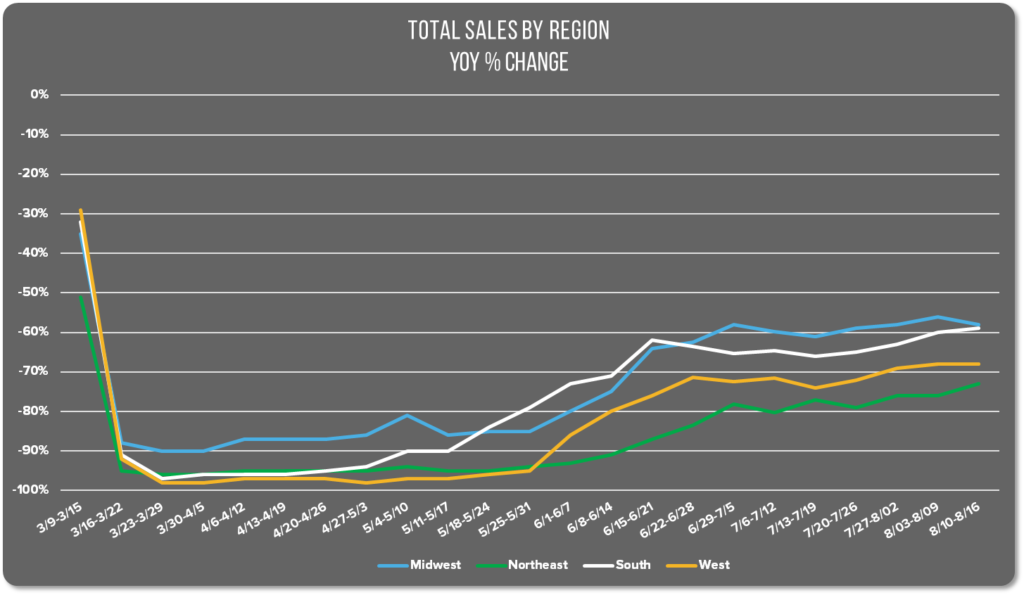

The Southern region leads this week’s index, coming in with a 3% sale increase and a 1% increase in open units.

Reports about the current coronavirus outlook in the South are mixed. News from Texas show a decline in the number of coronavirus tests being administered, but a higher overall test positivity rate. One prediction model created by the University of Texas, based on cell phone geolocation as it pertains to social distancing, predicts a sharp increase in Covid-19 deaths by the end of the month. Currently however, the number of new cases seems to be trending downward.

In Georgia, many school districts resumed in-person learning last week. Already, 19 schools have been impacted by coronavirus outbreaks landing 925 students in quarantine as a precaution. In Florida, new cases are falling steadily. They also reported 276 deaths, their largest number in a single data set, on Tuesday.

The Western region enjoyed a 1% increase in sales compared to last week. The number of open units in the West fell by 1%. California continues to see a rise in Covid-19 cases and fatalities despite closing restaurants, salons, and gyms again mid-July. Additionally, a computer glitch reportedly contributed to a significant undercounting of cases in the state, adding to alarm about the outlook there.

A report from the Colorado Restaurant Association predicts 62% of Colorado restaurants will be closed permanently within the next six months under current conditions. Unfortunately, with colder weather on the horizon, restaurant performance is likely to get worse in that time frame unless indoor dining becomes a possibility. Colorado is one of many states in the Western region that have rolled back health restrictions to add evening curfews to in-door dining and prohibit in-door service at bars.

The index does not show any growth in restaurant sales in the Northeast unfortunately. But there was a 1% increase in the number of open units.

Massachusetts is currently trying to control spiking Covid-19 cases in several of their most populated counties. In response, Governor Charlie Baker announced a new rule restricting the sale of alcoholic beverages to establishments that prepare and serve food on-site.

Researchers at the PolicyLab at Children’s Hospital of Philadelphia warn of a coming spike in cases, spreading north up the coast from Florida. In the last two weeks, the highest rate of infection growth in a major city occurred in Baltimore. Additionally, a resurgence is being tracked in Philadelphia and upticks are grabbing attention in shore regions of New Jersey and within New York City boroughs.

Health departments across the country are continuing to press the importance of social distancing and mask wearing as crucial steps to limiting further spread. If we can help save restaurants by following this advice, we’re all for it!

AUGUST 10-16: RESTAURANT SALES CONTINUE SLOW CLIMB TO RECOVERY

Index at a Glance

- All Avero Index: sales up 2%, open units up 1%

- Midwest: sales down 2%, no change in open units

- Northeast: sales up 3%, no change in open units

- South: sales up 1%, no change in open units

- West: no change in sales, open units up 1%

Nationwide Restaurant Performance

The All Avero Index is showing another week of slight growth in the US restaurant industry. Sales were up 2% last week and the number of open units grew by 1%.

On Monday, the US had the lowest number of new coronavirus cases in a day since June 24. Looking back at the Avero Index, in the weeks following that spike in June, we saw lagging sales and open units across multiple regions.

Since then, sales and open units have climbed back up, as overall cases in the US have gone down. With this data, we can’t speculate on causation, but certainly there seems to be a relationship between infection rates and customer confidence and their willingness to patronize restaurants is evident.

Regional Restaurant Performance

The regional performance of restaurants also tends to mirror the rate of infections in each area. This heat map shows the saturation of new daily cases by state. The cluster of yellow states in the Northeast indicates a lower rate of new infections in that region. Similarly, the Avero Index reports the most growth in restaurant sales in the Northeast last week. Sales were up by 3% despite no increase in restaurant openings.

The heat map shows a concentration of orange states in the Midwest region, indicating an escalating rate of community spread. Likewise, our index shows sales lagging in the Midwest, taking a 2% hit to sales with no change in the number of open units.

In the South, the heat map shows several states in red, indicating unchecked community spread. The remaining majority of states in the South are classified in the orange category. The Avero Index shows a mere 1% increase in sales and no change in the number of open units in this region.

The Western region is a mix of yellow and orange on the heat map. Oregon and Washington and Colorado are all coded yellow. With California and Nevada both in orange, it’s not surprising that the Avero Index is showing no increase in sales and only 1% increase in open units.

It will be interesting to see how restaurants perform as colleges and universities welcome students and resume in-person learning. Though the majority have yet to start, several college campuses including The University of North Carolina, The University of Notre Dame, and Oklahoma State University are already dealing with virus outbreaks on campus.

Regardless of which direction the trend goes, the Avero Index will be tracking and reporting it here every week.

AUGUST 17-23: FIFTH CONSECUTIVE WEEK OF RESTAURANT SALES GROWTH

Index at a Glance

- AAI: sales up 1%, no change

- Midwest: sales up 5%, no change in open units

- Northeast: sales up 3%, no change in open units

- South: sales up 2%, open units up 1%

- West: sales up 1%, open units down 1%

Nationwide Restaurant Performance

This week’s Avero Index brings good news for US restaurants. Restaurant sales are up 1% across the country. There was no overall change in the number of open restaurants last week.

This week marks the fifth consecutive week we’ve seen an increase in national restaurant sales. The last decrease we reported was during the second week in July when coronavirus cases were high and national sales fell 1%.

The growth we’re seeing is gradual, which bodes well for stability in the long run. Sharp gains are often followed by subsequent decreases in sales weeks later, as demonstrated in July, as new coronavirus cases emerge over a 14-day period.

Nationally, we’ve seen a decline in new infections over the past several weeks. Data from John Hopkins University shows an average of 47,300 new cases, down from a peak average of 67,317 new cases in mid-July. If cases continue to fall, we can expect to see continued growth in restaurant sales.

Regional Restaurant Performance

Restaurant sales in the Midwest jumped 5% last week, with no change to the number of open units. That marks the largest single-week increase in this region since the second week in June. Restaurants were closed for in-person dining in Michigan until June 8th, when reopening began and sales grew 5%. One week later, sales grew by an impressive 11%. Since then, increases have been more modest, in the 1-3% range for the most part with a slight dip in mid-July.

Restaurant sales aren’t the only thing rising in the Midwest. Coronavirus cases are growing across the region as well. The Washington Post reported Saturday that 8 states in the region saw seven-day averages for new cases rise. South Dakota saw a 58% increase in the number of daily caseloads, and Wyoming’s daily caseloads grew by 50%.

Restaurant sales in the Northeast grew by 3% with no change in the number of open units. This region has experienced more fluctuations in sales than the Midwest to date. Sales fell by small percentages in both May and June, and twice in July.

The Northeast has made progress in terms of reducing new coronavirus cases. On Monday, New York Governor Andrew Cuomo announced a new record-low test positivity rate of .66% and the 17th straight day the positivity rate stayed below 1%.

Philadelphia is also reporting a drop in the average daily number of cases to 3.4%, largely credited to social distancing and mask wearing.

In the South, restaurant sales grew 2% and the number of open units rose by 1%. Like every region, the South has lost a lot of restaurants to permanent closures in the wake of Covid-19. Last week, Eater published a list of 29 restaurants in Austin and 41 others in Dallas that have closed permanently in Texas. We found reports of 29 more permanent closures in Atlanta, Georgia and 19 closures in Nashville.

On a more positive note, Miami-Dade restaurants will be allowed to reopen on Monday, August 31. Last week, we saw several Southern states in the highest “red” category on the NPR new daily cases heat map. This week, only Mississippi remains in red, giving us hope that we’ll be able to report a positive shift in open units in the South.

In the West, restaurant sales only increased by 1%, and the number of open units fell by 1%. Arizona has made significant progress after a large spike in cases and deaths in July. Currently Arizona is reporting cases and deaths at a similar level as they were in April.

Though California and Nevada remain in the “orange” category on the heat map, Arizona, Colorado, Washington and Oregon remain in the “yellow” category, providing us with some hope that things may start to progress faster in terms of restaurant viability.

Every region has passed the half-way mark in terms of the number of open restaurants. We’re classifying “open” restaurants as those that are doing any business, whether that be take out only or full-service indoor dining.

As of this week, the percentage of open restaurants by region, as compared to last year are as follows:

- Midwest—76% open

- Northeast—55% open

- South—59% open

- West—58% open

That’s all for now. Here’s to hoping for a strong finish across the board in the last week of August. Check back next week for another update.

AUGUST 24-30: PROGRESS SLOWS BUT CONTINUES UPWARD TREND

Index at a Glance

- AAI: Sales up 1%, no change in open units

- Midwest: no change in sales or open units

- Northeast: no change in sales, open units up 1%

- South: sales up 1%, 1% decrease in open units

- West: no change in sales or open units

Nationwide Restaurant Performance

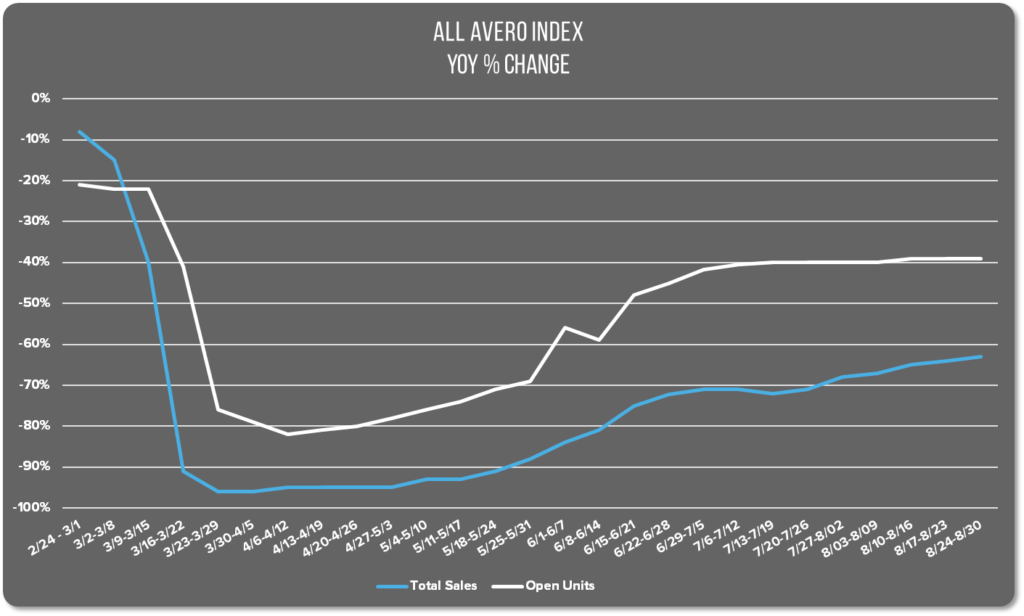

Restaurant sales and the number of open units largely remained steady last week for most of the nation. The All Avero Index reports an increase in restaurant sales performance of 1% and no change in the number of open units.

That makes six consecutive weeks of a slight sales increase. And slight is the key takeaway here. Whereas last week we reported that sales were 63.9% of normal YoY, this week, they’ve eeked in another half percentage to reach 63.4% of normal YOY.

Regional Restaurant Performance

The Midwestern and Western regions both held steady in terms of both sales and the number of open units. We’re not reporting a change in either metric, in either region.

In the Northeast, there was no change in sales, but the number of open units grew slightly by 1%.

The Southern region was the only area with a reportable sales increase. The mere 1% sales increase accompanies a 1% decrease in the number of open units however. This is not shocking considering the news reports we cited last week listing multiple permanent restaurant closures in this region.

An NPR report on retail sales shows a similar trend in retail as the one we’re seeing in the restaurant industry. Recovery looked positive in May, spiked in June, but fell again in July after the mid-summer swell in new coronavirus cases. The overwhelming trend for dining-in at home dovetails nicely with the nearly 23% spike in home electronic purchases.

Both retail stores and restaurants are seeing a modest rise in sales since July. However, National Retail Federation Chief Economist Jack Kleinhenz warns, “…the economy is far from being out of the woods. The question is whether it is re-entering the woods.”

With restaurant sales trending up, albeit slowly, we can’t say we’re re-entering the woods just yet. There’s still hope we’ll continue to climb out of this recession and return to business as usual in 2021.